Imagine that you have just founded a firm based on your business idea. You are going to act as CEO and work on product and business decisions. Your technical co-founder is going to handle most of the building and design.

You are both fully committed, and you have both quit your day jobs. You plan to hire some employees later. But they will not be co-founders.

So, you decide to split your equity. You decide on 40% for you and 60% for your co-founder and issue stock accordingly.

You and your co-founder trust each other. But you want to make sure that you both stay for the long haul and put in the work needed.

Fortunately, there is a process by which you can agree to “earn” your shares over some time, vesting. Your co-founder and you should definitely make your stock grants subject to it.

In the US, it would be difficult for startups to hire without formalizing stock option grants.

In Europe, informal promises of stock options can secure hires. So, stock option grants are formalized after Series A fundraising.

It would not be good for startups if these stock options could be converted into shares immediately. They would not be effective for retaining employees. This is where vesting comes in.

Vesting has two main benefits. It incentivizes a person to stay and protects the company if the person leaves.

This article will provide all the details you need about vesting and typical vesting schedules. Read on to find out the usual time period of vesting, and how vesting can incentivize members while protecting your startup.

What is Vesting?

Vesting allows founders and employees to earn their shares over some time. Founders and employees can (and at times do) earn their shares based on specific actions. These include hitting $1M in sales, hiring 50 employees, etc.).

But most vesting agreements are based on time, so they are referred to as a vesting schedule.

E.g., you and your co-founders will buy your shares on day one (usually at par, or $0.00001).

But your company will have the right to repurchase the shares from you at $0.00001 if you leave the company. This is called the repurchase right.

The company loses its right to buy back the shares as time goes on.

The founders will own the shares outright. The founder will “earn” the shares away from the firm.

This is as the founders will own the shares from day one. It provides the company with some assurance that the founders will stick around.

This structure allows for better tax treatment.

Vesting works slightly differently in the case of options.

An employee may have received an option grant subject to vesting. It increases the number of shares they are allowed to buy (or exercise) at any given moment.

This is rather than decreasing the company’s right to repurchase shares they have.

Typical Equity Vesting Schedule Template and Types

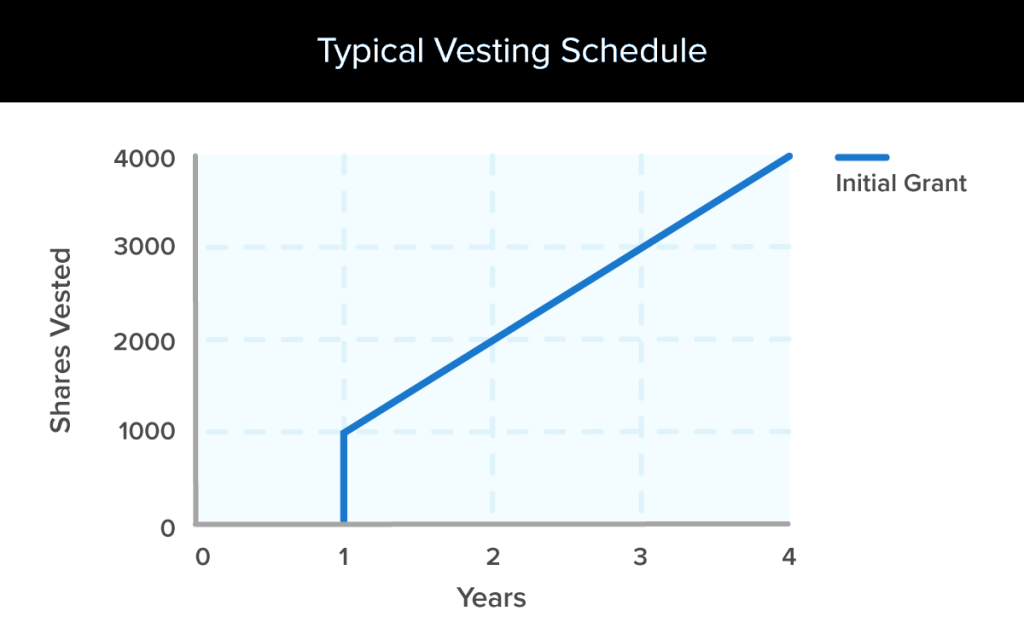

Here is a usual four-year stock option vesting schedule:

- Most employees have their shares vest in precisely the same way in startups. This is true whether they are senior executives or entry-level employees.

