CEOs of early-stage firms rarely think of debt financing as growth capital. Venture capital has more considerable mindshare. Many founders are anxious about taking money that has an interest rate or repayment cap attached. They do not know that debt is cheaper than equity.

Financing your healthy growing company with debt is not the same as maxing out your credit cards to fund your product development.

You have to pay customers, maybe even a few enterprises. You have revenue. So, you (hopefully) have an accounting function. This infrastructure makes debt easy to account for.

You know your repayment obligations ahead of time, and you can plan for them.

Also, debt financing may offer hidden benefits. Thus, getting debt help from experts is a wise decision when dealing with such matters.

Also, debt financing may offer hidden benefits.

This article will explain why debt is cheaper than equity. We will show how start-ups can benefit from debt as growth capital instead of equity.

Why is debt cheaper than equity?

Debt is cheaper than equity for several reasons. However, the primary reason for this is that debt comes without tax.

This means that when we choose debt financing, it lowers our income tax. It helps remove the interest accruable.

The interest is on the debt on the earnings before interest and tax. That is why we pay less income tax than when dealing with equity financing.

There is no such thing as interest on equity in the case of equity financing, but we have a dividend. Thus, EBT in equity financing is usually more than it is in the case of Debt financing, and it is the same rate in both instances.

EPS is usually more in debt financing than equity financing. Inequity financing, the share number has increased more than before. In debt financing, there is no alteration in the share number.

Why Should I Choose Debts Over Equity?

We have established that debt trumps equity when it comes to financing. Owners of startup companies rarely think of debt financing as growth capital. Venture capital usually has higher mindshare.

So, several founders are quite anxious about collecting funds with a repayment cap or interest rates.

This, however, should not be the case. The simple reality is that financing your company growth using debt is not the same as exceeding your credit cards’ limit.

You will have paying customers. This means revenue. Surely you may also have an accounting function.

Also, it means that you will know your repayment obligations in advance, and as such, you can plan.

Benefits of Debt Financing

Also, debt financing brings many benefits you may not be aware of. There are some unique benefits of debt financing.

Unique tax benefits

If your company is faced with financial issues, debt financing gives you what equity financing will not be able to.

For instance, if your company uses accrual accounting, the payment’s interest is often a part of the loss and profit payments. This means a reduction in your taxable income.

So, the cost of borrowing will be lower than the interest rate stated. The American government helps you in mitigating the cost of the loan procured.

In the long run, debt is cheaper than equity

Many entrepreneurs have the erroneous belief that venture capital is free money. The truth is that it is not. Debt is the best way to go if you intend to make any meaningful progress.

Autonomy in running your business

Usually, a lender will not come to tell you how you should run your organization. However, by taking equity, you will have the investors on the board of your company.

This also means that you will have to conform to their expectations regarding how your company should be run. Sometimes the control of the owner of such a business gets limited.

This is because of conflict with the investors. But lenders are interested in you being up to date with your payments. They do not want seats on your board or a controlling stake.

Extra push

For companies that are at their early stage of development with recurrent revenue streams, a minor debt amount will lead to an increase in net cash flow.

There will be an increase in the overall cash flow with the added funds. You can hire some extra hands with this extra cash.

If you are lucky enough to hire the right people, it will reflect in your business’s overall productivity. This will reflect your overall ROI and sales.

Luxury of time

One of the significant drawbacks of equity financing is that it usually takes much time for raised funds. It also takes much effort to raise the funds, with phone calls, pitches, coffee meetings, and the likes.

Debt financing is usually relatively quick. Debt saves you the time needed to run the business.

Lenders are not interested in keeping up with each decision you make. They usually do not need board meetings. They do not bother themselves with your strategy or hiring process.

Limited obligation to lenders

If a firm goes bankrupt, which is what happened with Lehman Brothers, equity holders lose everything.

Lenders have the first claim on company assets (collateral). This increases their security.

So, since the debt has limited risk, it is usually cheaper. Equity holders are taking on more risk. Hence they need to be compensated for it with higher returns.

Massive IPO valuations are highly uncommon

Coal India plans to raise US$ 3 bn. Recently, Brazil’s Petrobas raised US$ 70 bn in the world’s largest IPO.

These companies can afford to raise this kind of money as the risk is relatively diversified among many investors.

A bank or even a group of banks would never lend such massive amounts to one borrower.

What Is the Cost of Debt Financing?

The capital structure of a business is usually composed of both equity and debt. The dividend that is paid off to the shareholders is the equity cost.

In the case of debts, the company pays the loan and the interest. The cost of borrowing is the cost of payment of the debt instruments.

The sum of the cost of equity financing and debt financing is the cost of capital. The capital cost represents the lowest return.

A firm has to make this on the capital if it seeks to please its creditors, shareholders, and capital providers. Every decision of a company regarding investments must generate returns that should be more than the capital cost.

Suppose the returns on capital expenditures are lower than the capital cost. In that case, such a company is on a positive note.

What Is Debt Financing?

Debt financing occurs when a company sells certain fixed products such as bills, bonds, and notes. This helps to get the much-needed capital to grow its operations.

