Introduction

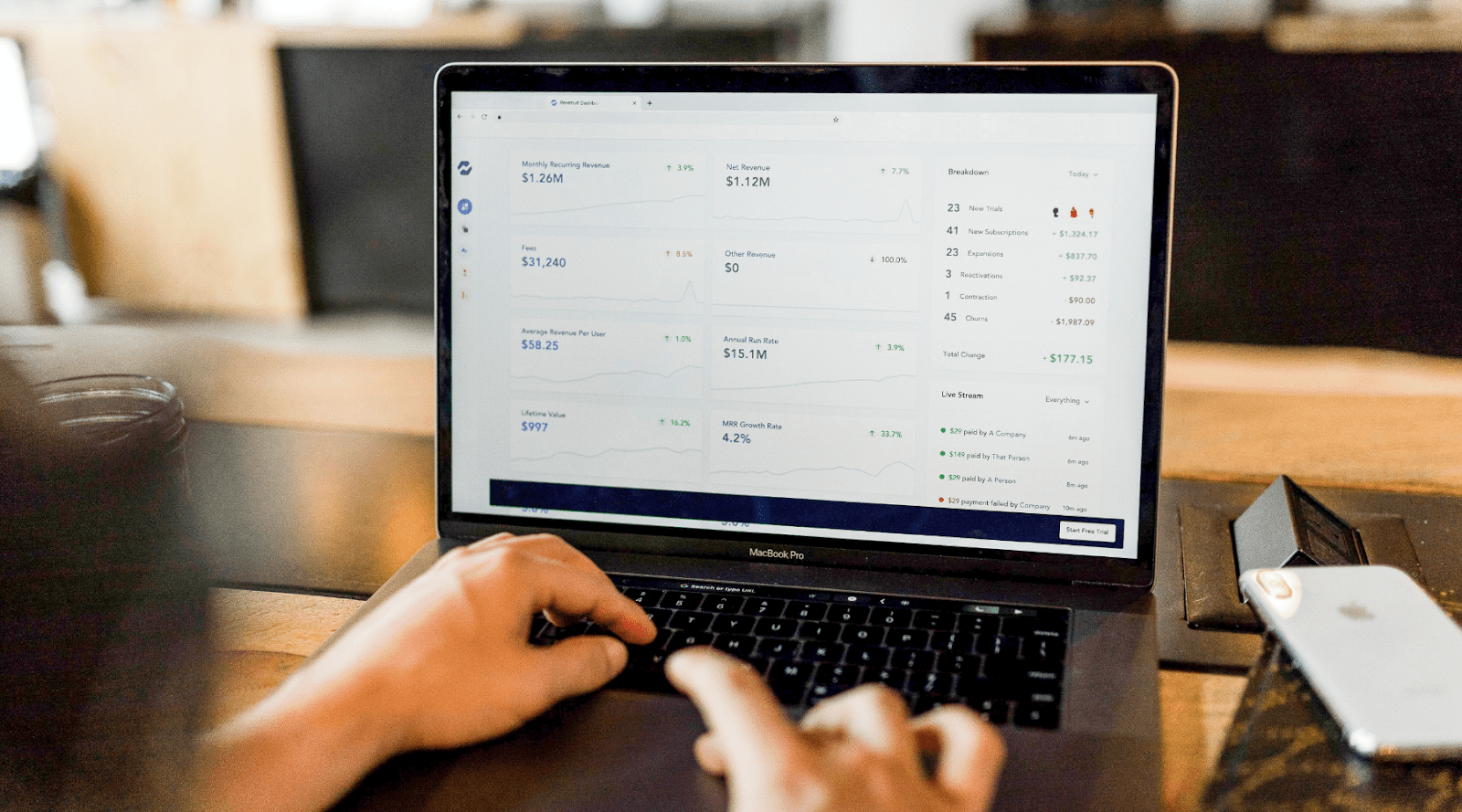

SaaS startups have grown tremendously in the past few years. As we started with due diligence we realised that most of the important saas metrics were ignored by founders. Thus leading to an obstruction in EFFECTIVE company management.

