To understand the concept of Series A B C Funding, Let’s say you are the founder of a startup. The startup has passed that early, unceremonious pre-seed phase.

Till this point, the amount of money spent on meeting over coffee is more significant than what is raised. At this point, your heart, soul, and a hefty bank account have been put into the foundations.

In the next half a year, you grind out the finer points of your business development. The startup is now a semi-successful venture with a large consumer base.

The financial team is optimistic. They have a model that can be monetized. But the business needs another round of funding to scale even further.

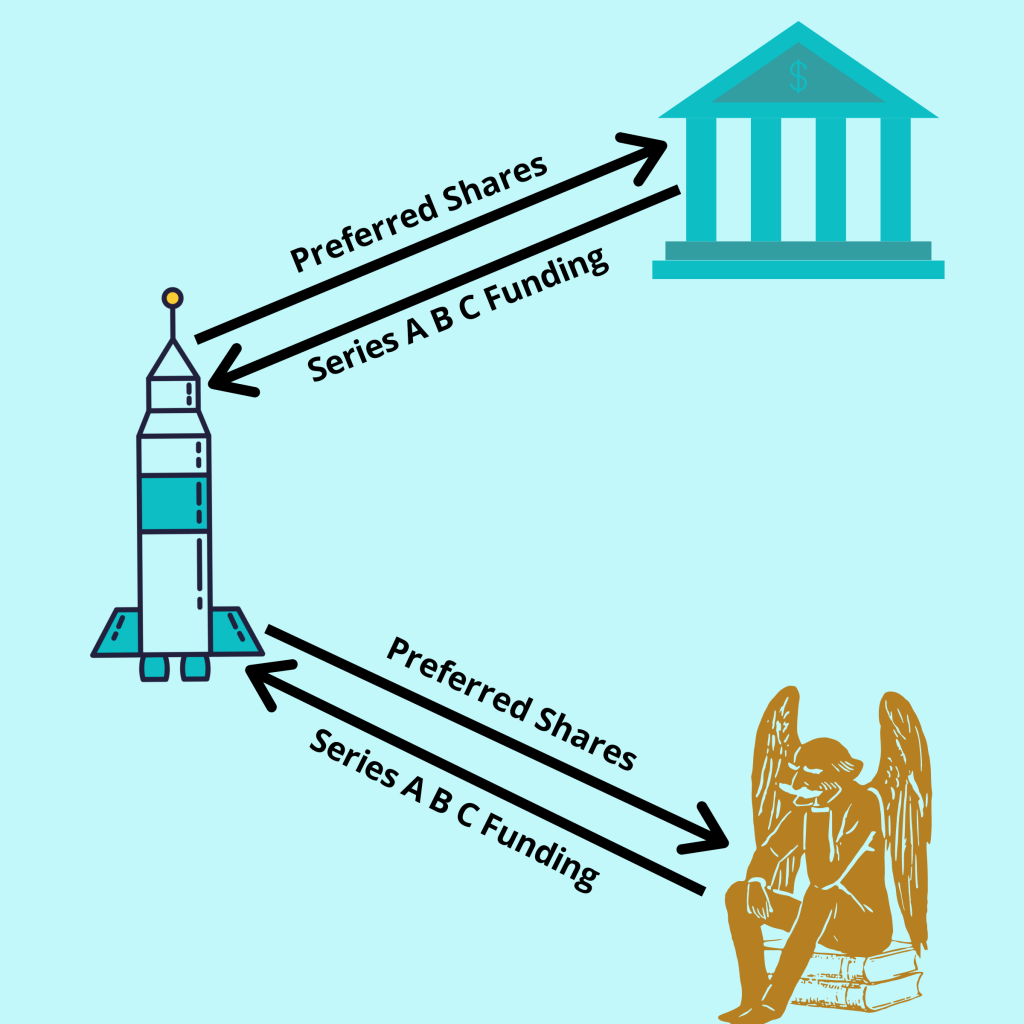

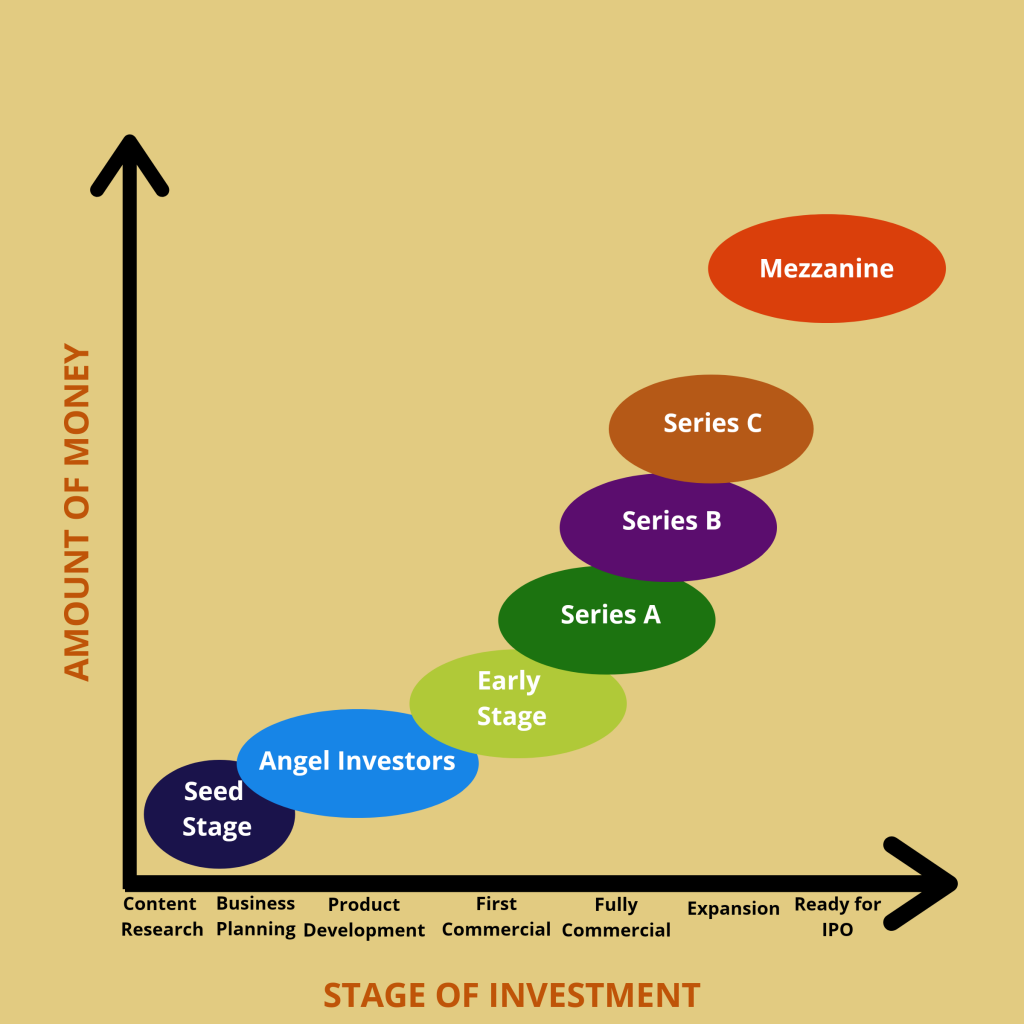

Thus, startups go through a series of funding from venture capital firms. Capital is raised in many rounds of financing as the valuation of a company may increase.

Series A is the initial fund-raising round. The later funding rounds are named Series B, Series C, and so on.

We will give complete details of startup funding in general and Series A B C funding in particular. So read on to know everything about venture capital funding.

How funding works

A business turns to external funding when it looks to supercharge its growth. New startups often bootstrap. They operate without external funding as far as they can. Then they seek investors to help fund their venture.

Startup founders should have evidence of growth and traction. Or there must be a genuine interest in the market of the product or service before they reach out to investors.

Investors may see potential in the Company to produce a financial return. Then they will invest money into the startup in exchange for an equity ownership stake. As the Company grows, its shares will increase in value.

The Company may successfully exit (i.e., gets acquired or is listed on a public stock exchange). Then the investors will make a significant return. If the startup goes bust, they lose everything.

Startup founders will provide a valuation before investors part with their money.

Investors use the valuation to assess several factors about the likelihood of success. This includes its track record to date, the size of the market it operates in, and the Company’s profit margin.

Changes in Modern Funding

The last decade has seen some trends reshape the way startups raise investment.

Earlier, venture capital funding was reserved for a few startups with massive growth potential. Those startups also had a wealth of good connections. But recent years have since a surge in finance available for businesses of all types.

