For Startup valuation, knowing the value of the assets and what are its determinants is of the utmost requirement for decision making. Valuations are tricky and for early-stage startups, it’s more complicated. Investors don’t pay more than the worth of the startup.

Broadly, the Valuation process has two extreme views. On one side, valuation is like hard science, with no space for human errors or analyst views. On the other side, valuation is more like an art, where analysts can manipulate the numbers to generate whatever resulting figure they desire.

But the corporeality lies somewhere in the middle.

Valuation doesn’t start with an empty slate. There are numerous assumptions on the road to valuing a startup. This could be pessimistic or optimistic. A startup showing margins below industry averages is pessimistic and optimistic in the vice-versa case.

Thus, before Investing & valuing a startup, Investors considers the following five points, that includes:

- Are you playing in a hot sector? or Are you the next big thing?

- How good is your management team? What are their years of experience? Does your team have diverse skills?

- Do you have a working prototype in place? Or Are you rolling out with an MVP?

- Does your idea have good traction?

Market conditions of the industry, sector, exit size, investors’ willingness to take the risk in your startup, future outlook, etc are the big determinants of the Startup Valuation. For seed startups, where the revenue is not yet warranted, investors play with their instincts while combining them with quantitative methods.

All this could be daunting, for an entrepreneur while figuring out the right valuation figure. But with the experiences and wisdom of investors & various capitalists here comes the 10 ultimate methods for valuation of seed-stage companies.

-

Scorecard Valuation Method

Bill Payne created the Scorecard Valuation Method for evaluating the startups with angel capital needs. This method compares the target company with the other seed-stage company for determining the value of the company. For eg: if an identical startup is valued at $50 Million, then yours also will be valued around the same figure.

“This method compares the target company to typical angel-funded startup ventures and adjusts the average valuation of recently funded companies in the region to establish a pre-money valuation of the target”

-Payne (2011)

To simplify this method, we divide it into three steps:

Step #1: There are two companies:

-

Target Company:

This company could be your company or any company that requires capital or the one in which capital will be invested.

-

Comparable Company:

This is a recently funded company or any startup within the same market space, region, or business sector and at the same stage.

Step #2: Determining the average pre-money valuation figure of the comparable companies. For the study, assume the pre-money valuation of comparable companies varies in the range of $2.5 – 3.5 Million. Thus, the average pre-money valuation for the firm is $3 Million

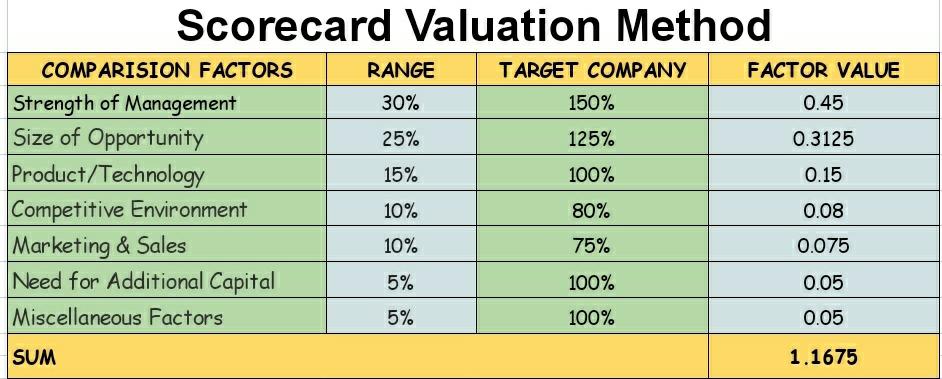

Step #3: Comparing the target company with Comparable firms, to the perception of similar deals based on the following factors:

- Strength of Management: 0-30%

- Size of Opportunity: 0-25%

- Product/Technology: 0-15%

- Competitive Environment : 0-10%

- Marketing & Sales: 0-10%

- Need for Additional Capital: 0-5%

- Miscellaneous Factors: 0-5%

Here each factor is assigned a fixed weight, based on its worth in the process of valuation of the company. For the target company, each factor is assigned a below-average(<100%), an above-average (>100%), or at par (100%) value.