To become a successful enterprise, one has to measure the right SaaS metric to achieve profitability. Customer Success in the SaaS industry is extremely difficult. It’s not just spending money to earn customers.

It can be anywhere between you spending big money with small to zero success – You may not always get the payback.

So, here is a blog we made for you that gives insights about integral saas metrics to make data-driven decisions & informed growth strategies to make a difference in their company management. So here comes the list of important SaaS metrics that shouldn’t be ignored:

List of Important SaaS Metrics

1)Customer Lifetime Value (LTV)

Customer Lifetime Value is an important SaaS metric to understand customer lifecycle. It reflects the economic impact of each customer on your SaaS Company.

It refers to the total revenue that a customer generates for the lifetime of their account. If customer lifetime is low then the retention is less.

It can be calculated by the following Formula:

There are three steps to this formula: First calculate ARPA i.e, Average Revenue Per Account.

Consider your total revenue as $500,000 & divide it by 500 customers. You get $1000 ($500,000/500)

The Second Step is to calculate Customer Lifetime-

Customer Lifetime= 1/Customer Churn Rate

Consider, your monthly Churn Rate as 5%, thus you get customer lifetime as 20 months(1/0.05).

The final step to finding the average value of your customer is to multiply customer lifetime by ARPA. In this case, it is $20,000 ($1000X20)

To improve the Customer Lifetime Value one should invest in good customers & get rid of bad customers. Focusing on customer satisfaction & improving the product or service will have a positive impact on customer loyalty.

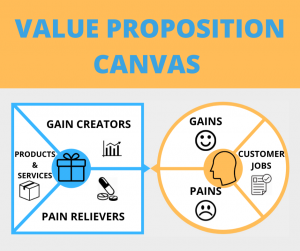

Your Business is going great if your LTV is greater than CAC. The Golden Rule to follow is to have LTV 3x greater than CAC.

2) Customer Acquisition Cost (CAC)

Customer Acquisition Cost, SaaS Metric, is the cost your company incurs to attract & acquire new customers. It is taken into account by adding up sales, marketing, ad spend, etc.

CAC can vary at times depending on the inclusion of various fixed and variable costs. Most of the time companies go with the flow of rigorously acquiring customers with a minimal preference to the acquisition cost.

Therefore, big marketing spends with a small growth rate is a red flag. Whereas if you gain great growth with minimal marketing expenses then it’s a golden flag for your business.

Hence, a business model is greatly viable when the cost to acquire customers is lesser than the lifetime value of customers.

It can be calculated by dividing total marketing costs by the number of new customers.

Let’s consider, your SaaS company has spent $50,000 on sales and marketing of your product. And got 50 new signups for the same month. Thus, your cost to acquire a single customer for this month is $1000.

3) Monthly Recurring Revenue SaaS Metric(MRR)