Before, you may have been tempted to bootstrap entirely. But the likelihood now is that you’ll need to rely on more than just family and friends for the capital.

Many firms bag funding every day. There has also been an unstoppable rise of alternative finance such as crowdfunding. So, it’s easy to get overwhelmed by the types of venture funding available to businesses.

To fully understand why modern-day investment looks the way it does, we need to look at these changes:

1) Investment has increased massively

There are peaks and troughs in fund-raising. This is typically driven by exuberant over-investment followed by reactive belt-tightening.

But despite these fluctuations, the growth trend for fund-raising is hugely positive. Startups are raising more capital at higher valuations.

2) If there’s a bubble, it hasn’t burst

There has been an escalation of valuations and an increase in round sizes. This has led to speculations of an investment bubble. But the data shows that current slowdowns have been short-lived.

3) The earlier the round, the riskier it is

The level of risk impacts the types of investors attracted to a deal. It also affects the amounts raised. Early-stage investments attract risk-loving angels and VCs. Later-stage fund-raising appeals to risk-averse financial institutions.

4) Most investment takes place in the enterprise

80% of VC investments happen in the enterprise. The lion’s share of those investments goes to enterprise software. This is second only to the burgeoning biotech industry.

5) “Seeds are the new Series A”

This continued increase in investment has created a kind of fund-raising inflation. Startups are expected to work harder for each round of financing than ever before.

We’ve even seen the introduction of a new term into the fund-raising lexicon. That is a pre-seed investment.

Prior Stages of Funding

-

Family and Friends Round

In the early days, asking family or friends for capital can be the easiest and fastest way of raising funds. But, do not raise a family and friends round with poorly planned execution. This can cause structural problems for future investors.

Founders with no experience can often fall into the trap of over-valuing the Company. This can cause detrimental damage to future funding opportunities.

It is advisable to formalize the process (and thoroughly document it). Speak to founders who have gone through a similar approach. Be open to family and friends about the risks of their investment.

-

Pre-Seed

Seed rounds are the first type of fund-raising round available to founders. In a competitive marketplace, there has been a massive growth in the number of startups.

This has allowed “traditional” seed investors to become far more discerning. This has raised the threshold required to attract “traditional” seed funding.

A typical pre-seed round sees a founding team receive a small investment. It helps to hit one or more of the milestones.

But they’ll need to ready themselves for “true” seed investment. This ranges from hiring a critical team member to developing a prototype product.

It is led by many of the same investors that lead seed rounds. This round is often used to bridge the gap to the next round.

Average Funding Amount: <$1 million

Typical Company Valuation: $1–3 million

Common Investors: Friends and family, early-stage angels, startup accelerators

-

Seed

The first equity funding stage is Seed funding. This is where your Company needs to gain traction before you run out of runway.

Usually, this money is used for product development and extending your founding team. It funds product development, and in some cases, even facilitates early revenue generation.

Wrapped-up within seed investment is expected. It expects that vital signs of Product/Market Fit and some degree of traction will begin to emerge.

The traction can be in the form of a growing waitlist or month-on-month revenue growth. It helps to pave the way for later fund-raising.

Earlier, seed rounds were the reserve of angel investors. But there has been a proliferation of cash-rich VC funds. There is a vast range of startups to invest in now. This has attracted more venture capital firms into a seed round investment.

This has created a considerable variance in seed sizes. The median angel-funded seed size is around $150,000, but the median VC-led seed size is closer to $1.5 million.

The involvement of VCs leads to seed rounds ten times larger than those shown by angels. The most significant seed round in 2015 was a staggering $10 million.

You can read more about seed funding in our detailed write-up.

Average Funding Amount: $1.7 million

Typical Company Valuation: $3–6 million

Common Investors: Angels, early-stage VCs, startup accelerators

Series A B C Funding Stages

| Funding Rounds | Best for |

| Series A | Going-to-market and stabilizing |

| Series B | Scaling products and delivery channels |

| Series C | Scaling reach and operations |

| Series D | Saturating markets and preparing for exit |

-

Series A Funding

This is the first round of equity financing that startups raise. This allows them to take their product to a mass market and stabilize the Company.

Most startups are on shaky ground until this round of funding. This is because they are often outgrowing their ability to generate revenue.

