FAQ

Have a question? We have the answer.

Investability Score

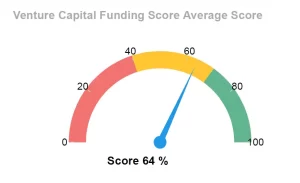

ALCOR puts a scoring system and invests directly in companies that score more than 85%. ALCOR supports companies through its Investment Bank to raise capital from 6500 active global Investors for those who score more than 60% but are less than 85%.

ALCOR will call for detailed due diligence based on the “Investability” Analysis. The documentation will call for more information on the promoters, the team, the market research, the company, the shareholding, the legal structure, legal documentation, financial model with BS, P&L, ratios, assumptions validation, and the like.

ALCOR will in investing cash for equity. In some instances, ALCOR will also take sweat equity in place of its “intellectual’ contribution.

In most cases, ALCOR will be a single investor. However, in some cases, if ALCOR needs specialist expertise, ALCOR may bring in co-investors who are industry specialists.

The average funding ticket size is about $1 Million and ranges from $500,000 to $10 Million.

Our timeline is between 12 weeks to 20 weeks after the “Investaibility” report of the company.

ALCOR has various companies in its portfolio for direct investments, including software companies, Services Companies, Artificial Intelligence companies, Offshore services companies, healthcare companies, manufacturing companies, and acquisitions in the education industry.

ALCOR Fund’s model is unique. ALCOR funds companies with a score of more than 85% for the Artificial Intelligence Investability Risk Assessment. If the score is less than 85% and above 60%, the Investment Bank engages and acts as an advisor with mutual permission and agreement to get the funds from a global list of 6500 active Investors in ALCOR’s database of international Investors.

ALCOR has its headquarter in the United States, with operations across 20 countries globally.

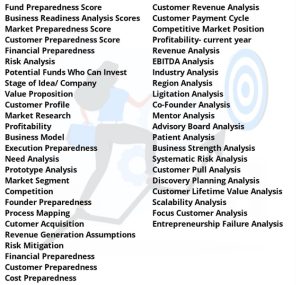

The Artificial Intelligence Investability Risk Assessment Score does a risk analysis over 40 different parameters that Investors look at while investing in a company. In most cases, we have seen entrepreneurs cover about 10-15 risk parameters and do not secure funds because they have not covered the rest of the business risk parameters.

Yes. This assessment will be valid for all other funds and investors also. It will give any investor an immediate “Investability” score for any Investor to access your company’s potential to succeed. This will also help you understand your risks and mitigate them when you pitch to a series of Investors.

You should provide a copy of the assessment already done along with your pitch book for review.

ALCOR has various companies in its portfolio for direct investments, including software companies, Services Companies, Artificial Intelligence companies, Offshore services companies, healthcare companies, manufacturing companies, and acquisitions in the education industry.

ALCOR’s success rate for equity funding through its global Investment Bank is 83%.

You can get an Investability report from E&Y, Deloitte, KPMG, or PWC. ALCOR can give you the parameters.

Yes. You can take a sample of the Artificial Intelligence Investability Risk Assessment Score on five parameters. The main report has 40 parameters to score.

The Artificial Intelligence Investability Risk Assessment Score does a risk analysis over 40 different parameters that Investors look at while investing in a company. In most cases, we have seen entrepreneurs cover about 10-15 risk parameters and do not secure funds because they have not covered the rest of the business risk parameters.