You have spent years building your business. You are at the point where you start to think about what comes next. But business exit strategy planning is a subject that has completely eluded you.

You are not alone. Exit planning is often overlooked in the life-cycle of a business.

Two-thirds of businesses lack a business exit strategy or succession plan. This is according to a national survey of high-net-worth business owners. The figure remains as high as 64 percent among older business owners.

What does this mean for the future of their firms? Or for their financial plans? Essentially, it is time to get to work.

This post looks at common business exit strategies. We will explain what a business exit strategy is and how it can be highly beneficial for you. Using this guide, you will be able to start your exit strategy planning.

What is a business exit strategy?

A business exit strategy is a plan that the owner of a business makes. This is done to sell their company, or share in a company, to other investors or other firms.

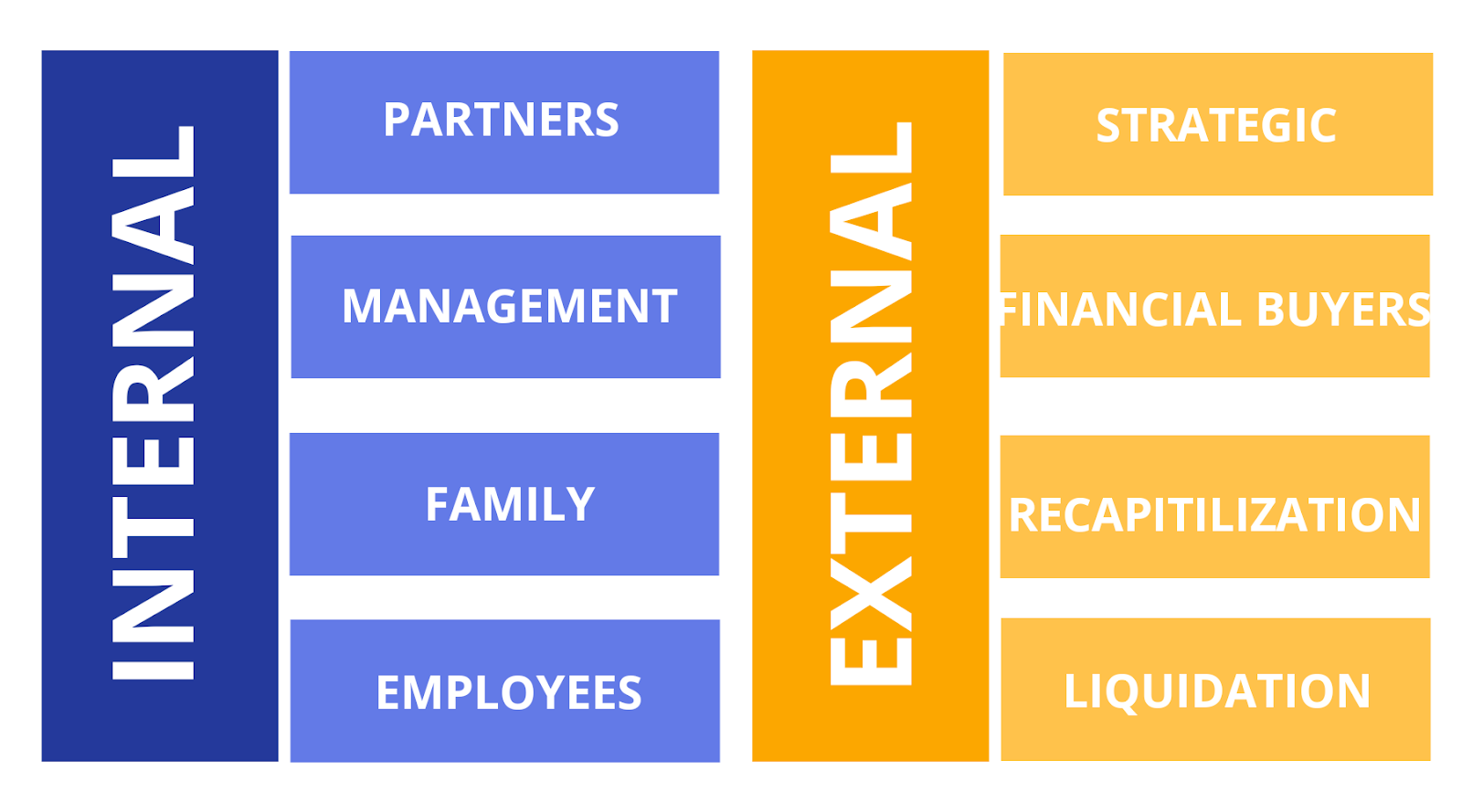

Initial public offerings (IPOs), strategic acquisitions, and management buyouts are common exit strategies.