Another reason to raise Series A is going to market. At this stage, the startup has already developed a minimum viable product (MVP). They have piloted the product and found product-market fit.

But, in most cases, its operations are demographically or geographically constrained. This round enables them to reach a wider audience.

In Series A, investors will be looking for a strong strategy and excellent execution.

At this point in your Company’s journey, you’ve made progress on your KPIs. For example, consistent revenue or an established user base. You may decide to take part in Series A funding rounds to optimize further and scale your business.

By now, it is usual for investors to take part in a somewhat more political process. A single investor may serve as an “anchor.”

Once a company has secured a first investor, it may find that it’s easier to attract more investors as well. Angel investors also invest at this stage. But they have much less influence in this funding round.

According to a KPMG report, the number of first-time capital raises has declined. But the deal sizes have grown larger. This is because the cost of going to market is falling. Private capital for earlier stages of funding is growing.

Angel investors are offering more massive funding amounts. More startups are turning to crowdfund to reach their customers.

How to get Series A funding

To persuade investors to put funds, you’ll need a clear and rigorous valuation of your Company.

There are different ways to value a business. This includes order book value or the cost or resale price of assets. It can even be a combination of several key characteristics of your Company.

It’s reasonable to choose the method that shows your business in the best light. But be sure that you can support your valuation if potential investors question it.

By doing this, you also protect yourself against certain risks. This ranges from taking on more liabilities than your Company can afford. It can also be accusations of deliberate fraud.

Make sure you know how much finance is typical in a Series A funding round in your chosen industry. It can vary a lot, especially in high-growth sectors. So some research will help you to make sure that you ask for the right amount.

Valuation of the startup in this round is done based on:

- proof of concept

- progress made with seed capital

- quality of the executive team

- market size

- risk involved

The goal of Series A round is:

- To cover up the salaries of people involved

- More market research

- Finalization of product/service to be introduced into the market

Series A Funding Round: Fund-raising and Valuation Stats

- Median 2019 Series A fund-raising amount: $9 million, up from $2.7 million in 2012

- Median 2019 Series A startup valuations: $22 million, up from $8 million in 2012

Series A Funding Round Typical Investors

Series A investors include accelerators and venture capital firms such as:

- Y Combinator

- 500 Startups

- Techstars

- New Enterprise Associates

- SOSV

Use our venture capital report to evaluate your business and get access to 1000’s of investors that are looking to invest in your company.

Example of Series A Funding

Coinbase used the $5M they raised in their Series A round to focus on their business goals. It was to make Bitcoin more comfortable to trade.

-

Series B Funding Round

You have already found your product/market fit if you get to Series B. Your product is succeeding, and your user base is growing substantially. You’re struggling to wear many hats and keep up with demand.

This is where Series B comes in.

Here, venture capitalists are most valuable. This is because they can offer both funding and advice.

The differences between Series A and B are the scope of the venture and the amount of capital raised. It also includes the solidification of serious expectations set forth by investors.

Another cause is the increase in the time that previous rounds afford startups to scale. With the growth of startup ecosystems, many enterprise-level solutions enable quicker scaling.

Startups consider a Series B funding round the most difficult to raise. The main hurdles to raising a Series B round are survival and growth.

Many startups do well but do not scale the business with a Series A round. This is often because of an overestimation of the potential market size.

Getting a high enough valuation is another barrier. Its sometimes caused by an overvaluation from the previous funding rounds.

How to get Series B funding

You should give investors a sensible, accurate valuation for your Company.

But as your business has grown and staked its claim to more of the market, you might want to look again at how you value it.

For example, try not to base your valuation on your future order book or forecasts of future value. You might be in a stronger position to use existing data like any assets you own.

Combined with the continued growth, your new valuation could be much higher. It would be more appealing to investors who are looking to place Series B finance.

It can also have a significant impact on the amount of equity you give away at this stage. A higher valuation means you have to part with less equity for each dollar invested.

Characteristics of Series B Funding

- Venture Capitalists as your primary investors

- A medium-to-large user base of consumers

- A viable product/service idea

- Proof that your Company can meet specific expectations outlined by your stakeholders

The goal of Series B round of financing is:

- Onboard top talent

- Business development

- Software development

- Marketing

Valuation of the startup in this round is done based on:

- Performance of the Company in comparison to the industry

- Revenue forecasts

- Assets like Intellectual Property, etc.

