Larry Page and Sergey Brin started working together from their Stanford dorm room to create Google. Only when they got funding in 1998, they”upgraded” to their garage office in Menlo Park.

From the times within the garage, until the rounds of funding and innovation, Google has become a household name — processing over 3.5 billion search queries per day.

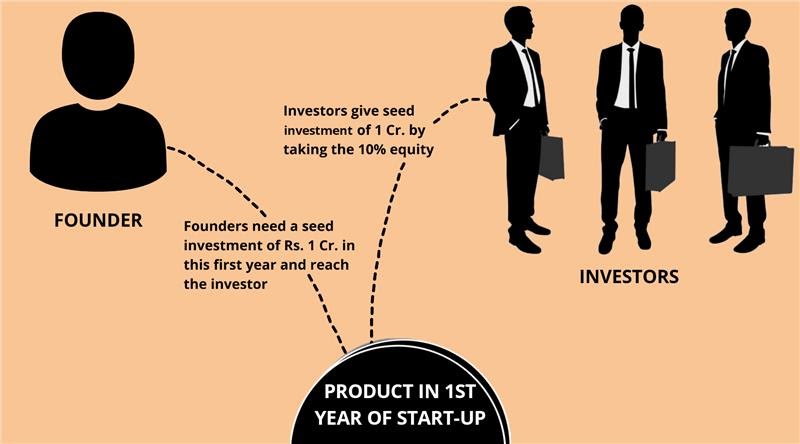

So, to understand the concept of startup investment for seed round valuation it is very important to understand the dynamics of the seed round.

“At the very earliest stage of any new venture, it’s all about hope and not metrics,” says Jason Mendelson, a founding partner at the Foundry Group, a venture firm based in Boulder, Colorado, and the managing director of Techstars.

According to Klipfolio, It is estimated that of all the firms VCs invest in 65 percent fail and return less than the capital invested.

It is almost impossible to start and pitch a business idea without capital, which is why seed round funding exists as one of the main sources of finance for a new business.

While seed funding is one of the stepping stones on the road to IPO success, understanding the startup investment for seed round valuations is important.

For startups, the large hurdle – the one you would like to beat if you’re to urge on the trail to serious growth – is convincing people that don’t know you personally to invest in your firm.

In this article, I’ll help you to understand how these startup investments for seed round valuations work which will help your company to grow and gain insight around the world.

Seed Round Dynamics

Startup investment Seed round valuations are based upon two types: priced and unpriced.

A priced seed round is a round of funding in which the company is given a valuation, & shares in the company are purchased for cash by investors at a price determined by that valuation.

In Unpriced round, the company is not given a valuation, & the investor isn’t necessarily purchasing a known amount of equity at the time of investment. Instead, it is an agreement between the investor and the company to issue shares in the future.

The two financial instruments used in unpriced seed rounds are convertible notes and Simple Agreements for Future Equity (or “SAFE notes”).

A convertible note is a financial instrument that is issued first as debt, & then converts to equity under predetermined conditions, such as raising a priced round.

A SAFE note is a convertible note, except it’s not a debt instrument, meaning that SAFE notes don’t carry an obligation to pay interest. SAFE notes were introduced by Y Combinator in 2013.

These are more founder-friendly than convertible notes because they are not treated as debt, so they don’t have an interest payment or maturity dates associated with them.

Startup Valuation

Startup investment for seed round valuation generally covers only the essentials of needs such as operating expenses—rent, equipment, payroll, insurance, research and development, and a business plan.

So, valuation for startups can prove to be a real deal maker or breaker, which is why valuation does not involve any guesswork or based on the valuation of other similar startups.

Remember, before proceeding with calculating the particular value of a corporation, founders got to have proper knowledge about how the whole process of startup valuation works.

For instance, Quoting an absurdly high figure to seed investors, even when there is no revenue generation, then the expectations will be quite high, & if a startup is unable to meet the high targets, it might have to raise funds at a lower valuation in the next round.

This may prove negative within the end of the day, and therefore the startup or founder may need a troublesome time convincing other seed investors or companies for seed funding.

Conversely, quote too low & the startup may end up giving a larger chunk of equity to investors, which will again prove negative.