- Employee stock options typically have a one-year cliff. The employee must work for the firm for an entire year before any shares vest. Then 25% of his/her shares vest.

The employee may leave or be fired before the year is up. Then his/her shares never vest.

- End of the first year – the shares vest on a monthly or quarterly basis.

- End of four years – 100% of the shares are fully vested.

That is usually how things are structured. However, there are always exceptions to the rule.

Some employees may also receive additional stock options. These vest over four years as a bonus or reward for good performance.

These additional stock options have their vesting start date.

Founders usually own founders’ shares. But the company typically reserves the right to repurchase them.

This is different from the employee stock options described above. But the results tend to be similar.

Vesting requirements can apply to stock options and retirement accounts alike. Typically, there are three types of vesting schedules:

-

Immediate vesting schedules

These have no waiting period for employees to leverage their benefits. You immediately have full ownership of the asset.

-

Graded vesting schedules

This allows you to receive incremental ownership of the asset over time. This will eventually result in 100 percent ownership of the asset.

E.g., you might earn 10%, 25%, 25%, and 40% annually over four years.

Vesting schedules on retirement plans are a maximum of six years.

-

Cliff vesting schedules

It provides a lump sum benefit to the employee at a specified date. E.g., there may be a three-year cliff vesting schedule.

Then you receive no part of the benefit until you reach three years of employment.

At this point, you assume 100 percent of the asset.

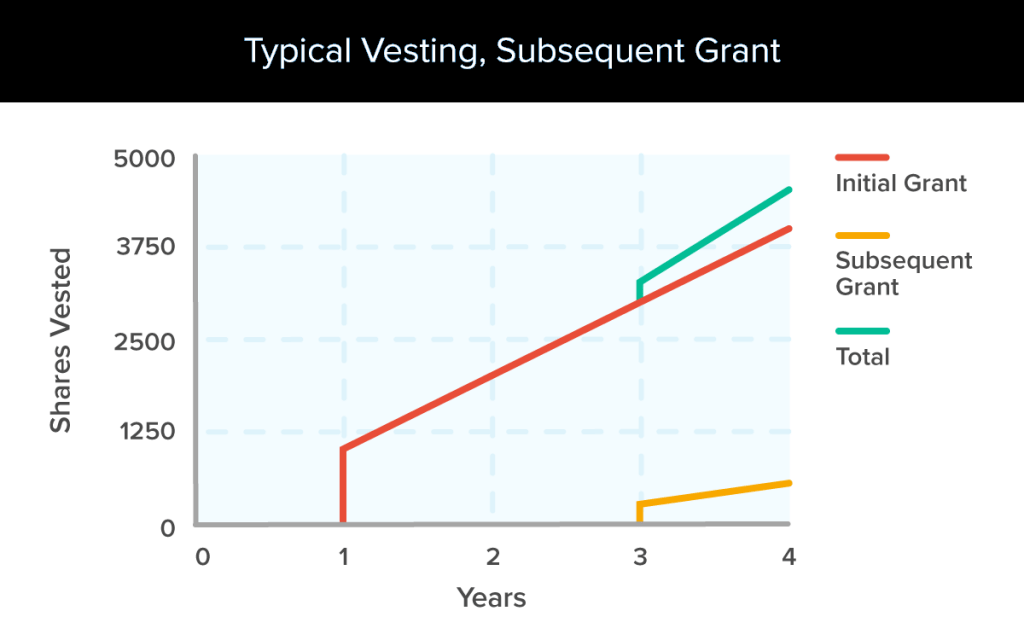

Typical vesting and subsequent grants

Vesting is a feature of the grant. The vesting schedule in stock grant applies to that grant. It does not apply to subsequent grants.

It has no relationship to the length of the recipient’s tenure.

A founder may receive a 4,000 share grant with 4-year vesting.