Let’s assume, Team strength, co-founders’ experience are 150% more than the comparable companies and have a large market opportunity of 125%. Similarly, for the target company, all the rest factors get assigned a score.

CHECK OUT: How to determine Co-founder Equity Split?

The summation of the factor is multiplied by the average pre-money valuation. We get 1.1675 * $3 Million = $3,502,500. Thus, the target company can be valued at around $3.5 Million by using this method.

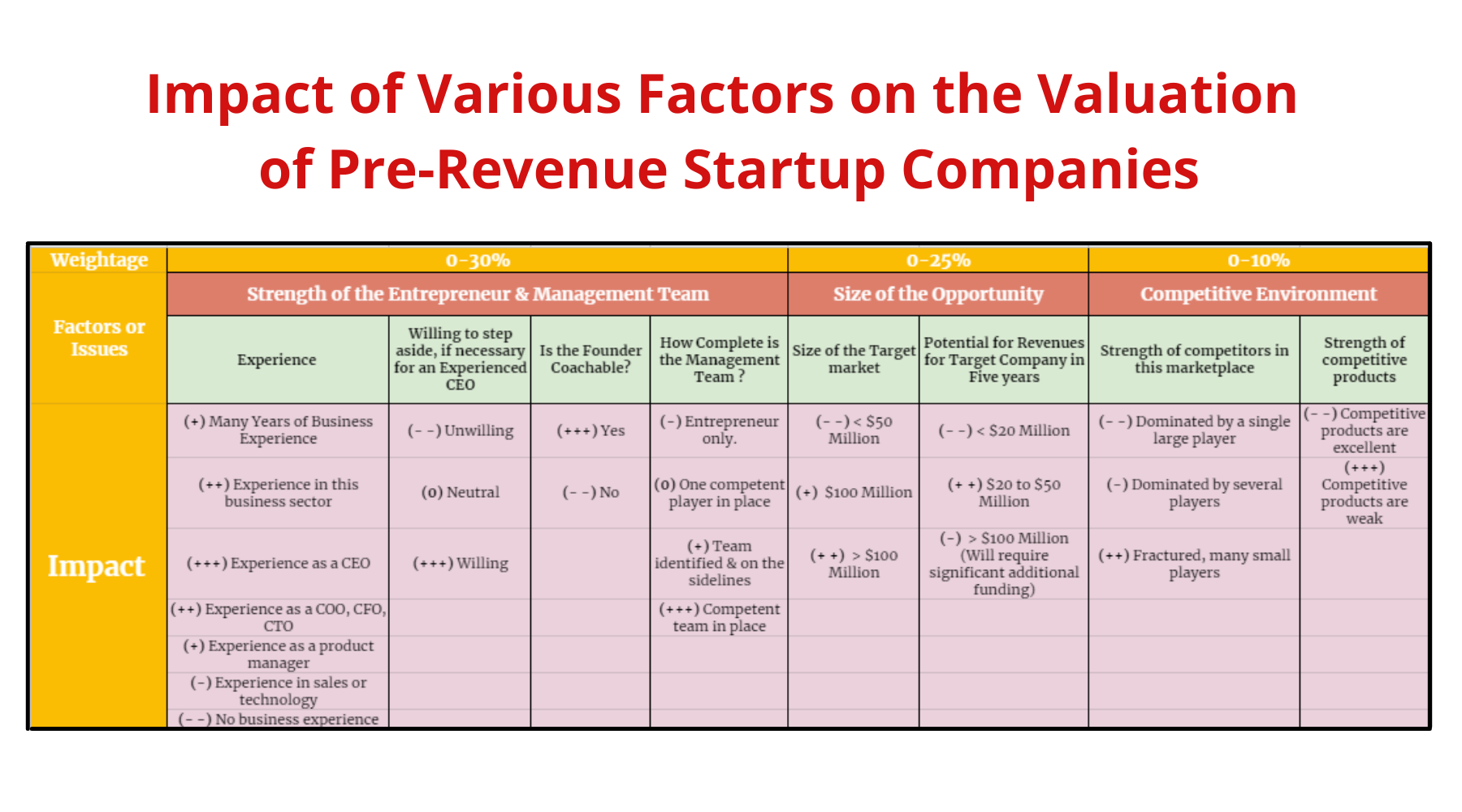

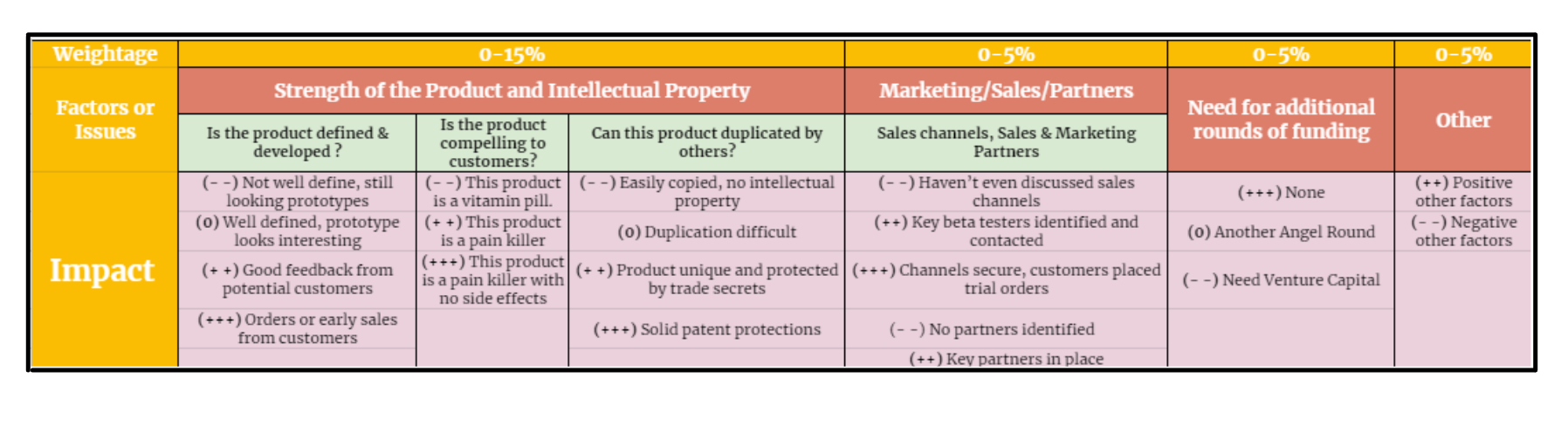

Bill Payne created a worksheet for helping investors and founders to better understand the impact of various issues on these above criteria. Within each factor, each issue is assigned a valuation ranking +/positive to -/negative for assigning the weighted ranking in the valuation of a startup company.

-

Venture Capital Method

As the name suggests, this method is in favor of Venture capitalists and forms a great go-to tool for investors. The method starts with projected future revenue & reflects the investors’ outlook about the business exit within a few years.

The method has several pre-money valuation formulae. To simplify, let’s cut it down to two steps:

Step #1: Calculating the Terminal Value

Terminal Value is the estimation value of the startup on a specific future date. The formula has the following three requirements:

- Estimated Revenue in the Harvest Year.

- Estimated Profit margin in the Harvest Year.

- Industry P/E ratio.

Here, harvest year is the year of exit for the startup. The year when startups reap their benefits and investors enjoys it. The Terminal value is formulated as:

For eg: A SaaS startup projects a $20M revenue in 10 years, with a profit margin of 15%. The industry P/E ratio is 20.

Terminal Value = $20M * 15% * 20 = $60 Million

Step #2: Calculating Pre-Money Valuation

For, Pre-money valuation we require two things-

- Desired Return on Investment by Investors.