So, Let’s discuss how these startup valuations are evaluated depending on three aspects in the seed stage.

- Ins and outs of valuation, before you evaluate.

- Seed- stage startup Valuation Factors.

- Timing. If founders and startups take too much time, they might face increased competition in the market.

Ins and outs of Startup Investment Valuation

- Always remember, there are lots of investors hoping to give the right startup money but “Fundraising is brutal”. The process of raising that money is long, arduous, ego-deflating, and complex. Hence, it is a path almost all companies and founders must walk, but when is the time right to raise?

- When founders are ready to tell this story that a business idea is compelling with a team of founders to realize its vision and that the opportunity described is real and sufficiently large, they can raise money.

- Approaching the proper investors during the seed stage can bring the perfect results, therefore, finding a less-aggressive investor who can guide and mentor the startup is best for the end of the day.

Analysis

- For example, let’s say you need $100K. Now decide what percentage of the corporation you’ll sell for $100K. Pick a number between 10% and 20% of the company’s post-money. You can go below 10% but that probably means your valuation is going to be too high & you will raise insufficient money.

- So, if you’re willing to sell up to 15% of the company—that’s your bottom line dilution. This signifies a bottom line post-money valuation of $666K.

- Finally, convince investors that, “Firstly, we’ll make the company more valuable by raising $100K—which is our minimum. Secondly, we are willing to sell out 10% of the corporation share .”

- It’s the lowest dilution you can justify. Combining the dilution of 10% with the minimum amount you’re raising ($100K) implies a minimum post-money valuation of $1M. But the valuation is not explicit. This gives you room to boost your valuation if you raise quite $100K.

- If $25K buys 1% of a company, your post-money is $2.5M—that’s on the high end. If $25K buys 5% of a company, your post-money is $0.5M—that’s on the low end.

- According to Y Combinator, they buy about 6% of a company for $15K-$20K. So, the post-money valuation of their investments is around $250K-$333K. But don’t fixate on valuation. Low valuations aren’t bad if you keep the dilution down too. 6% dilution is extremely low if the corporation makes tons of progress with $15K-$20K.

Dilution

The norm is 15-25% dilution depending on how much one raises and how much competition there is.

– quoted by Mark Susterwho is an American entrepreneur and venture capitalist. He is a Managing Partner of Upfront Ventures, formerly known as GRP Partners.

- Don’t over-optimize your dilution. Raising money is usually harder than you expect, especially for first-time entrepreneurs.

- Average Seed Round Valuation of investment for startup Funding Amount in 2020 is $2.2 million. Average Seed Funding Startup Valuation is currently $7.5 million.

- For seed rounds, a common range of stake is 10-25% with founders usually diluting their ownership by around 15%. Seed investors will usually cap their valuation of any company at this stage at $4-6 million. It’s better to own 70% of a large, successful company than 100% of a failing, underfunded one.

- For instance, Mark Zuckerberg retained 26% equity in Facebook. Zuckerberg’s net worth is $52.3 billion as of January 2017. How did Zuck retain 26% on Facebook? By September 2004, it had ad revenues and traction.

- Peter Thiel invested $500k for 10% of Facebook. Many startups get $25k for 10% equity. Facebook remained attractive for follow-on rounds. Yahoo! was planning to buy Facebook for $1B in July 2006. Facebook then was 2 years old. Investors wanted to sell. Zuckerberg did not want to sell. Zuck won because he had ownership control.

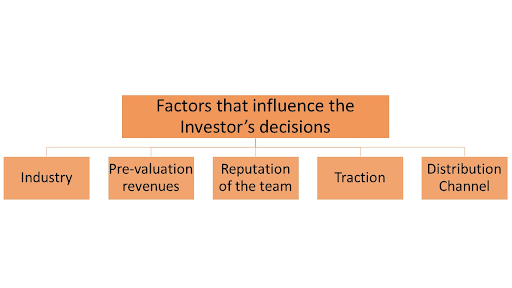

Valuation Factors

-

Industry

If the startup belongs to a booming industry, Investors may pay a premium to stand in that particular industry. This implies that it is important to choose the right sector. This will increase the worth of a business enterprise.

