Competitor Research is nowhere related to spying or snooping on the competitors. It’s a strategic form of research for knowing what’s going around your business. It tells about what competitors are doing for keeping up with the market.

The research identifies the strengths & weaknesses of the competitors. And check their products & services while paying attention to the latest industry trends. It helps the brand to stay competitive in the market

Competitor Research is a detailed process followed by an action plan. It gathers key competitive information & capitalizes on the opportunities. The ultimate aim is to be better than the rivals.

Benefits of Competitor Research

Competitor Research is of immense benefit, especially for business executives and entrepreneurs. The process is complex and overwhelming. But, the remarkable insights from around the market make this a worthy investment.

“Competition in business is a blessing, for, without it, we wouldn’t be motivated to improve.”

Nabil Jamal

Business Executives must view this as an ongoing process for monitoring the competitors. It encourages tracking the market size & gathering key information for better success. Following are the few benefits of competitor research:

-

Identifies Market Gaps:

Market Gaps are opportunities in disguise. As you research the industry, you’ll find markets & places that are unserved. Tapping unhappy customers gives a specific understanding of what competitors are doing wrong. It opens windows of opportunities that are not yet answered.

-

Anticipates Future Trends :

The business market keeps on changing. What trends today, will not trend next week. There are constant arrivals of new competitors in the market. Analyzing industry trends and eyeing competitors guides in creating strategic plans. It improves product strategy, services, upgrades pricing strategies & reforms promotional activities.

-

Increases Market Understanding:

Understanding the market is essential for a successful business. Tracking competitors’ activities allow a better understanding of the market & competition. These insights offer a competitive landscape for improving the value proposition for customers.

-

Improves Marketing Strategy:

Customers leaving and turning to competitors is the worst nightmare for any entrepreneur. This signifies that their products or benefits/offerings are better than yours.

Competitor Research Methods:

-

SWOT Analysis

SWOT Analysis helps to know a company in and out. It refers to the Strengths, Weaknesses, Opportunities & Threats a company faces. But, the strengths and weaknesses of a company come from within.

These internal factors include brand reputation, company culture, and more. These factors have a greater influence on a company’s goals as it’s within the control of the company.

Whereas External factors are those that are not in control of the company. This includes the number of direct competitors, availability of funds, government policies, etc.

The method gives a holistic and well-rounded view of where the company stands in the market.

-

Porter’s Five Forces

Michael Porter created this tool for examining the attractiveness of an industry. This tool is based on five industry forces. It includes:

- Threats of new entrants,

- Bargaining power of buyers,

- Competitive rivalries,

- Bargaining power of suppliers,

- Substitution threat.

This model broadly helps in forming a good corporate strategy. It evaluates every corner of the business structure based on market conditions.