- Amount of Investment.

It is formulated as –

Now, let’s assume a pre-revenue investor expects an ROI of 20X on his investment amount of $1 Million

Pre-Money Valuation = ($60M/20) – $1M = $2 Million

Thus, the pre-money valuation for the startup with an investment of $1 Million and an ROI of 20X is $2 Million.

-

Berkus Method

The Berkus Method was originally led by Dave Berkus an American angel investor and venture capitalist in the 1990s. The method was first published in the book “Winning Angels” by Amis & Stevenson in 2001.

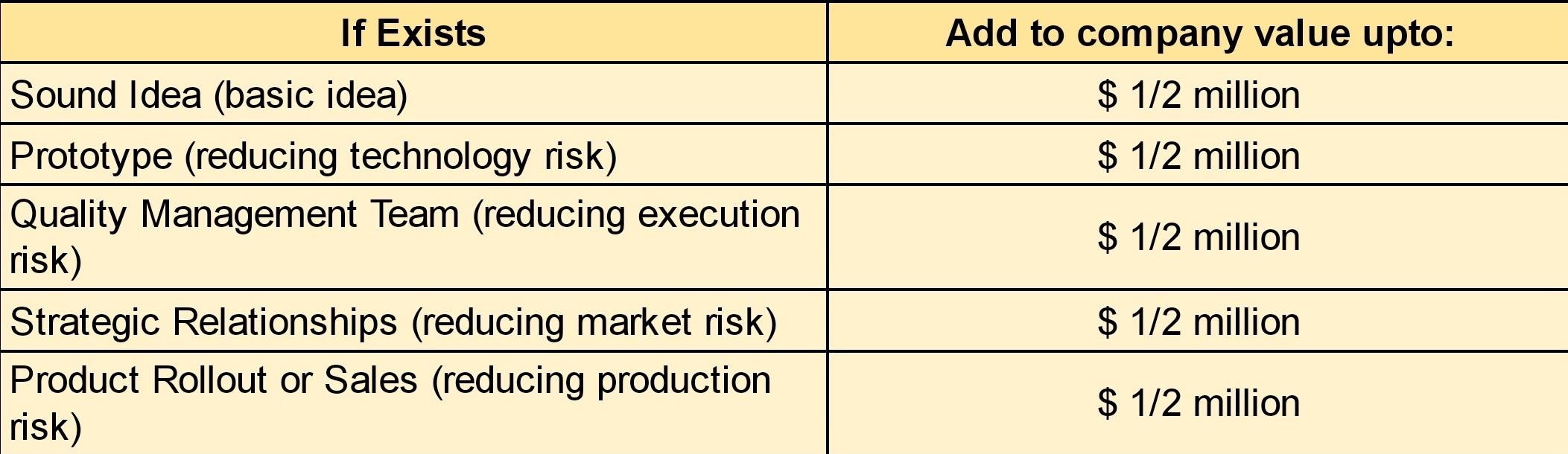

Berkus proposed a universal truth that only one in a thousand startups meet or exceed their revenue as projected in the planned period. Under this method, investors assign a number or a financial valuation to the Four major elements of a seed-stage company. This includes:

- Sound idea (Basic Value)

- Prototype (Reducing Technology Risk)

- Quality Management Team (Reducing Execution Risk)

- Strategic Relationships (Reducing Market Risk)

- Product Rollout or Sales (Reducing Production Risk)

It assigns each item a value of half a million by assuming that the startups should generate $20M revenue by the end of the fifth year.

The company value adds up with each passing factor. Thus, making the startup ready to earn a pre-revenue valuation of up to $2 Million or $2.5 Million for post-roll-out value.

After 20 years, in 2016, Berkus stated this method to be restrictive and should be used as a suggestive tool rather than in rigid form. Although it doesn’t consider various risk factors, it’s still favorable for businesses looking for a simple tool.