-

Pre-Valuation Revenues

Revenues are important for any company as they make it easier for investors to carry out the valuation.

In the initial stage, if you have a functioning product and up to the most the product is yielding the revenue from the market, it could sway the investor’s decision in the favor of that startup.

-

Reputation

Before going to take around for investment founders need to ensure a positive image in the market. The most important thing that a VC looks for is the founder’s image and capability.

-

Traction

Traction is a sign that your company is growing. The quantitative proof of customer demand, traction demonstrates development and growth. Hence, that is why it is the most important aspect that convinces investors to invest money in a company.

-

Distribution Channel

Even though your product might be in the early stages, you might already have a distribution channel for it.

Hence, the founders need to be careful regarding the distribution channel that is being used. Because it can have a direct impact on the valuation.

Valuation Timing

Timing is significant. If founders and startups take an excessive amount of time, they could face increased competition within the market.

Arriving too early may put the startup at the risk of not being relevant in the market. So, by the time a startup reaches the seed funding stage, its product must be able to be launched within the market.

Valuation Example

ilan abehassera introduces the debate from the founder’s perspective: if you are raising a seed round at a $15-20M cap, it dramatically increases the difficulty of raising a Series A or Seed extension at a higher valuation.

So, Should you maximize the valuation when raising a seed round? I like you to think about it in the framework of upside maximization and downside minimization.

Let’s say everything goes amazingly with your company and product. So, having maximized the valuation will result in the lowest possible dilution.

But, if things don’t go that well, then having a super high valuation starts to become a truly existential issue. So, at that point, you have three choices:

- Extend the seed at the same valuation.

- Raising at a lower valuation

- Swinging for the fences and trying to do a seed+ at a slightly higher valuation

Recently, Jitendra Gupta led Jupiter and raised a $24 Mn seed round investment for a startup at $70 Mn valuation.

Through Jupiter, Gupta along with Vishnu Jerome, founding partner at Jerome Merchant + Partners, would offer digital banking solutions like investments, lending, fund transfer, insurance, and other products and services.

Jupiter is expected to provide a neo banking solution. This has helped global startups such as Revolut, N26, Monzo, Nubank, and NiYO to gain popularity.

Methods of Valuation

-

Discounted Cash Flow Method

The discounted cash flow method defines free cash flows. These are generated in the future by a company and discounts them to present a present value.

These cash flows are affected by the various factors which include the inflation and instabilities that will come in the market at the future stage.

-

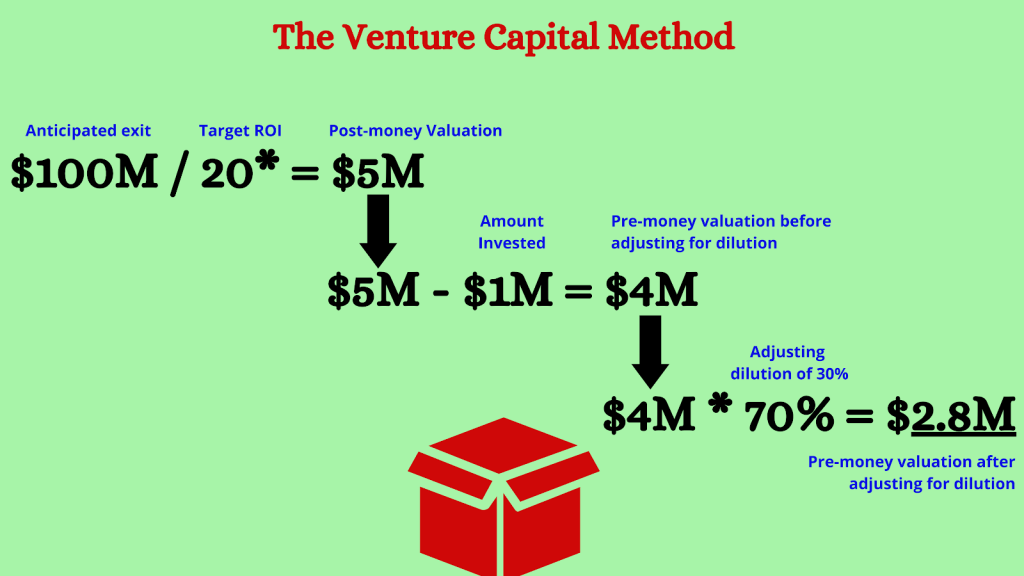

Venture Capital Method

The venture capital method reflects the process in which the investors are looking for an exit. This exit takes place within 3 to 7 years.