If the business is making money, an exit strategy lets the business owner cut its stake. It lets them completely get out of the business while making a profit.

The business may be struggling. Then implementing an exit strategy can allow the entrepreneur to limit losses.

Examples and Templates of Top Business Exit Strategies

-

Management Buyout (MBO)

An MBO happens when an executive team combines its resources. It uses them to get a part (or all) of the business they manage.

Management buyers put up company assets to secure financing in some cases. This is called Leveraged Management Buyout (LMBO).

Pros:

An MBO or LMBO gives personal liquidity to owners. MBOs may help to get buyers. It does not need to perform due diligence and manage the transition.

You may cede your business to a leadership team that’s already well established. Then you may feel more confident about its long-term outlook.

Senior team members will reap the rewards of their hard work.

Cons:

Conducting a business valuation and securing financing can take months or years. Management team members will need a solid business plan for debt repayment. Plans may include cost-cutting or aggressive growth initiatives.

-

Outside Sale

Selling to someone outside the firm can make sense for several reasons. But it does not happen overnight. Waiting until you sell or retire limits your return potential.

Pros:

Again, the opportunity to cash out immediately (versus an IPO) is a significant upside. You can choose your ideal buyer and sale terms.

Also, the legwork involved in prepping for sale inevitably makes your company stronger. Ultimately, you may find you have more options than you realize.

Cons:

You will have little say over what happens to the business direction. In advance of the sale, you will need to invest (years of) time and energy. This is to make your business as attractive as possible.

You will want to show a strong value proposition and a solid sales/performance history. This may mean assuming a more profit-driven agenda.

Finally, if word of imminent sale gets out, you may risk losing significant customers.

-

Employee Stock Ownership Plan (ESOP)

An ESOP is a qualified retirement plan. This is according to the American Bar Association.

It is like a profit-sharing plan. An ESOP has to invest primarily in shares of the ESOP sponsor. An ESOP is one of several alternatives that will enable an owner to gain liquidity and ownership. ESOP strategies afford several unique advantages.”

Pros:

There are various tax benefits associated with an ESOP. Individual business owners can leverage these. This is in the form of capital gains taxes deferred.

Companies benefit from lower tax rates. ESOPs offer a method to reward dedicated employees.

Cons:

The transaction valuation is typically lower. This is the fair market value versus strategic value. Every firm may not like the ongoing administrative burdens.

What is more, your company may have amassed significant debt. If employee turnover is high, an ESOP probably is not the best route.

-

Initial Public Offering (IPO)

IPOs are certainly less common nowadays. But that does not mean they are less profitable. Are you primed to go public?

Pros:

An IPO strategy can deliver unparalleled ROI in the right market. This is in the form of long-term capital

The financial gains to be realized are far beyond that of a company sale or liquidation. This is one reason why so many entrepreneurs aspire to an initial public offering.

Cons:

Immediate liquidity may be a priority. Here you will not be able to monetize your shares for six months or more. This is as you will likely be subject to a share lock-up agreement.

There is also a need to address the complex, costly requirements of going public.

Major undertakings include independent board setup, auditing arrangements, and system upgrades. There needs to be an overhaul of all your reporting mechanisms.

Finally, market conditions are not always ideal for going public. There is an element of timing involved. This means you cannot pre-plan your timeline according to your ideal retirement age.

-

Transfer Ownership to Family

Selling or transferring company ownership to your heirs is often the simplest option. Yet 84 percent of high-net-worth owners do not expect their children to continue. Does an in-family transfer make sense for you?