CHECK OUT: Startup Equity – Types & Tools for Calculations.

-

Cost-to-Duplicate

The idea of this method is to calculate how much it will cost to duplicate or build another similar company from the scratch. This turns out if the cost to duplicate is low, the valuation will be low or close to nothing, whereas if it’s costly to replicate the process, then the startup value increases.

The method carries out heavy due diligence, for figuring the total assets and reproduction costs. For an automobile firm, it includes the total cost of production, cost of machines, cost of manpower hours, etc.

The major drawback is it doesn’t reflect the value of intangible assets like the brand, the future potential revenue, and business growth, and other relevant elements like customer retention and engagement.

-

Market Multiple/Comparable Transaction Method

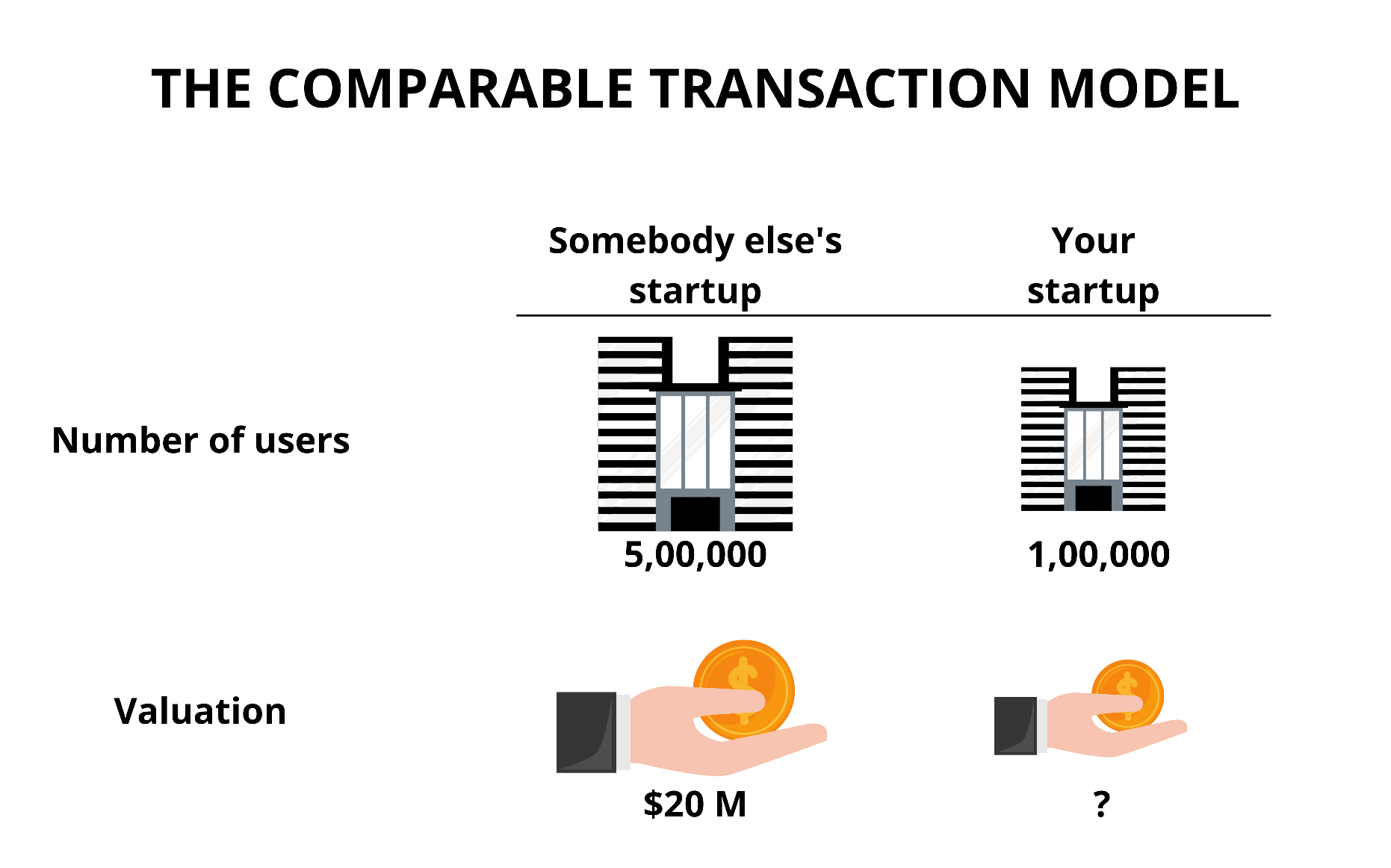

Most entrepreneurs believe these to be two different methods for Startup valuation. But the factors involved in calculation make them identical to each other.

Market Multiple method values the companies against the multiple of similar companies which recently got valued or acquired by investors in the market. Finding out how much valuation a SaaS firm garners from investors for five-times sales, will give you a basic figure for your startup as well.

Whereas while valuing an infant startup, investors conduct extensive research for ascertaining the possible sales and earnings of the business during its maturation.

To a similar extent, Let’s assume, Investors acquire a Gaming Startup with 5,00,000 users at 20 Million. This results in $40 per user. Your gaming startup has 1,00,000 users, thus it reaches a valuation of $4 Million. This is a Comparable Transaction Method.