Series B Funding Round: Fund-raising and Valuation Stats

- Average 2019 Series B fund-raising amount: $20 million, up from $7 million in 2012

- Average 2019 Series B startup valuation: $70 million, up from $21 million in 2012

Series B Funding Round Typical Investors

Series B investors include venture capital firms like:

- ARCH Venture Partners

- Alumni Ventures Group

- Tuesday Capital

- Lux Capital

- Rev1 Ventures

Example of Series B Funding

Stripe (who now boasts a $35B valuation) went through Series B funding back in 2012. According to TechCrunch, co-founder Patrick Collison planned to use the funds for hiring. It was required to scale-up the organization.

-

Series C Funding Round

You’re now a successful company. You’ve got a top-notch user base, you’ve acquired great talents, and now you want to conquer the world. Here, Private Equity Firms and Investment Bankers start to take an interest.

These players aren’t looking for high-risk investments. They leave that to the VCs and Angel Investors. What they are looking to do is put vast sums of money on a “sure thing” to allow them to secure a leadership position.

This round of financing is used to scale reach. It helps to spread operations on a national or international level. This is the round in which most of the well-known venture capital firms invest.

It includes investors who are behind significant companies like Facebook and Uber. This is because of the expertise, leverage, and scale that these investors have.

Secondary market groups will also be involved in buying stock from your Company now. Previous investors will sell shares on the secondary market. Investment banks will sell securities. They hope to make a profit on a company’s rising share price.

Generally, this round is the final push to prepare for an acquisition or IPO. But some companies carry on to raise series D and even Series E funding.

Businesses raising this round of funding can be more selective about investors. They need a different set of expertise and require a large amount of capital.

How to get Series C financing

Different factors make Series C financing easier in some ways and harder in others.

A precise and reliable valuation means you have a compelling offer to show to investors. It removes some of the risks and doubts for them.

But there will be large sums of money involved. This will mean your offer will likely only appeal to significant institutional investors. These include investment banks, private equity firms, and hedge funds.

Another hallmark is that you are more likely to have full control of how you spend the money. There will be no interference or support from your investors.

For most business leaders, it is a major personal milestone to reach the stage. Here you are the one with sole control of how you spend investors’ funds. This is a sure sign that they have put their trust in your business expertise.

The investors at this stage are institutional investors and industry leaders. These include:

- Hedge funds

- Investment banks

- Private equity firms

The goal of Series C round of financing is:

- Expand into international markets

- Develop new products or make some acquisitions

- Boost your post-money valuation before going for an IPO.

Valuation of the startup in this round is done based on:

- Company is profitable

- Good track record

- Low-risk profile

Series C Funding Round: Fund-raising and Valuation Stats

- Average 2019 Series C fund-raising amount: $27 million, up from $11 million in 2012

- Average 2019 Series C startup valuation: $103 million, up from $48 million in 2012

Series C Funding Round: Investors

The investors include venture capital firms such as:

- New Enterprise Associates

- Accel

- Sequoia Capital

- Kleiner Perkins

- Bessemer Venture Partners

Example of Series C Funding

Bank-disrupting fintech Revolut raised an impressive $250M in its Series C funding. It used the funds to expand worldwide.

It also increased its workforce from 350 to 800 employees, according to TechCrunch. They were looking to start with the U.S., Canada, Singapore, Hong Kong, and Australia at the time.

Later Stages of Funding

For many companies, Series C round is the last time they raise finance in this way. They fund future growth using the Company’s profits or from funds raised via IPO.

But this is not always true. You may still have a large amount of equity left in your business. So, you could offer this to investors in further stages, and Series D and E finance rounds are not uncommon.

-

Series D

There are a couple of reasons why your business would go through Series D funding.

The first? You had a “down round“ at Series C.

This means you didn’t hit the expectation you laid out in your series C funding. You’ve raised a lower valuation than in previous rounds.

Companies that have gone through this have a difficult time raising capital now. This is because investors’ trust in their ability to deliver has been put into question.

But it’s not all bad times in Series D funding. Many companies go through this round. This is because they have discovered a new opportunity for expansion.

They want to take advantage of it before going for an IPO and need that last boost of capital to get them there. Or, they just want to stay private for longer than “normal.”

The same factors that increased valuations in previous rounds are at play in this round. The ratio of the fund-raising amount to cost has continued to decline. This is reflecting the declining risk of investment.