When a company issues bonds, the people who buy such bonds are investors who give the company the needed debt financing.

The loan must be paid after some time at the date agreed. If the company closes business, the lenders are at liberty to sell off the company assets to recover their funds.

What is the Interest Rate In Debt Financing?

Several investors in debt are merely interested in principal protection; others look for a return in the form of interest. The interest rate is determined by the market rates and the borrower’s creditworthiness.

When there is a higher payment rate, it merely implies that the borrower has a higher tendency of defaulting. This means he or she is a higher-risk investment.

The higher rates compensate the borrower for the higher risks. Aside from the interests payable, debt financing also requires the borrower to adhere to some rules strictly. Such rules are known as covenants.

Debt financing is always quite challenging to get. But it also means funding at rates lower than that of equity financing. Debt financing offers borrowers tax-deductible funding.

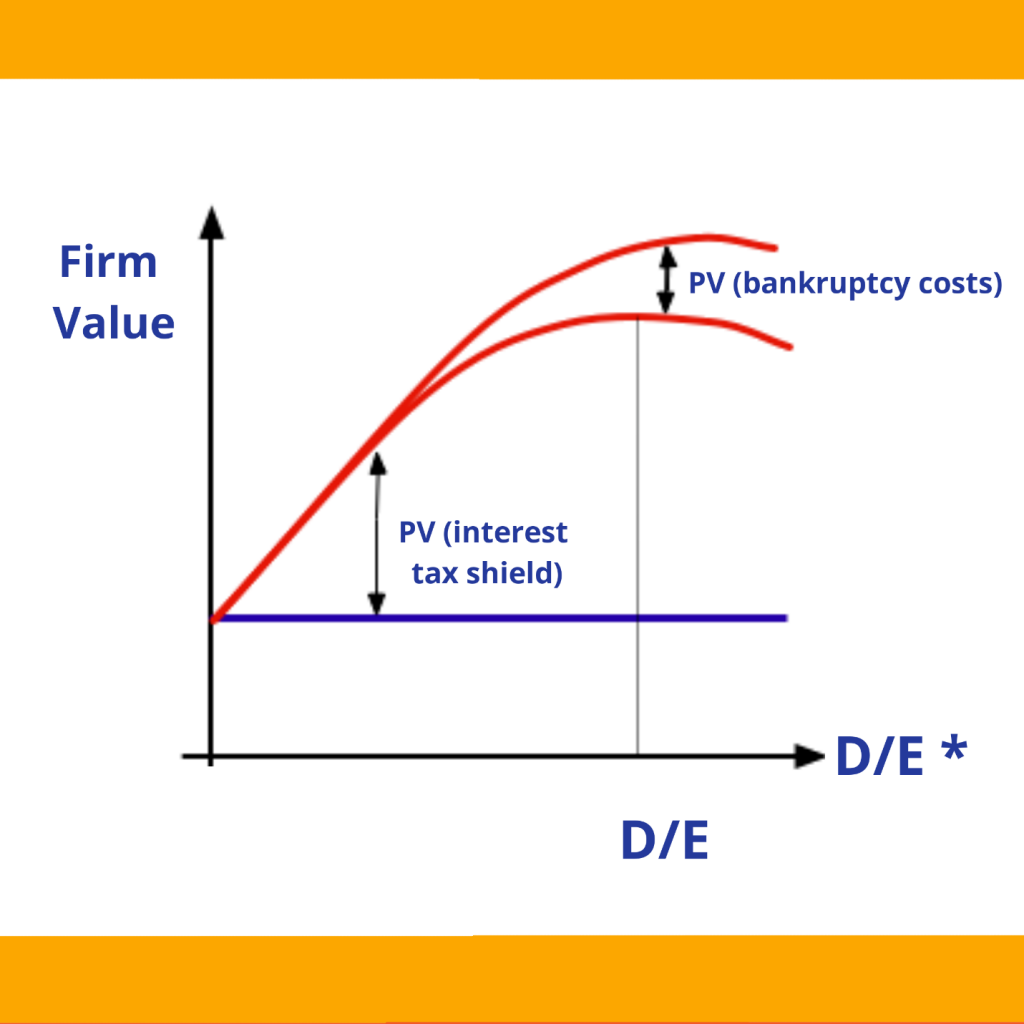

However, one needs to be careful with debt financing because having too much debt may affect capital costs. This leads to a reduction in the value of your organization.

What Does The Debt-Equity Ratio Mean?

A firm’s character in financing is a function of its debt-equity ratio.

Lenders are motivated by a lower debt-equity ratio, as it implies that the company is more investment-based. It translates to higher investor confidence in the business.

There may be a case where the debt-equity ratio is high. Then it means that the company has too much borrowings on a comparatively small investment base.

Conclusion

The funding option you pick today is highly important. It will determine what you can and cannot do with your business in the future.

It is essential in those early years—after launch and before complete traction—to be aware of all your funding options.

Plan where you want the business to be in ten years. Think about how much time or control or money you are willing to give up to get there.