You started your venture and you are the one and only owner of your company. But as you look to expand your business – the action of raising equity funds to back your expansion will dilute your ownership. This action is what we called – Share Dilution.

You started the firm with 100% ownership. As you flourish further, assume you raised funds from 4 new shareholders. In exchange, you give them your company’s ownership proportionately. Thus, now your firm has 5 shareholders, who own 20% of the company. Thus, diluting your ownership from 100% to 20%.

As you flourish more, assume you raise funds from 5 more shareholders. Thus, reducing the ownership to 10% for each shareholder.

As the company raises more shares, the value & ownership of existing shareholders reduce on a proportionate basis. It is also termed – founder dilution, startup dilution, stock dilution, and private company dilution.

This activity of share dilution has a greater preference from private companies. It is more frequent in private industries than in public industries.

As private firms require large amounts of funds, private investors often acquire 20-35% of share ownership. This issuance dilutes significant ownership of the existing shareholders & founders.

As it dramatically affects the ownership of founders and investors, the conditions for dilutions get heavily negotiated during venture capital deals. As we get more into the depth of Share dilution. Let’s first understand, how Basic shares differ from Diluted Shares…

Difference between Basic Shares & Diluted Shares:

In 1997, the FASB imposed two methods for reporting per-share earnings. This includes Basic Shares and Diluted Shares. It shows the portion of investors in a company’s profits.

Generally, all shareholders hold Basic Shares. Whereas when convertible securities of a company are exercised for shares, it is Termed as Diluted Shares

The convertible securities comprise stock options, stock warrants, and convertible bonds. Its prominent use is to calculate a company’s market value of equity

How Dilution of Shares Occurs?

Why does a company dilute the shares if it makes them less valuable? This has a multitude of reasons. Here are a few of them:

-

– Issuance of new shares for growth opportunities & to improve the profitability and value of the business.

- – Issuance of additional shares to buy another company or as exchanges for acquisitions & services.

- – Offering stock options and other optionable securities to employees or board members. With the exercise of stock options, it converts to the shares of the company. Thereby, increasing the number of outstanding stocks.

- – Small Companies may issue shares to independent service providers.

- – Issuance of warrants or other convertible securities such as bonds, to lenders.

- – With the advantage of share dilution, existing shareholders with maximum stakes remove shareholders with fewer stakes.

Now, as you know, the reason behind additional issuance of shares in the event of share dilution. Let’s check out few clues to detect Share dilution in the company:

#1st Clue: When the company gives an official announcement about the release of new shares of stock in the form of a press release or by the investor relation office.

#2nd Clue: If the company has a history of frequently releasing stock options, then you can hear about it through the company’s hearsay.

#3rd Clue: You can simply get the news of the announcement by adding the company’s stock name to the Google News alert.

#4th Clue: Checking company’s 10-Q of SC 13G forms for any share issuance filings.

#5th Clue: This clue is nothing but a red flag. It is when you notice volatile pricing patterns in your stocks.

How to Calculate Share Dilution?