This is the stage that most often produces “unicorns.” These are startups that earn a valuation of more than $1 billion.

The investors at this stage are institutional investors and industry leaders. It includes:

The expertise required to take a company public or negotiate the terms of sale is different. It is not the same as the skills needed to scale operations.

- Late-stage venture capital

- Private equity

- Investment banks

The goal of Series C round of financing is:

- Further Funding

- Expansion

- Ensuring private holding

- Imminent IPO issue

Series D Funding Round: Fund-raising and Valuation Stats

- Average 2019 Series D fund-raising amount: $60 million, up from $16 million in 2012

- Average 2019 Series D startup valuation: $345 million, up from $92 million in 2012

Series D Funding Round Typical Investors

The investors include private equity firms and investment banks such as:

- SV Angel

- Lightspeed Venture Partners

- Goldman Sachs

- Battery Ventures

- Norwest Venture Partners

Example of Series D Funding

Reddit in 2011 regained their independence after an acquisition.

Condé Nast acquired them in 2006. But they announced in September 2011 that they would be returning to independence. This will help them to handle their future growth better.

Reddit went on to raise $550M through Series B, C, and D rounds. It ended its Series D funding round with a massive $3 billion post-money valuation.

-

Series E

Series E is a fund-raising round that acts very similarly to that of D round. Perhaps you’ve missed your previous targets? Or maybe you’ve wanted to remain private further into the future?

Either way, it’s scarce to see companies progress to the Series E stage of investment. Founders usually make a move due to an unforeseen circumstance. Maybe that wasn’t accounted for in earlier business plans.

This isn’t to say that moving into Series E is a bad thing. It could prove highly lucrative for your future profit margins. Again, the funding raised at this stage is highly subjective.

It is dependent on too many variables to quantify. At all phases of your startup’s life, make sure you keep a level head and approach your plans with a critical eye.

And there’s no reason why each stage of your fund-raising rounds can’t be a resounding success.

-

Series F, G, H and Beyond

As we touched on in Series E of Funding, it’s possible for your startup not entirely to see itself as prepared for an IPO. Or it may not be fully immersing itself into the market. Subsequently, it may choose to engage in more rounds of funding.

In the wake of the pandemic, more businesses have been entering the latter stages of funding. This helps to survive without heavy losses due to a lack of productivity or consumer power.

Some startups have found great success from these late stages of funding. Notably, Couchbase managed to generate over $105 million. This was a bid to enter the global markets with a better state of preparation despite COVID.

The recent series of fund-raising may feel like a level of failure for your startup. But it’s important to remember that every business is different.

Some endeavors can comfortably enter new rounds of funding for a variety of reasons. These don’t signify that failure’s inevitable.

-

Mezzanine Financing

Our ultimate guide wouldn’t be complete without the unusually named Mezzanine Financing. Mezzanine finance sits between debt and equity finance. It can be highly complicated at times.

This round can represent a lifeline for organizations in different funding scenarios. The approach could offer an alternative option.

It can be utilized alongside a standard loan, equity fund-raising, or both together.

Mezzanine represents the third way. Lending mechanics can vary wildly depending on business structures and approaches to fund-raising.

A startup combines elements of risk and reward in the equity investments that they take on. It is combined with more predictable income from loans over the shorter term.

One more popular arrangement comes in the form of a loan that can convert into an equity share. It happens after a pre-determined amount of time elapses. It can also occur at the discretion of the lender in question.

This means that if your startup scales accordingly, the business can pay back the money of its own accord. But if things don’t quite go to plan, the lender can recover costs in the form of company shares.

Other scenarios can position Mezzanine Funding as shares in a startup. This will act as a form of collateral for loans. This means that the future growth of the business allows it to borrow more than possible.

This round should be looked upon as a viable ‘top-up’ funding option for big projects. For instance, you were aiming to raise upwards of £10 million. You’ve agreed on a loan of £7.5m with a standard lender.

By turning to a Mezzanine agreement, you could secure an extra £1.5 million. This means that you could only have to find an extra £1 million yourself to add to the mix.

Or, you could still add in the required £2.5 million but enjoy having a project fund of £11.5 million instead of £10m.

Mezzanine Finance allows users to leverage their future profits in the short term. This is for the greatest return with the available cash contributions.