-

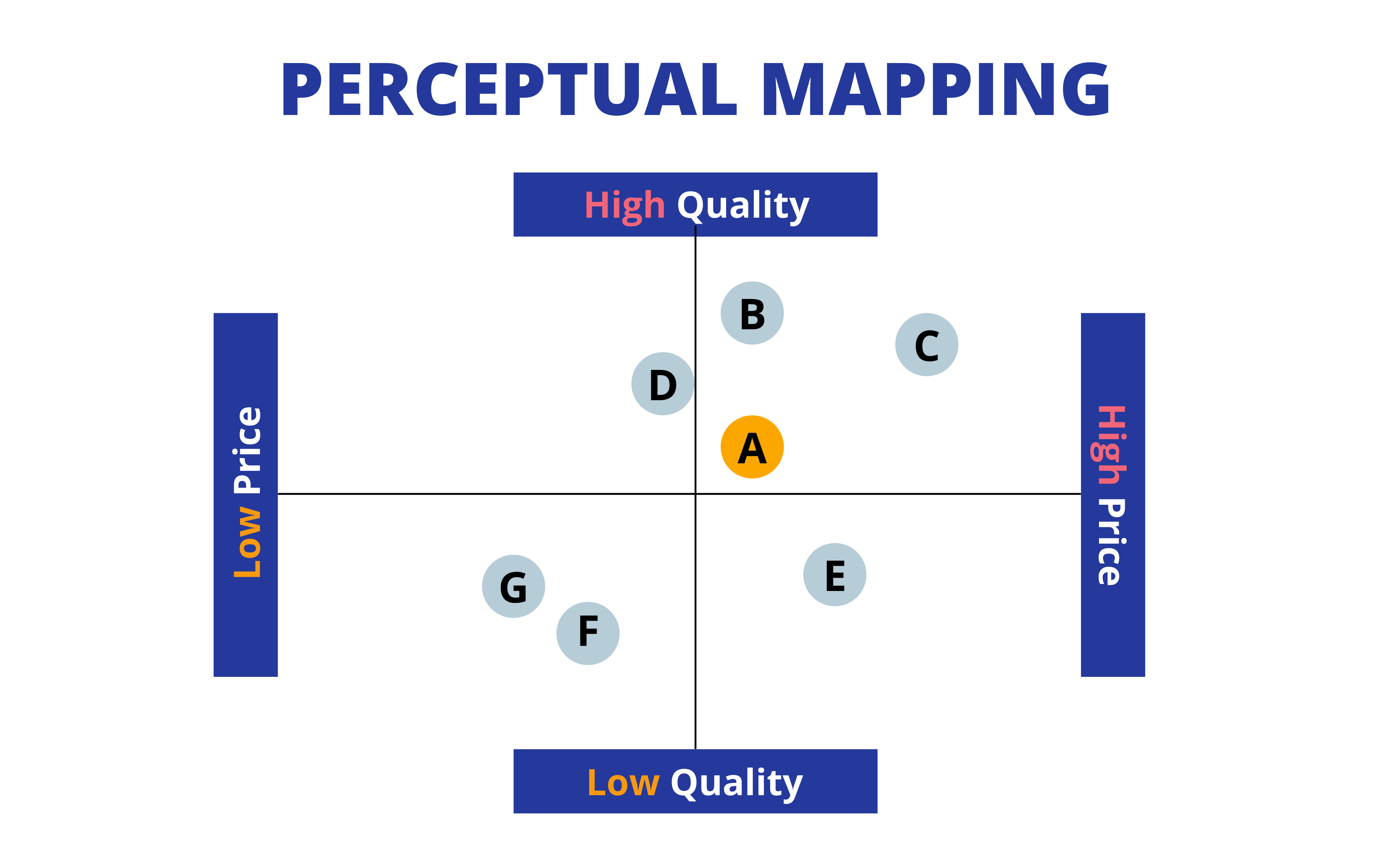

Perceptual Mapping

It is the visual representation of how customers perceive the product in the market. The method compares the business products with competitive alternatives. It depicts the position of the product based on customer inputs. As a result to understand the position of the brand & product against competitors. This framework requires two key attributes for the mapping basis. For example, price, and quality in the above image.

Conducting a Competitor Research:

Thorough research about the competition is integral for the business. Hence, having upright information about the competitive market becomes a crucial task. There are lots of things one needs to consider while conducting competitor research. Here are the crucial aspects that form a major part of the competitor research process:

1) Defining the Competitors:

The process begins with what type of firms are your competitors. Every company has a competitor, that your customers are comparing you with it. Generally, there are three types of competitors for any business. This includes:

-

Direct Competitor:

Direct Competitors are the prime competitors of the business. They sell the same kind of product or services in the market as you do. They share the same target market as you & have the same source of revenue For eg: McDonald’s and Burger King

-

Indirect Competitor:

These competitors have dissimilar products or services. But serve the same needs as you. For example, eyeglasses brands and eye lenses brands solve the same problem. But both are different products. Another example is McDonald’s & Burger King. Both solve the same issue i.e Hunger but with different food items.

-

Replacement Competitor:

They are the ones that your customer will choose, over your product or service. For eg: health-conscious individuals choosing the Subway over a McDonald’s Burger.

2) Monitoring Budget:

Businesses run on money. Review on which activity are competitors spending more. What are their spending priorities & how effectively are they spending the money. This will track if you are spending less on things that matter. The purpose here is not to replicate their process and strategies, instead to be one step ahead of them.