Pros:

Typically, this approach creates less business disruption and is easier for employees. Your children may have grown up in and around your workplace.

Then they probably have an aptitude for the business. They can get a fulfilling career and continue their legacy.

Cons:

There is potential for significant estate tax consequences. So, the transfer should be carefully planned. It should be reviewed with a financial professional’s help.

Transfer portions of the business early (when it is worthless) via a living trust. This may allow heirs to avoid hefty gift tax. You may also transfer the business to a charitable remainder trust.

Why should you have an exit strategy?

- Planned exits are a lot more favorable than unforeseen ones.

- The longer you withhold investments, the less you can contribute to retirement.

- Be able to take on health problems without stress. There will be no stress about what could happen to your business and investments.

- Stay on top of interest charges.

- You will be prepared for unexpected offers.

- Also, you may set out on a more lucrative business venture. You can quickly liquidate your current situation.

- An exit strategy can help If you find yourself where you need to raise money quickly.

- Personal time may take precedence for you. This will help you prepare for that.

Practical reasons for a business exit strategy

Why would you want to think about an exit if your startup is your dream? It will be so successful and fun that you do not need to think about what comes after.

Wrong. There are two genuine and practical reasons why you need to plan an exit:

- Outside investors want to collect their returns. Equity investments are not like loans with interest. Investors get no return until the firm is sold or they cash out. Even three years is a long time.

- Entrepreneurs love the art of the start. Your startup may take off. Then you will find that the fun is gone by the time you reach 50 employees or a few million in revenue. The job changes from operating a “cookie-cutter” instead of a “work of art.”

You will be anxious to start a new entity with new ideas and spinoffs built up in your mind. In three to five years.

The certainty that you can avoid all those potholes you hit the first time around. If your startup were less than a success, you would want to erase it from memory.

When is it Time to Sell?

Think hard about the risk versus the offered amount. Consider the offer in the context of future dilution. Dilution would happen to build revenue and move to cash flow break-even.

Now measure the progress of the company. Do you have game-changing technology? It must be deep and defensible. Do you have the potential to shift the way a market functioned completely? Is it pretty much finalized to go to the market?

You may not be paid anything extra for early revenues. Such a revenue ramp may already be assumed into the price. The question is how long it would take to surpass the dilution-adjusted offer.

How to do a Business Valuation?

There is no perfect time to execute your business strategy. When you look at the life-cycle of a business, you’ll see four distinct stages:

- Inception

- Growth

- Maturity

- Renewal or decline

The cycle your business is in will impact how sellable it is. Less mature yet booming businesses might need more time to grow.

Seasonality, industry trends, and the consideration of what is right for the business also play a massive part in putting your exit strategy into play.

You do not need to be profitable, booming, or failing to sell your business. You have to be ready.

Business Exit Strategy and Liquidity

Business owners get different levels of liquidity from different exit strategies. A strategic acquisition can offer the most amount of liquidity in the shortest time.

This depends on how the acquisition is structured.

Market conditions also determine the appeal of a given exit strategy. During a recession, an IPO may not be the best exit strategy.

When interest rates are high, a management buyout may not be attractive to a buyer.

Business Exit Strategy: Which Is Best?

Exit strategies also depend on business type and size. A medical office partner benefits from selling to one of the other existing partners.

A sole proprietor’s ideal exit strategy might be to make as much money as possible. He or she may then close down the business.

The company may have substantial shareholders and founders.

These interests must be factored into the choice of an exit strategy.

Should you include an exit strategy in your business plan?

Including your exit strategy in your business plan and your pitch is vital. It is crucial when asking for funding from VCs or angel investors.

Most of the time, small businesses do not need to worry about it. This is because they will not seek investment.

Not all profitable businesses are suitable investments for angels and VCs. The founder’s goal might be to own the business themselves for the foreseeable future.

Conclusion

The best exit strategy is the one that suits your personal goals and your small business. Decide first the result with which you want to walk away.

Your legacy and your business may be necessary for you. In that case, family succession or selling to employees might be best for you.

It would help if you started working on whichever exit strategy you choose. You get the time to do it right through planning. It helps you to maximize your returns.