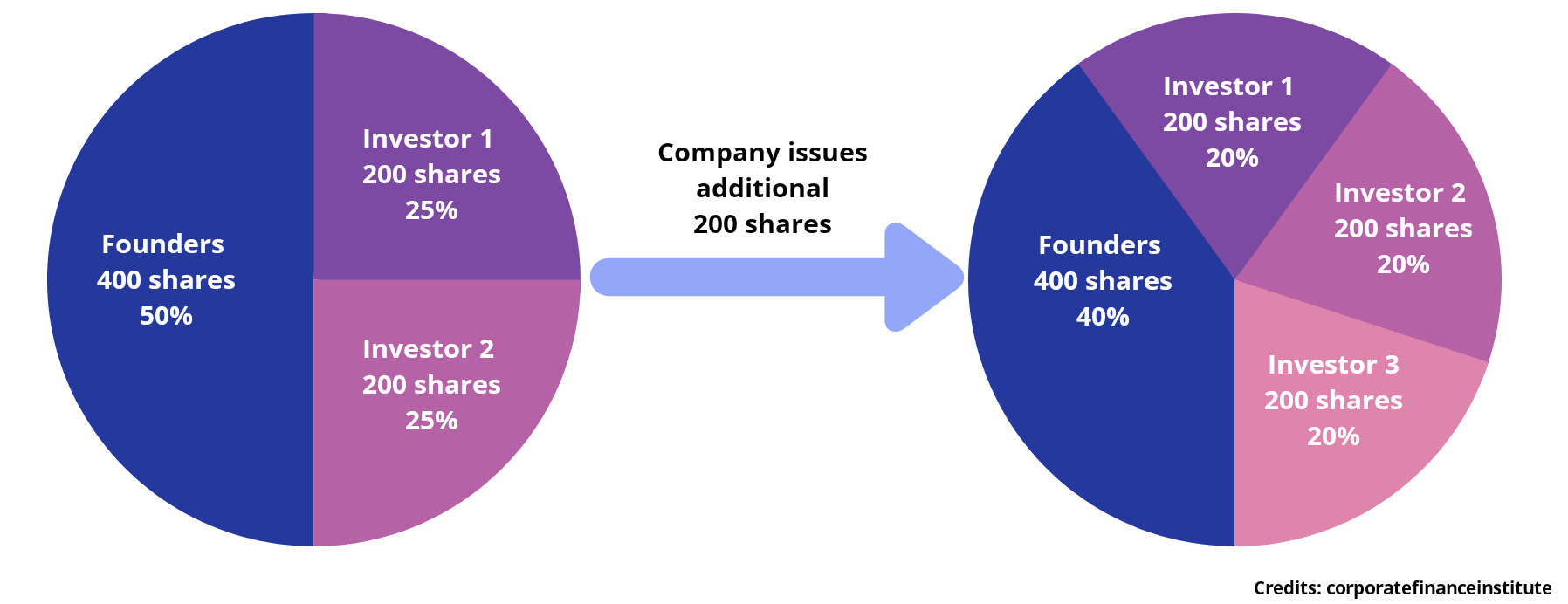

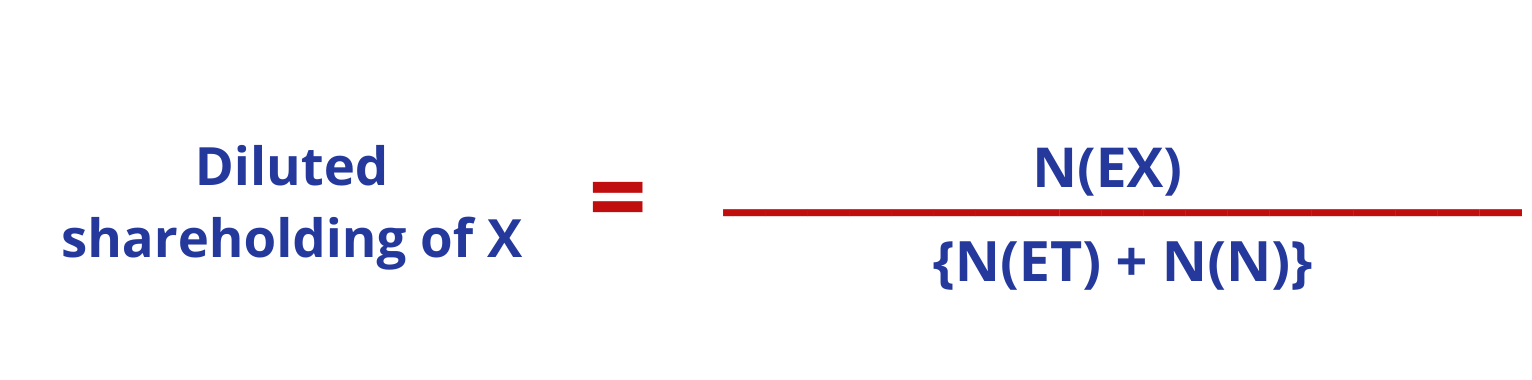

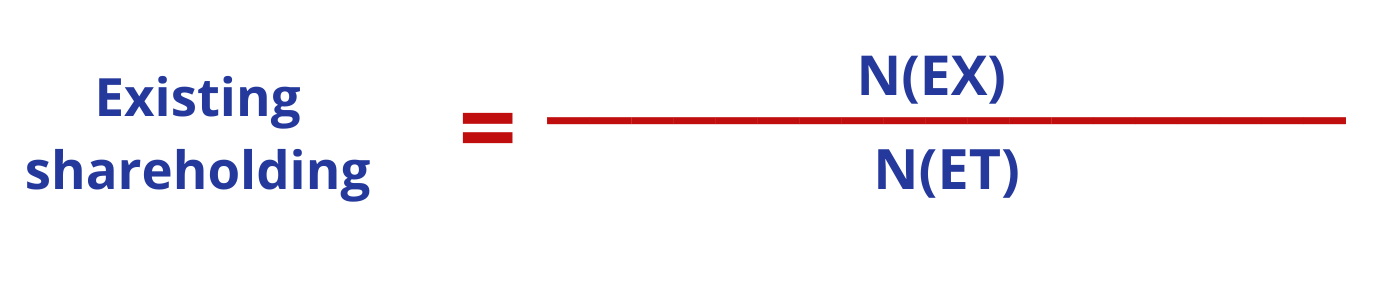

Diluted Shareholding is calculated by dividing existing shares of an individual (Let it be X) by the sum of the total number of existing shares and a total number of new shares.

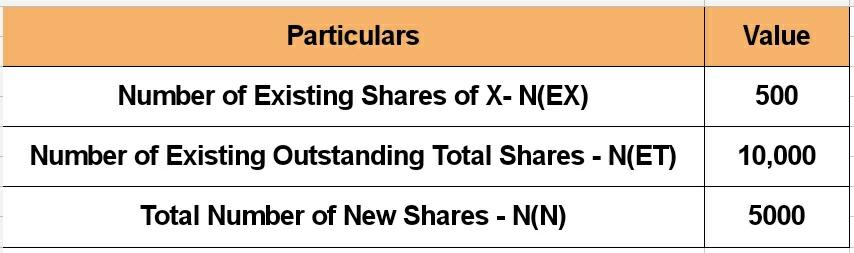

Where,

N(X)= Number of Existing Shares of X

N(TE)= Number of Existing Outstanding Total Shares

N(N)= Total Number of New Shares.

Let’s Consider, Jenny has 500 shares out of the total outstanding shares of 10,000 shares of Company ABC. The company issued new stock of shares of 5000. To calculate diluted shareholding, we are required to calculate Existing Shareholding.

Existing Shareholding= 500/10,000 = 5%

Whereas Diluted Shareholding is calculated as,

Diluted Shareholding= N(EX) / {N(ET) + N(N)} = 500 / (10,000 + 5000) = 3.33%

Thus, Jenny’s shares dilute from 5% to 3.33% on the issuance of new shares.

Is Stock Dilution Good or Bad?

Stock Dilution has a bad and even good impact depending on the number of shares issued. Precisely, the impact game share dilution is all about – “Number of shares issued.” When a stock gets diluted, it creates both positive and negative impacts on three main areas, i.e, On startup, On founders, and Investors. Let’s see how:

-

Impact on Startup:

When a startup issues shares, it creates a positive impact by encouraging revenue growth and by the accomplishment of company goals. But at the same time, it negatively impacts the stock’s earnings per share.

If a company is repeatedly issuing shares then investors may consider this as the decrepit financial health of the business and potentially will sell off the shares. Thus leading to a decline in the stock price.

-

Impact on Founders:

Many companies issue stock options to their employees in place of tangible rewards. When these stock options get exercised, it dilutes the stocks of existing shareholders which includes startup founders. Thus leading to founder dilution.