This method follows the rule of three. To find out the startup value, fetching a good indicator for comparison is a success. This could be monthly recurring revenue, weekly active users, profit & loss, sales, gross margin, EBITDA, etc. But the hitch is, it’s hard to find close comparisons in the startup market.

-

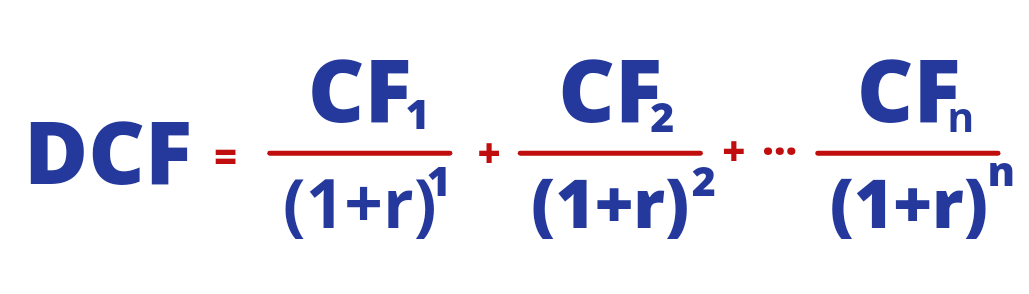

Discounted Cash Flow

DCF method is based on future performance and is ideal for startups with no historical performance. It estimates how much cash flow a startup can bring out & discounting them at a certain rate of investment or the “discount rate.”

Here, CF= Cash Flow, DCF= Discounted Cash Flow & r= Discount rate.

The higher the discount rate, the more risky the investment will be. But why does this method focus on future cash flows & then discounting them further?

- Assume you produce organic & healthy snacks. If your snacks idea turns into a viable business, it will generate good profits for the coming years. The investors funding in your startup today will obviously reap the fruits for future earnings. Hence, we figure out the future cash flows.

- The future is uncertain. But as the value of future earnings is more today, its uncertainty impels discounting of the earnings. Assume I give you to choose between $100 today or $100 in six months. Naturally, one will choose the former one, as the risk is involved that I won’t pay the amount in the future.

Thus, we discount the cash flow of the inherent risks involved and reduction in the monetary value over time.

Checkout: Seed Funding – Importance, Prerequisites, Steps to Raise, and Equity Required.

-

Valuation based on EBITDA

EBITDA is Earnings before Interest, Tax, Depreciation, and Amortization. It indicates the net income before accounting for taxes, interests, or depreciation. Excluding these elements, makes EBITDA an instrumental tool to calculate operational performance and the valuation of the business.