“You should learn from your competitor but never copy. Copy and you die.”

Jack Ma

3) Evaluating Products & Services

Once we know our competitors the next immediate step is to check their products and services. Analyzing it against your products or services and tracking every aspect and characteristic.

What did you like the most and what you didn’t like? How is it manufactured? And what it takes to manufacture. In short, conducting the SWOT analysis of the product. Thus, tracking what the competitors’ product lacks, and where your products need improvements.

4) Attend Conferences & Events:

Competitor research is a combination of online and offline insights. As you research online, don’t miss out on the possibilities that offline research can give you. Get involved with communities. Have real face-to-face talk to get an insight into competitive landscapes.

Attend conferences to get an idea about what trends are driving the atmosphere. Find out what brands they are talking about to add them to the competitors’ list. Make your presence in these events to catch your customers’ eye.

5) Communicate with Suppliers & Partners:

Suppliers and Partners can prove to be the key point of communication. There could be suppliers and partners that are in connection with your competitors. Find them and take away key information about competitors from them.

Diligently track the praises and complaints to know where you need extra effort. Host meetings or small thankyou events to get insider information about competitors.

6) Tapping the Clients:

Want to know more about competitors? Then go directly to them. Call them. Talk with their sales associate or customer service representative to get inside coverage. Try out their product and detect what amazes your mind.

Many of them offer free trials. Encourage your employees to sign up for their service and to present a report on the experience. Inform employees to be on the lookout for friends and family that are using their products. There is no better resource for competitor research than the competitor itself.

7) Evaluating the Brand:

Above all this, what “Extra” does your competitor do to hook their customers? People buy products which they “Need”. But there is another spectrum of customers who buy products which they “Want”. People buy things that “Feels Good” to them. That could be in Luxury terms.

Or Sustainability terms.

Learn their brand language, Create your Brand equity either at the same level or better than them. This helps to build a rapport with the customers.

8) Sourcing Competitive Information:

Sourcing competitive data and insights is a cumbersome task. There are many ways to know about competitors. Check out the articles or ads in the trade press release or publications. Understand their marketing literature.

Pull out information from professional associations, survey reports, directories, and the local Chamber of commerce. Lookup for financial fillings on U.S. Securities.

Uniform Commercial Code Filings, litigation reports, and real estate records can give records for free for competitor research purposes. Paid research report about the industry is another way to get inside statistics.

Industry overviews by Forrester Research and Gartner for information about primary competitors and annual market forecasts in the industry.

9) Digital Exploration

Google is the first-stop solution for any research. Most companies build a digital presence on popular platforms like Facebook, Instagram, Twitter, Linkedin Youtube, and even Snapchat. Dig into their profiles and updates, their social tones, and posts.

Apart from these platforms, Google has a large collection of information. Gauge the online presence of the competitors. Start by monitoring their websites. Get an idea about their SEO strategy by checking their on-page keywords and inbound links.

Once you get a clear picture of digital presence, pull them together. This assists in knowing where you stand against them to craft a better strategy than them.