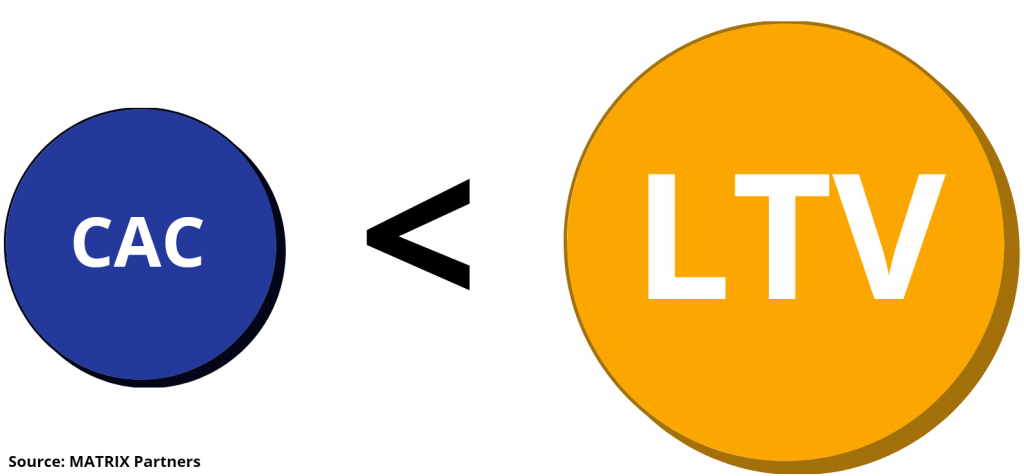

This SaaS Metrics refers to the amount of revenue that an acquired customer generates over a month. Though a different metric from total revenue – it’s an integral SaaS metric that describes at which stage a company is with regards to product or service revenue.

The blue line represents MRR Growth with inclusive of new customers, upgrades/upsells, downgrades and churns. Thus, projecting better insights about sales performance.

This SaaS metric should include only software-related revenues that are recurring in nature. Other streams such as set up fees, consultation, one-time payments, onboarding, etc. shouldn’t be included.

It is calculated by adding up all the active and recurring revenues we generate from customers. An increase in MRR depicts a healthy stream of revenue you have for each month – which is great for your business growth.

But if your MRR is showing a downward trend – you have to monitor the cause of it. Therefore, the more regularly MRR is understood and monitored the more you can effectively strategize to improve it.

4) Annual Recurring Revenue (ARR)

Annual Recurring Revenue or Annualized Recurring Revenue is the SaaS metric that indicates the amount of revenue generated every year. It is calculated by multiplying Monthly Recurring Revenue by twelve. It is formulated as:

The majority of SaaS enterprises focus on Annualized based recurring revenue rather than a monthly one. As most of them favor yearly contracts over monthly subscriptions.

5) Customer Churn

The business growth is sustainable when customers are retained. It refers to the number of customers that abandon your product or subscription-based SaaS software. It can be because of the non-renewal of subscriptions, cancellations, etc.

So, the reason for this could be dissatisfaction of customers, better products offered by competitors, rigorous marketing from competition or product or business failure.

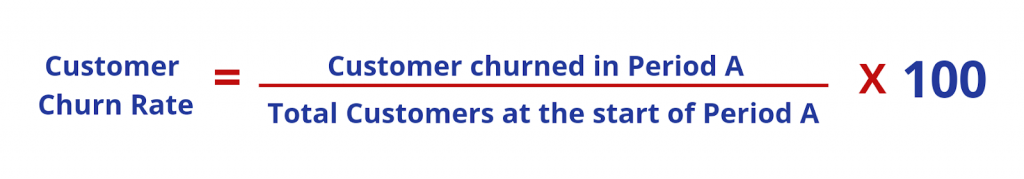

It is calculated as:

If you gain 30 Customers at the start of the month and by the end of the month you lose 9 customers. Your Churn rate will be 6.3%(30-9/30x 100).

This SaaS metric is more valuable than CAC as the cost of acquiring new customers is always greater than retaining the current ones. For a SaaS company, each customer is worth thousands of dollars in the long run.

There are two types under the Churn Rate: Gross Churn & Net Churn. Gross Churn is the rate at which the customers cast aside your service and Net Churn is deducting Customer Acquisition from Gross Churn.

Consider your Gross Churn is 10% and Acquisition Rate is 3%. Thus, your Net Churn is 7%.

A natural churn of some numbers is acceptable but a higher churn will require more capital investment to acquire new customers.

So, an Annual Churn Rate of 5%-7% is a sustainable figure for SaaS companies that means 0.58% for each month – that could be 1 in 200 customers or 5 in 1000 customers – that much ‘low’ it is supposed to be.

6) Revenue Churn

Revenue Churn is also referred to as MRR Churn Rate. Revenue Churn is the amount you lose as customers inscribe your services.