Investors use the following formula for startup valuation using EBTIDA:

Let’s assume, the Multiple as 5 & the forecasted or historic value of EBITDA as $1 Million. Thus, 5 x $1 Million = $5 Million forms the startup valuation figure.

Here, EBITDA is an estimated projection for the next twelve months or the actual value of the previous twelve months. Whereas, Multiple could have any value or range based on business stability, financial health, and profitability.

The EBITDA multiple differs from sector to sector and industry to industry. It highly fluctuates based on market conditions. According to Stern School of Business, the multiple for auto parts is 13.03 whereas for the electronic industry it is 45.65.

With a more extensive understanding of EBITDA, startup owners can better get hold of their company value in the competitive industry.

-

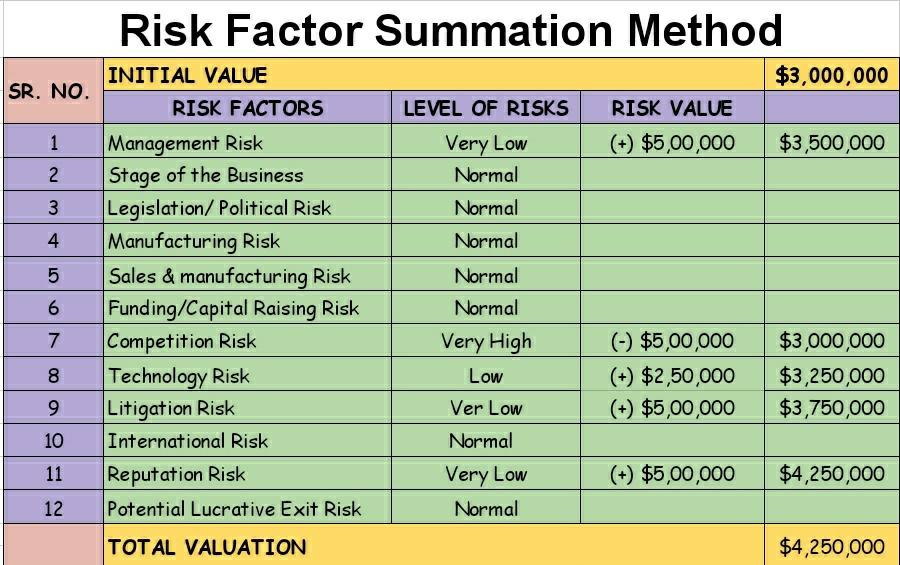

Risk Factor Summation Method

This method is ideal for early-stage startups looking to establish pre-money valuation. It is more potent when combined with Scorecard and Berkus Method.

Ohio TechAngels describes it as-

“Reflecting the premise that the higher the number of risk factors, then the higher the overall risk, this method forces investors to think about the various types of risks which a particular venture must manage in order to achieve a lucrative exit. Of course, the largest is always ‘Management Risk’ which demands the most consideration and investors feel is the most overarching risk in any venture. While this method certainly considers the level of management risk it also prompts the user to assess other risk types”