-

Impact on Investors:

Share Dilution naturally makes a negative impact on investors as it reduces individual investment value. But at times investors with larger stakes may use share dilution to kick out the small stakeholders.

In conclusion, Share dilution isn’t completely bad or good. If it’s favoring one party then it is unfavorable to the opposite party. If one is losing, then others must be winning.

Investors should also keep their eye open if a company trades in an unregulated market or make massive issuance of shares into the market to make the shares less valuable and causing loss to stakeholders.

How to Calculate Diluted Earnings Per Share?

Earnings per Share or the value of earnings of each share of outstanding common stock examines a company’s financial health before exercising stock options.

Whereas Diluted EPS is calculated to assess the company’s health after the convertible securities like convertible debentures, stock options, convertible preferred shares, convertible debentures, bonds, and warrants get exercised.

Diluted EPS is lower than the basic EPS but in cases of anti-dilutive securities, it can be higher as well. Its formula is –

Where:

EPS=Earnings per share

WASO=Weighted Average Shares Outstanding

CDS=Conversion of dilutive securities

Many companies report their essential dilution elements like basic EPS, diluted EPS, weighted average shares outstanding, and diluted weighted average shares.to analyze the effects of dilution in their Financial statements.

Stock Dilution vs Stock Split:

Stock Split is entirely different from Stock Dilution. So far you know, what stock dilution is, now let’s understand what stock split is:

The stock split is the process in which a company issues more shares to the current shareholders. It affects the number of shares and the price of each share but keeps the market capitalization the same.

E.g. Let’s consider you ordered one pizza to share between you and your friend. You cut it into two equal parts but your friend insists to make four cuts to the pizza. So now each one of you has 4 equal pizza slices. Here, the size of the pizza (market capitalization) isn’t increased, instead, it is split into more parts.

Similarly, companies prefer stock splits when the price level of shares increases. It reduces the current share price and makes it affordable to small investors.

E.g. You have 100 shares of ABC Company and the price per share is $30, your investment is worth $3000. When ABC splits you have 200 shares at $15 with a total worth of $3000.

In general, companies prefer two ratios 2-for-1 or 3-for-1, where each stockholder receives two or three shares for every share held. The main difference to observe between these two processes is, that in stock splits market capitalization remains unchanged whereas in dilution it increases.

Can you protect yourself from Share Dilution?

After you see all the dangers of Share Dilution, now is the time to tell you about how to protect yourself from this. Anti-Dilution Protection is the provision to reduce the advances of investor’s stake from being reduced in the funding rounds. It shrinks off the dilutive effect.

There are two types of anti-dilution protection. This includes:

-

Price-based anti-dilution:

It is when a company issues new shares at a price lower than the price it is issued to existing investors. The stakeholders negotiate the price-based anti-dilution protection mechanism to reduce the dilutive effects of future funding rounds. It has two types, which includes:

-

Weighted Average:

This method intends to adjust the conversion ratio to offset the effects of dilution. It compares the number of shares issued to the new investors at the same price as the earlier investors against the number of shares issued to the new investors at the lower price.

-

Full Ratchet:

Under the Full-Ratchet provision, the conversion price of existing preferred shares gets adjusted with new shares issued in recent rounds. It makes larger conversion adjustments which can prove to be detrimental to both founders and shareholders. Thus, compelling founders to back out from the vent of issuance of new shares.

-

Contractual Anti-Dilution:

With the issuance of additional stock, shareholders negotiate the right to receive percentage interest with zero payment to protect themselves from dilution, irrespective of the price at which the shares are sold.

Conclusion:

Dilution is undeniable in the life of a company. It is the main source of raising capital and making investments to achieve growth goals. Whether it comes in the form of secondary offerings or ATMs, every investor should be aware of it.

With its drastic impact on the portfolios, investors should look out for the red flags and understand its effect on their overall investments and the value of shares.