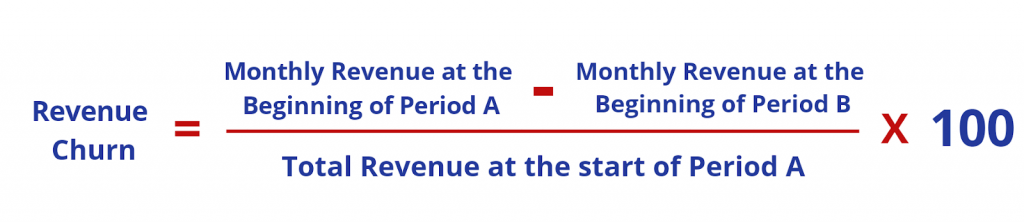

Its calculation is formulated as:

Consider, Your revenue at the beginning of January was $10,000 & at the beginning of the consecutive month is $8,500. Thus, your Revenue Churn for the Period A will be 15% ($10,000 – $8,500 / $10,000 x 100).

This important SaaS metric outlines the impact of customer churn on revenue – But not always. If your yearly subscriber chose the monthly subscriber for next year – then it could be revenue churn but, not customer churn.

Thus the customer churn impact will differ each time depending on varied subscriptions and plans you offer to customers.

7) Product Qualified Leads (PQL)