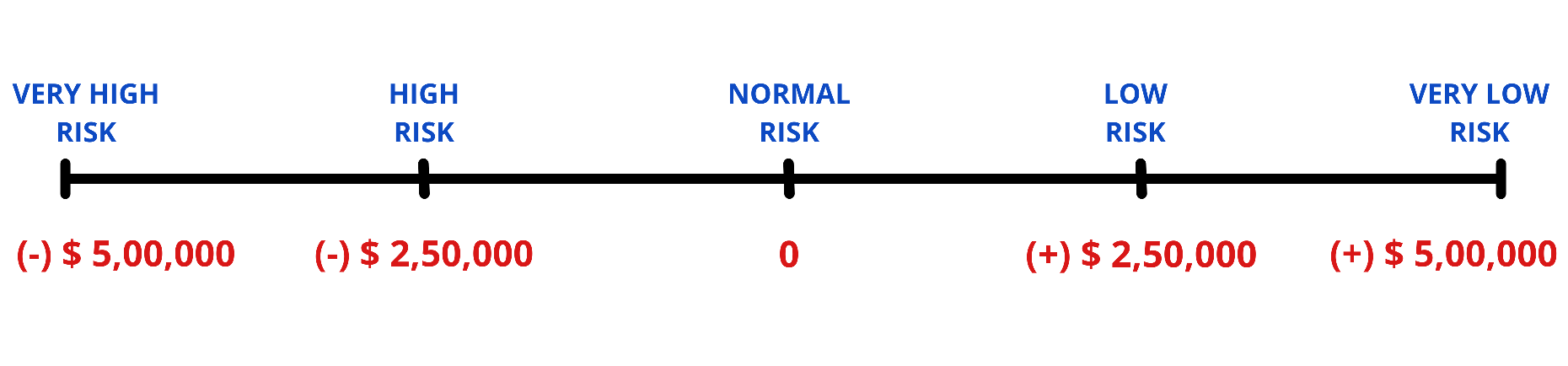

The approach examines the quantitative risks associated with a business with its impact on return on investment. It starts with calculating the pre-money valuation of comparable companies, followed by increasing or decreasing the value in multiples of $2,50,000 based on its positive or negative effect on the business.

Under this method, Very high risk factors get a double minus grade (- -), deducting $5,00,000 & high risk factors get a single minus grade(-), deducting $2,50,000. Similarly, Very Low risk factors get a double plus grade (+ +), adding $5,00,000 & low risk get a single plus grade (+), adding $2,50,000.

These are 12 standard risk factors under this method:

Let’s consider, the above pre-money valuation of a comparable company ie. $3 Million. Thus, we get a total valuation of $4.25 Million, on adding & subtracting the value of risks.

-

Asset-Based/Book Value Valuation Method

Asset-based valuation is the easiest method for startup valuation as it simply deducts total liabilities from the total assets of the company.

With the simplicity of the approach, the financial juggling makes it complicated. This could be offsetting the initial costs of assets by depreciation followed by adding total physical assets value to the balance sheet. And subtracting outstanding debts or expenses from the total to get an asset-based valuation.

The method comes with a major drawback of adjusting the net assets as it seeks the market value of the assets. And balance sheet value depreciates while decreasing the value of the assets over time. Hence, the book value of assets will not necessarily be equivalent to the fair market value.

-

First Chicago Method

The First Chicago Method was first brought by Chicago Corporation Venture Capital. Private equity investors and Venture capitalists widely prefer this approach. This follows a situation-specific approach & is generally used for valuing early startups and growth companies. It combines techniques of both discounted cash flow and multiple methods.

The method begins with defining three different scenarios for the enterprise. This includes:

- Best Case Scenario: When the company’s performance exceeds expectations.

- Mid-Case Scenario: A majority expectation or the belief about the firm’s future performance.

- Worst Case Scenario: A scenario where the firm is deemed to fail if most contingencies go wrong.

This requires developing each scenario based on future cash flows. The next step is to calculate a divestment price i.e. Terminal value for exit through multiple transaction methods.

Thus, estimating the valuation by comparing it with other transactions within the same industry, region, and at the same stage.

This is followed by the valuation of each scenario by discounting the terminal value & cash flows until the exit year.

It gets concluded by allocating or multiplying each scenario with a probability & then the weighted sum of each scenario.

Check out: Why is it important for a business to know about 409a Valuation?

To Wrap Up:

There’s not just one method to followed for figuring out the startup valuation at the seed stage. Every industry or sector the startup plays in is different and has unique requirements. These methods could be overwhelming and complicated.

Thus, a combination of various methods is the most favorable choice. Eventually, the value for the startup is what investors are willing to invest in. Investors study the market forces, similar deals, and recent exits before putting in their money.

So as you put your cards in front of investors, study those same resources to find your startup value. Pull out those strength factors to increase the value & for showing how worthy your startup is to invest in.