From there, one calculates back to the post-money valuation today. Hence this is based upon the time and the risk the investors take.

-

Market Comparables Method

The market comparables method attempts to calculate a valuation based on the market capitalization of comparable listed companies.

-

Decision Tree Analysis

Decision trees are used to forecast future results by assigning a certain probability to a particular decision.

The name decision tree analysis comes from the ‘tree’ like shape. So, this shape includes branches where each ‘branch’ is a decision that can be undertaken.

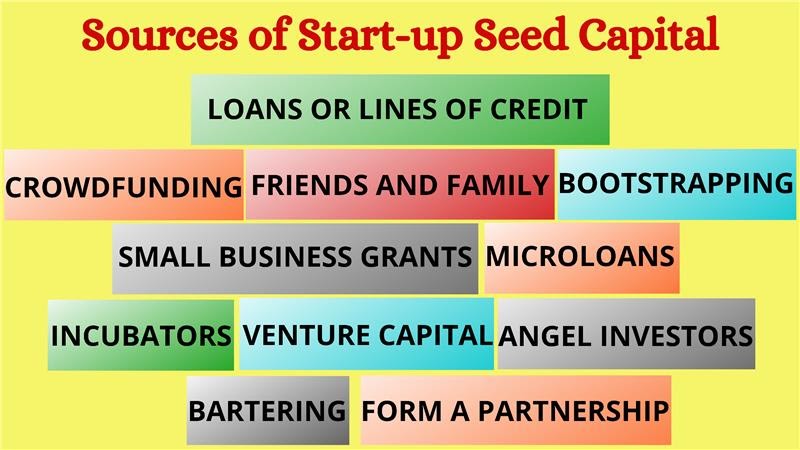

Funding Sources

So, remember one important criterion of the seed round investment for a startup. To acquire the initial capital , the budding entrepreneur has the following means:

-

Angel Investors

An angel investor is the one who can invest between 10K to 100K in new business. This takes place in return for ownership equity or convertible debt.

For example, Sanjay Mehta launched a new venture capital fund at 100X.VC is a significant milestone for the angel investor who has been investing for over eight years.

-

Venture Capital

The venture capital investors look forward to owning a share in equity along with control and decision-making power.

For example, one of the leading online furniture brands Pepperfry.com acquired USD 100 million for expansion of its business in Tier III and Tier IV cities through venture capital from Goldman Sachs and Zodius Technology Fund.

-

Crowdfunding

Crowdfunding platforms such as websites or social media are usually open. Therefore, anybody in the world may end up backing the concept, idea, or product.

For example, SkyBell Video Doorbell successfully collected $600000 in 30 days on Indiegogo for their idea of sending a live video of the person on the front gate, who rings the doorbell.

-

Incubators

Incubators provide small seed investments and offer services like office space or management training. For example, khosla labs and unltd india are some of the most active incubators.

-

Loans or Lines of Credit

To avail small borrowings from external sources, a budding entrepreneur may go for loans or lines of credit. These are available from commercial banks. This source may be required to keep personal collateral with the lender for security.

Final Note

Jenny Lefcourt, a seed investor and founding member of All Raise who has raised over $100 million, says “I think there are plenty of people, depending on the size of the round that they are raising, how successful they’ve been in the past, how far along they are, what their metrics are, where that could be much shorter.”

On the last note just remember, the biggest mistake entrepreneurs ever make is to raise a round of funding. They are comfortable in selling the company.

At this point, your incentives will be misaligned with your early investors, who are counting on you to bring them a 10x-20x return on their investment.

If you’re trying to make a $5 million to $10 million company, don’t choose investors. However, some investors are looking for $100 million-plus companies.

In many cases, you will be choosing to bootstrap to profitability. This would be with a simple product or service and building out the company on revenues.

Alcor private equity and Venture capital firm also empowers founders and businesses to grow their companies at all stages.