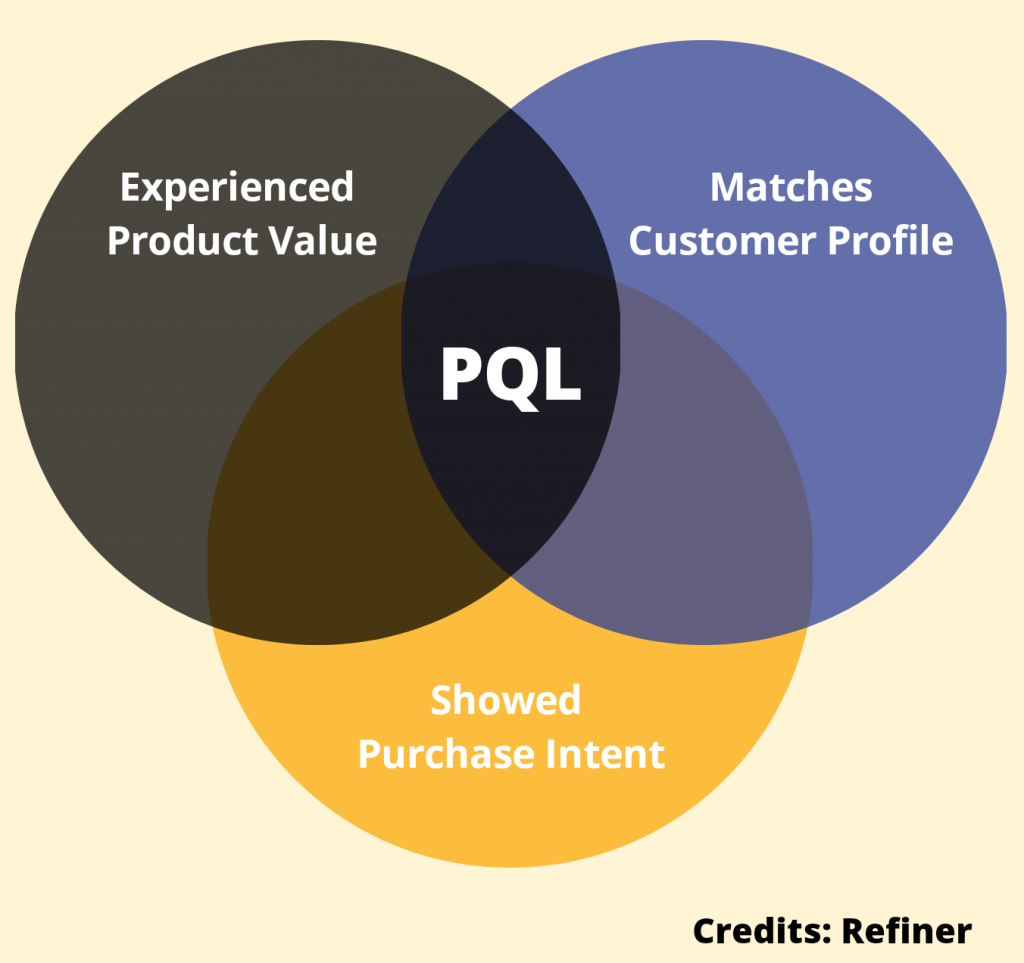

This is an important metric for a Freemium based SaaS Business. It refers to a strong likelihood of a product after using the product. Thus intensifying the chances of them turning into paying customers.

These leads are the individuals who have experienced your product value, shows the intent to purchase it and matches your customer profile.

It includes giving a unique feature that triggers them to buy the product package or making them the leads that have qualified the product usage.

This helps SaaS Enterprises in running experiments to increase the volume of PQL which eventually will make a sale.

Depending on your marketing, sales & your business type – your definition of business will differ from others. Keep a close eye on this SaaS metric to check how many of them get converted into paid customers. Thus, higher the rate, the better will be business growth.

8) Qualified Lead Velocity Rate (LVR)

This SaaS metric measures the monthly growth of Lead Generation.

As Jason Lemkin says – “Being able to quantifiably track the velocity of qualified leads is going to be your best possible indicator as a CEO of where you’re going to be in the future.”

It’s a great SaaS metric in estimating the effectiveness of the sales pipeline. Thus forming a competent tool when your company is about to scale for estimating future sales attainment.

It tells the number of potential customers that could be in the line as next paying customers.

It is calculated as:

Consider, you got 1500 leads for this month & 1000 leads for the previous month. Thus your LVR will be 33% (1500-1000/1500 x 100).

It’s a real-time metric that portrays the future of your business growth and revenue. So, based on existing insights that are combined with past development, this SaaS Metric can prove to be a great tool in estimating future growth.

9) Retention Rate (RR)

Research shows that an increase in customer retention by 5% can increase profits up to 95%. Retention is the ability of an organization to retain customers over a long period.

It can also be referred to as the number of customers that make continuous purchases from your organization.

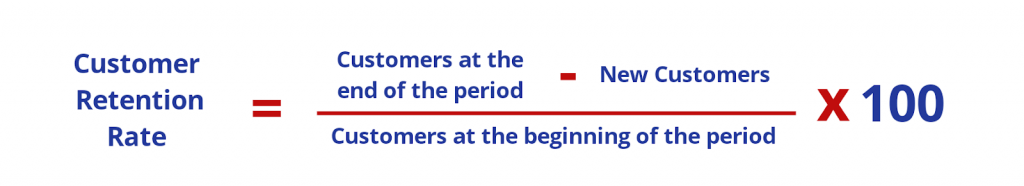

It is formulated as:

Acquiring more customers is considerably expensive than retaining the existing ones. In SaaS enterprises, successful customer support strategies play a very big role in satisfying customers and making them a loyal customer. SaaS firms should aim for a higher retention rate that keeps behind their churn rate.

One of the best ways to do this is to analyze the retention cohorts. So, the analysis of these Cohorts will let you draw better insights to understand your product and other parts that affect your product growth.

10) Net Promoter Score (NPS)

Net promoter Score tells about the probability of a customer to recommend your product or service to their colleagues and friends. Here you measure the loyalty of your business. It tells about what your customers feel about your product.

You can simply do this by taking a questionnaire-based survey that addresses your consumer’s willingness to recommend the product and their liking of the product.