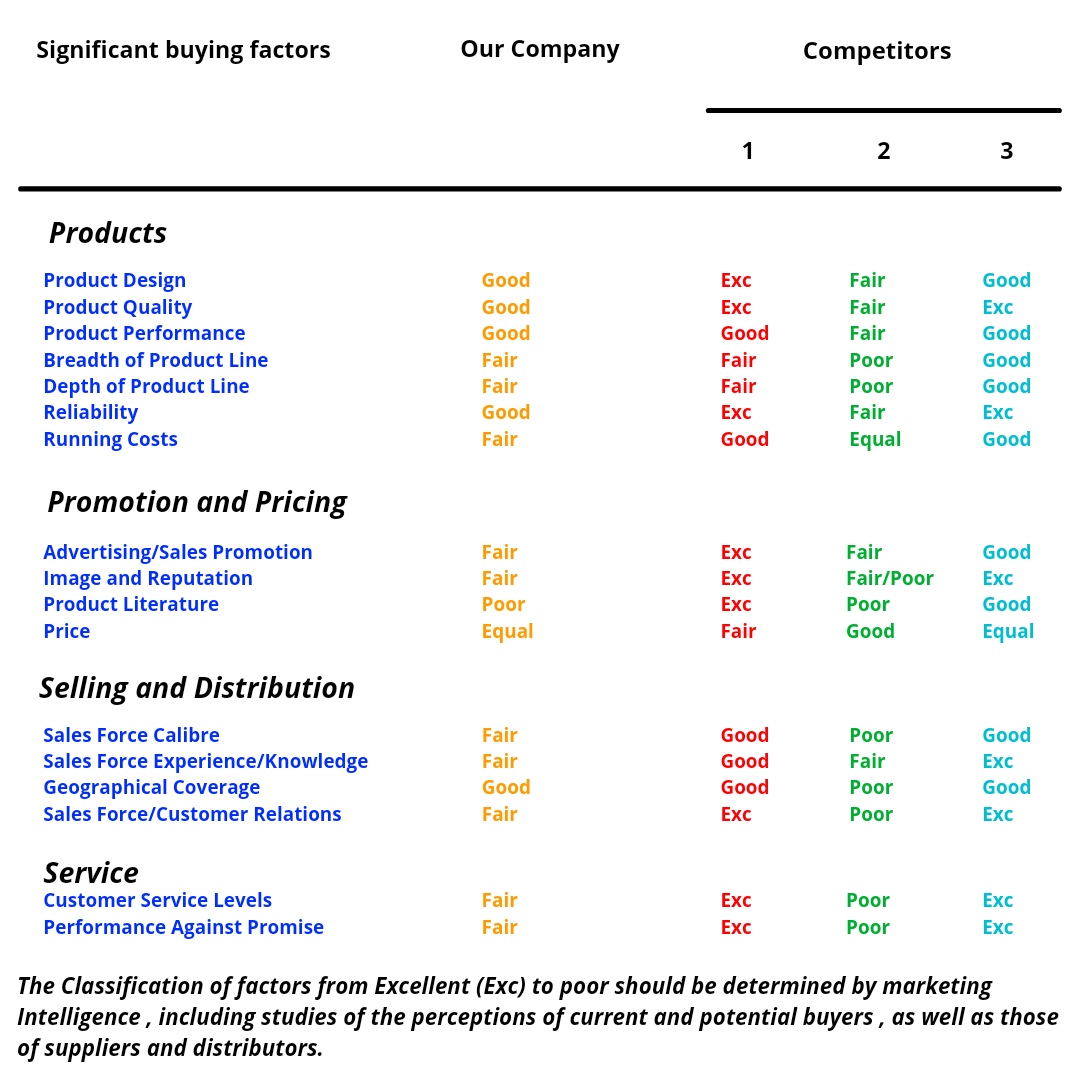

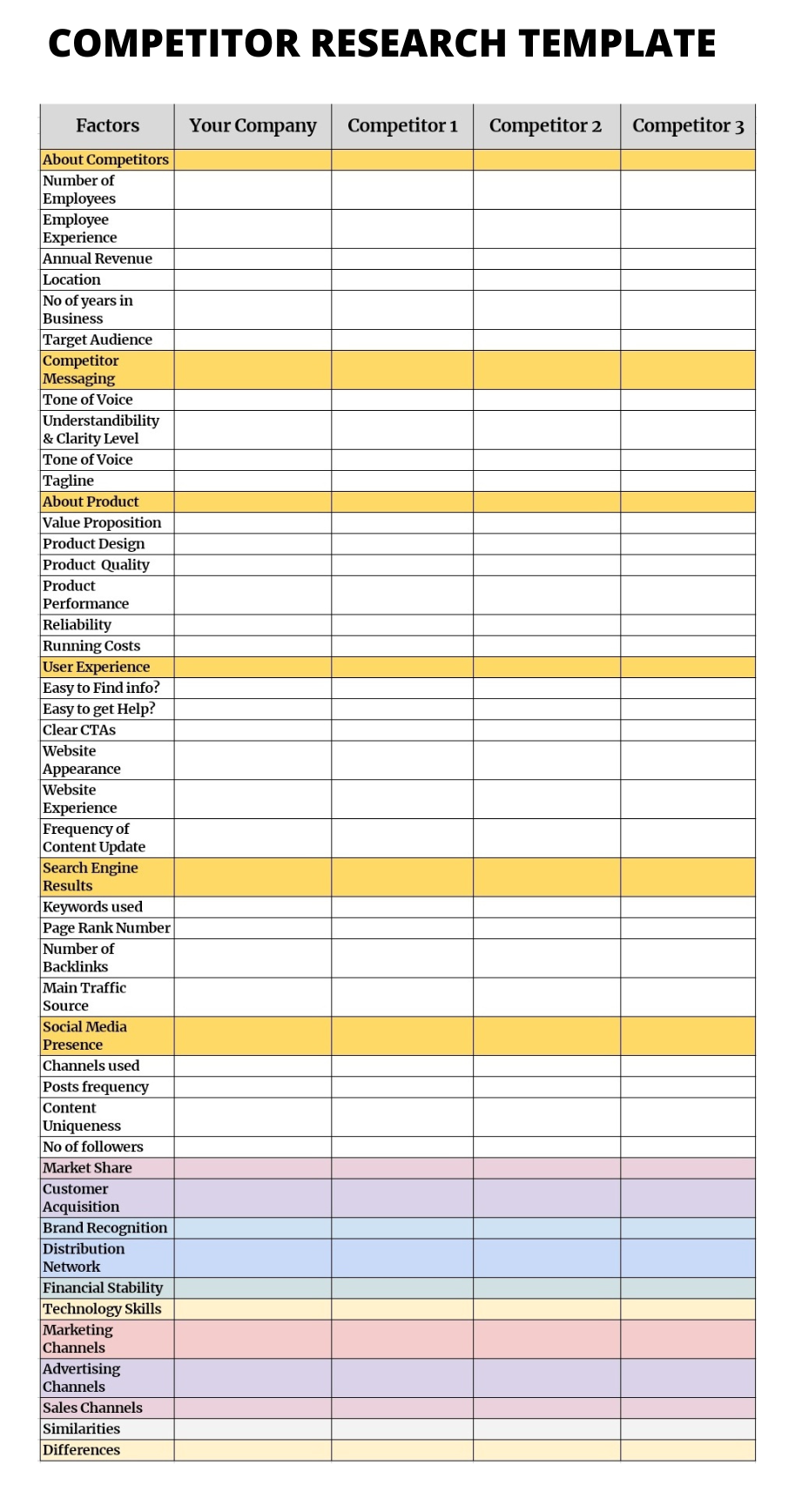

Template for Competitor Research:

The above template has all the factors to be examined for Competitor Research. The template is completely free. Add your views and comments that best describe your company & competitors.

Competitor Research vs BenchMarking:

Often, Competitor Research is mixed up with BenchMarking. But, both are different activities that serve different purposes. Benchmarking starts after competitor research. It compares business processes to the best & top-notch market practices.

Benchmarking purpose is to measure the performance using a specific indicator. It includes total sales, cost, cost per unit, etc.

It allows firms to plan out for further business improvement. Whereas competitor research monitors the practices and organizational insights of various industries. It helps to understand where the company stands in the market against competitors.

Competitor Research only monitors and keeps the track of competitors’ activities. It doesn’t work on making improvements in the company strategy as in benchmarking.

To Wrap Up:

Every factor that you research puts them into three categories. This includes:

- What you can learn from them and do better?

- Are they doing worse than you?

- What are they doing the same as you?

If the competitors are doing better than you, then your response is of utmost importance. Change strategies for improving the outcomes. In short, improve customer service, assess prices, update products, improve marketing strategies, etc.

The best way to beat competitors is to meet the customers with top-notch products or services. So, enthusiastic customers will praise your product in front of their families & friends. When one customer gets satisfied you are attracting a bunch of future customers.

No matter how big or tough the competitor is. There is always something that is unserved & left for better opportunities.