He may then get a 1-year cliff and an additional 1,000 shares with the same schedule after two years.

Vesting Acceleration

Acceleration explains what happens if the company is acquired. It is only used in equity grants to founders and executives.

This comes in two typical flavors: single-trigger or double-trigger.

-

Single-trigger acceleration

The acquisition results in all remaining unvested shares vest immediately.

-

Double-trigger acceleration

The remaining shares vest all at once. Two conditions must be met. These are usually the acquisition of the company and the grantee’s termination. But they could be a variety of things.

Advantages of vesting schedules

-

Vesting protects your company

Vesting is mainly done to protect the company. Things may not work out for one of you. Then without vesting, one co-founder can walk away with their entire portion.

The one who ends up staying will be stuck building a company for their retired team member.

But their equity would be a claim on any gains your company makes in the future. But equity is not just a share of the spoils—it also includes voting rights.

Your technical co-founder may leave with 60% equity. Then she will have decision-making power. And even if your co-founder had less than 50%, they would still have a significant voice as a voter.

There is a third kind of protection here, too. Vesting helps to take care of the cap table. So, it can be as clean and logical as possible when raising investment.

Investors care about shares and voting, too. This is since they will be buying a large chunk of your company.

But, even beyond that, they are interested in how you run your company.

-

Vesting helps incentivize team members

Vesting encourages members to stick around during tough times.

Most startups must go through various crises. Having a growing stake in the firm can be a compelling reason to stay on the team.

This motivation rings just as true for employees.

This is a big reason option plans are such a popular type of incentive for startups to offer. It makes other opportunities that much less attractive.

Why Does a Vesting Schedule Matter to Stockholders?

You may be granted stock options that follow a vesting schedule. Then it is essential to understand how and when you can take advantage of your benefit.

You may not be able to take unvested options if you leave the firm early. This could severely impact your financial planning.

You may choose to leave the company after two years of receiving your stock options. Then you would be leaving 85 percent of your stock behind. In terms of compensation, this could be worth tens of thousands of dollars per year.

There may be a grant of 50 RSUs valued at $2,000 each. Then you would only receive $5,000 in stock value after your first year (five percent vested shares).

After the second year, 15% of your shares will vest. Your stock value would triple to $15,000.

After year three, you would add an extra $40,000 to your annual compensation. This is twice the amount of the previous two years combined!

Tax Implications

The taxation of vesting shares is controlled by Section 83 of the Internal Revenue Code.

Founders can make an “83(b) election.” They have to do this within 30 days of the date the shares were originally purchased.

The founder elects to have the buy count as a taxable event. It treats the shares as if they are not subject to forfeiture.

They pay tax on the difference between the fair market value and the purchase price.

This will often be $0 since shares are typically purchased at fair market value).

This 30-day deadline has no extensions. After the deadline, founders lose the ability (and the benefit) to make an 83(b) election.

Examples of Vesting Schedules

Vesting schedules can vary by company. This is both in terms of duration and the percentage of shares vested each year.

Nike provides its employees a five percent match on their 401(k) contributions. They can vest it immediately. There is no waiting period or other requirements.

Nike also offers restricted stock units (PSUs). They typically vest at 25 percent per year over four years.

Four years may pass from the stock grant date. Then you can choose to sell the stock immediately or keep it to grow your wealth.

Amazon approaches vesting a little differently.

An example taken from an Amazon job offer shows that company equity (RSUs) does not equally vest each year.

Instead, only five percent of the stock will vest during the first year.

After year two, 15 percent of the stock units will be vested. This can also be 20 percent total from years one and two.

Year three will see a significant increase. Forty percent of the RSUs will be vested (or 60 percent total from years one, two, and three).

The same will apply to year four. Then the RSUs will be 100 percent vested.

Conclusion

Vesting provisions are standard for founders’ shares. These provisions can protect founders.

They can mitigate some of the risks associated with starting a business from nothing.

It can spur further growth when the company seeks outside financing from investors.

Seeking advice from tax and legal professionals is critically important. They can help you to structure the terms of founders’ shares and the tax approach.

The terms and structure of these arrangements will vary. It will be based on each founder’s and each company’s facts and circumstances.