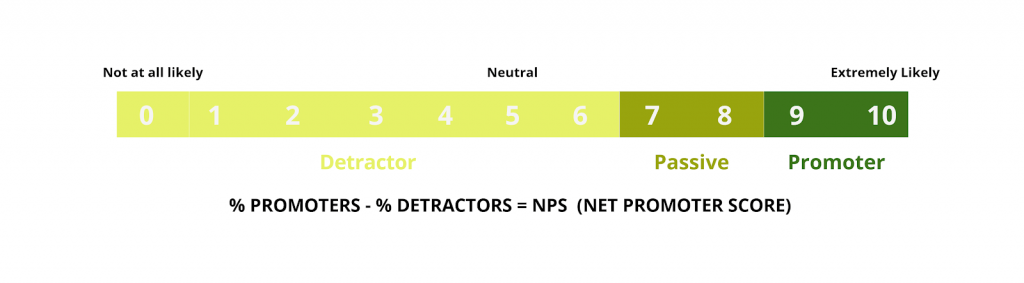

NPS is generally scaled from 0-10, zero means they won’t recommend your product and ten means they will recommend your product.

There are three categories in it:

– Detractors:– Less Liking towards the product (0-6 score)

– Passive:– Neutral towards the product (7 or 8 scores)

– Promoter:– Strong liking towards the product ( 9 or 10 scores)

The higher the NPS score, there are high chances of customers promoting your product. And lower rates leads to further developments in the product.

11) Expansion Revenue Rate

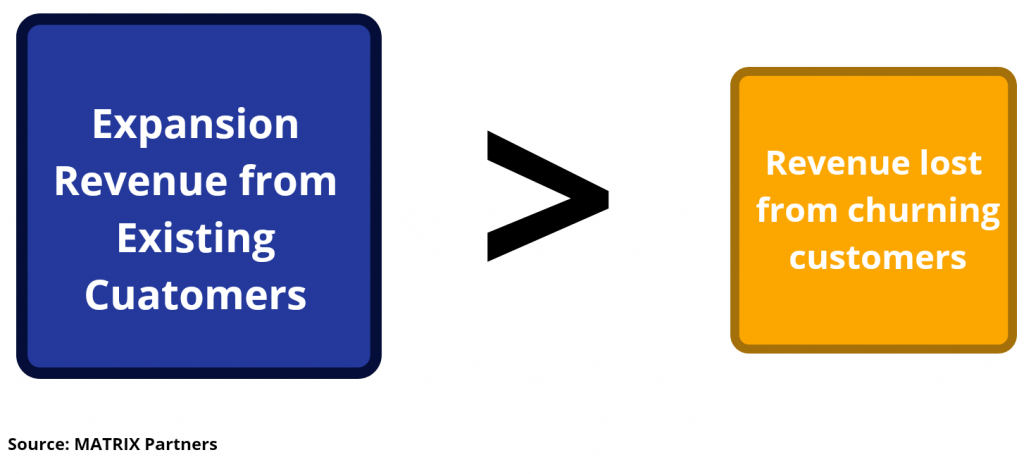

Expansion Revenue rate is the additional revenue the organization generates through existing customers. It can be by way of upsells, cross-sells & add-ons. Expansion Revenue is of greater value when it is higher than the revenue lost from losing customers.

It interprets how effective a company is in delivering more & more value. It’s about making the most use of limited customers. Hence, it is an important metric that focuses on generating more revenue without acquiring any new customers.

Conclusion:

The list of saas metrics is long. Every company has its own set of different metrics to optimize the business in its way. SaaS Metrics figures influence a major part of the business.

Building a tracking report with predefined SaaS metrics & benchmarks will give clarity about the monthly progress.

It is infrequent to match the exact same benchmark level – as it’s always above or below the level. Making small improvements to these figures will have an overall impact on the well-being of your SaaS business.

The Negative trends in your SaaS metrics should drive you to bring a positive impact to the business.

So, metric is just a tool – what pays you, in the end, is best-informed decisions and strategies based on those numbers that will make a positive difference for the next results.

Alcor private equity and Venture capital firm also empowers founders and businesses to grow their companies at all stages.