How to Track New Funding Rounds

News of funding rounds can be found from a combination of documents. These include company press releases and websites covering the same. It also has a disclosure document filed with the Securities & Exchange Commission.

But, there are limitations to both of these sources.

First, many companies don’t issue a press release of new funding. They give limited information.

Second, companies don’t provide domain information in SEC filings about new filings. Plus, these filings consist of a high percentage of investment funds raising money. This is not of interest to most people.

Some tips for raising funds for your startup

This is the million (or billion) dollar question. There is no one answer to raising funds for your startup. This will depend on your business, network, and industry.

-

If you work in a startup accelerator or incubator

Talk to other entrepreneurs and startup founders to understand their capital raising journey.

-

Attend startup funding events if you are new

Understand the landscape and make connections with investors and their networks. You have to impress investors with your pitch. They will also be looking at your team and experience in executing ideas.

Investors receive countless requests for coffee meetings and opportunities to hear pitches. You should have much evidence of traction or growth.

This is required to prove why investors should invest in your startup. You’ll often only have one shot.

-

Create a pitch deck – a 15 slide PowerPoint presentation

It summarizes the market, problem, traction, and investment requirements. This is required only for face-to-face meetings.

-

Have a target list of potential investors – an Excel spreadsheet

So, it has investor’s firm, name of the partner, list of 2-3 recent investments (in the same general space as yours). It also has email addresses, phone numbers, admin assistant’s name & email address.

Therefore, it is good to have some investor connections. These are people who can give you warm introductions to the investors). They can also provide you with status and notes fields.

-

Tailor an email introduction (40 – 100 words) and a one-page summary.

A simple text file with no images or graphs. It should be readable on mobile phones. This can be sent to your connections to introduce you to investors.

-

Who should you target by role?

Investment organizations have partners who are decision-makers. They also have associate/principals that are decision enablers. Partners make decisions, so if you can, get an introduction to a partner.

If you can’t, it’s not all doom and gloom. This is as many partners rely on their associates and principals to source deals for them.

-

Who should you target by investment thesis?

Every investment firm has an investment thesis. This is how they will deploy funds to get the best returns for their investors. This should guide you about whether you’d be a good fit for the firm.

Example: An investment firm might say we believe in India’s broadband access. Also, there are a vast number of consumers with high disposable incomes.

So, they are an excellent target for Indian eCommerce companies. The firms will deploy a certain percentage of their finances in eCommerce companies.

Similar theses exist for big data, SaaS, etc.

Example: You may be an education startup focusing on India. So Lightspeed (thanks to their success with TutorVista) should be on the top of your list.

If you are a SaaS firm targeting the US, Accel (thanks to Freshdesk) should be on your list. If you are a travel technology startup, Helion & Saif (thanks to Make My Trip) should be apparent targets.

A word of caution: A firm may have invested in a company in your sector. Then they will very likely ask you to speak to the CEO of their portfolio company.

They will request the CEO to perform cursory due diligence. You may decide that the Company might be competitive and likely to execute your idea better. This is because they have more resources.

So, proceed with caution and don’t reveal anything during your due diligence. It might hurt you later.

Several investors invest in a sector because they want it in their portfolio. So, I also recommend the “herd rule.” Talk to other investors if your first-choice investor has funded your competitor.

-

Who should you target by the investment stage?

Every Indian investor claims to be sector agnostic and stages agnostic. But there are a few early adopters VCs. Consider an early adopter investor if you are the “first” in a new space. Else any investor who has not invested in the sector will suffice.

Why Not Credit Cards or Bank Loans?

Many banks do not issue loans to new businesses that do not hold many assets.

A startup looking to borrow $50,000 to pay app developers will find it difficult to request a loan. This is unless they put up their assets as guarantees (such as a car or home).

If they successfully get a loan, they are obligated to repay the loan on time with interest.

Credit cards can provide a short-term source of finance for necessary purchases. A laptop or business flights can be put on a company credit card. This will help to separate funds from personal bank accounts.

Atlassian, one of Australia’s most successful startups, began with $10,000. It was all funded from their credit cards.

But credit cards will not provide the funds required to hire staff. It will not allow us to invest in production, nor make significant capital purchases.

Many Investors often have industry experience. They can introduce you to their network, or refer you, customers.

Such benefits have a significant advantage over a debt financing option. Debt options include a bank loan or credit card.

But debt financing should not be ruled out as an option to grow a startup. It is especially true for those with traction and can prove it to lending institutions. Entrepreneurs can turn to convertible notes or convertible bonds to raise funds.

Uber, the ride-hailing app company, has turned to debt financing on several occasions. They did so to supplement equity rounds. Whether you turn to equity or debt financing will depend on your business’ growth journey.

What is the role of a venture capitalist?

There has been an unstoppable rise of the ‘armchair investor.’ Someone may have the most ill-informed views of what forms a sensible investment. Now they can back startups to their heart’s content.

Indeed, there are alternative forms of raising finance such as crowdfunding now. Businesses can nowadays raise millions of pounds worth of investment. They do not have to give away an inch of precious equity.

So why do organizations decide to part with larger chunks of equity? Why do they go down the venture funding route?

The reasons for this often lie in the major role of the VC. It is about what they can offer your business besides the initial injection of cash.

-

Support services

Many VC firms will have their in-house marketing, legal, tech, and recruitment teams. They will offer their services to startups and smaller businesses that receive investment.

-

Strategic introductions

Partners or investors in VC funds should have a wealth of contacts. Your business should be able to tap into that quickly. These introductions will be highly strategic and targeted.

Said openings could include potential partnerships with larger corporates. It can be new investors or clients. It can even have potential hires.

-

Experience in efficiency

A seasoned investor and businessperson can streamline communication channels. They can ensure boardroom meetings are suitably productive.

They help to plan strategy and direction. An investor can ensure your business is prioritizing correctly – from the top down.

-

Wider market knowledge

You have spent the majority of your time concentrating solely on your own business. But venture capitalists have been scanning various horizons.

An investor can give global market insight. They can provide potential new clients and even exit opportunities.

-

Best practice

Many investors can add great value by helping instill good governance. It can be implemented in areas such as financial controls and reporting. Other fields are business ethics and contractual issues and procedures.

Example of Series A B C Funding Rounds for a Startup

A software developer offers real estate client management solutions. He is growing in the New York City market. But its growth is outpacing its revenue, and it hopes to avoid turning down customers.

It wants to capture more of the market and expand its workforce. So, it raises a series A round of funding from a venture capital firm.

After investing in the capital it receives, it sees growth continuing. Finances stabilize, and more opportunities open up. At this point, the Company is doing well, with a great product.

So, it notices that its customers need an automated marketing platform. Also, it develops a prototype and tests it on a few customers. It realizes that this solution could potentially grow their revenue and customer base.

Using feedback and projections, the founders raise a Series B. The Series B round is a great relief for the founders. They can now pursue more customers, hire engineers and, ultimately, continue to grow.

But the Company has to achieve a 100% increase in the number of customers to unlock more VC funds. To do so, the founders invest part of the funding in a nationwide marketing campaign.

The marketing campaign is a success. The Company achieves the necessary growth to unlock more funding. But, the scale and infrastructure to service these new customers are lacking.

The founders raise an extra round of capital with a venture capital firm. It specializes in scaling software companies. During the following year, it uses the funding and resources to scale and grow the Company.

The investors, employees, and founders are now ready to exit the business. And liquidate at least part of their equity. To help them out, the founders enlist a private equity firm.

The firm will help them optimize operations, reduce costs, find a buyer, and sell the Company. The Company is sold successfully to a major real estate conglomerate. It is at a higher valuation than the previous round of funding.

Conclusion

Understanding the marketplace’s distinction between Series A, B, and C is critical. It helps to maximize the Company’s exposure to viable investment sourcing.

The process of each stage works mostly the same. The difference is risk tolerance that attracts different capital sources. This translates to how much equity will be required for the infusion of cash.

At each stage, investors will make different demands to the Company. It will be based upon perceived risk/reward. Startups should opt for a risk analysis report to plug their gaps.

According to the stats, 9 out of 10 startups fail. This is why VC & PE groups tend to stay out of the seeding stage and focus on Series B and C funding. There the chances of picking a winner are higher.

And as the data shows, startups that secure Series A funding are more likely to pass milestones. They will get Series B and C, as well.

Some take months or years looking for funding. Others get scouted to build capital quite quickly. Either way, we hope this path sees a successful outcome to your business needs in a way that it entirely thrives.

We are one of the largest capital venture firm, come grow with us!