When you start your venture, you’ve got a variety of selections to form. What are you going to offer? What market are you going to target?

Are you planning to run your business solo or have a helping hand? If you don’t want to run your business alone, you may consider forming a partnership.

All conceivable business situations, from the opening of business to dissolving the partnership, should be addressed in the partnership agreement with consensus solutions to these situations.

Creating a partnership agreement is a voluntary action for partners, but it can be legally binding if any of the agreements are contested in court.

But which type of partnership should you opt for?

In this blog, I will explain the difference between partnerships, which partnership you should opt for when you should use a limited partnership agreement, its pros, and cons with a sample that will help you in understanding it.

Types of Partnership In Business

One of the primary things you decide as a business owner is your kind of business structure.

Here what I mean is whether it is a Sole proprietorship, Partnership, Corporation, S corporation, or LLC.

A partnership could be a business that two or more individuals own and operate together. Unlike other business structures, there are multiple forms of partnership you’ll be able to establish.

Depending on the number of participants within the partnership, partners could also be responsible for business debts.

So, let’s understand them in detail. Well, there are four types of partnerships.

General Partnership

A general partnership is a company owned by two or more individuals who conform to run the business as partners or co-owners.

Each partner shares an equal amount of profits and losses. Partnership agreements play a significant role in general partnerships that don’t evenly split duties and shares.

If you propose forming a general partnership, create a proper agreement stating each partner’s role and shares.

Be sure to also specify how you propose selling or closing the business if the partnership dissolves.

General partnerships are easy to determine, low-cost, and versatile. On the downside, your assets are in danger during a general partnership.

Limited Partnership

To start a limited partnership business, you need at least one general and one limited partner. So, how will you differentiate between a general partner and a limited partner?

Limited partners only serve as investors for the partnership and they do not have decision-making rights.

They get ownership but don’t have any responsibilities and risks as a general partner.

Limited partners can lose their status if they become too involved in managing the company like signing legal documents or contracts.

If you’re a limited partner, watch out about the activities you are doing and also the decisions you create within the partnership.

Limited Liability Partnership

A liability partnership, or LLP, is a form of partnership where owners aren’t held personally accountable for the business’s debts or other partners’ actions.

With an LLP, you can’t lose your assets if someone takes a proceeding against your business. But, partners may be held liable if they do something wrong.

The protection an LLP partner receives is different for every state. Check your state’s rules before you form a liability partnership.

In some states, only a few professions are allowed to form an LLP, like doctors, lawyers, or accountants.

LLPs make it easy to feature or remove partners. And unlike other sorts of partnerships, you’ll have liability protection from other members’ actions (depending on your state).

LLC Partnership

An LLC partnership can have two or more owners that are known as members. Limited liability companies with multiple members are mentioned as multi-member LLCs or LLC partnerships.

In LLC partnerships, members’ assets are protected. In most cases, members can’t be sued for the business’s debts or actions.

Though, members can be held liable for other members’ actions. Most businesses can form an LLC partnership. LLC partnerships provide tax flexibility for members and personal liability protection.

One of the common differences between LLC and C Corp is related to corporate income tax. The owners of an LLC can choose to have the business taxed as a C-corp or as a pass-through entity.

Owners of pass-through entities pay taxes on business income on their personal tax returns.

For a C-corp, business income gets taxed once at the corporate level, and then shareholders get taxed again on their personal tax returns if they receive dividends from the business.

When should you use a limited Partnership Agreement?

Now that you have a fair idea about the different types of partnerships, so let’s dive deep into knowing more about when you should use a limited partnership agreement.

Use the Limited Partnership Agreement document if:

- You’re ready to form a Limited Partnership, and you wish to define the business terms.

- You and your business partners have already formed a Limited Partnership, but you want to formalize your agreed-upon terms.

- Or when you want to decide the terms of the partnership and how the profit-sharing will work.

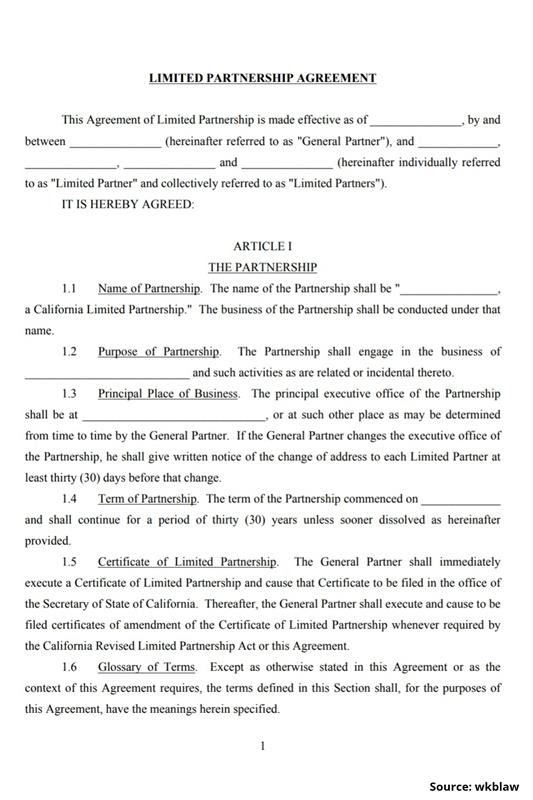

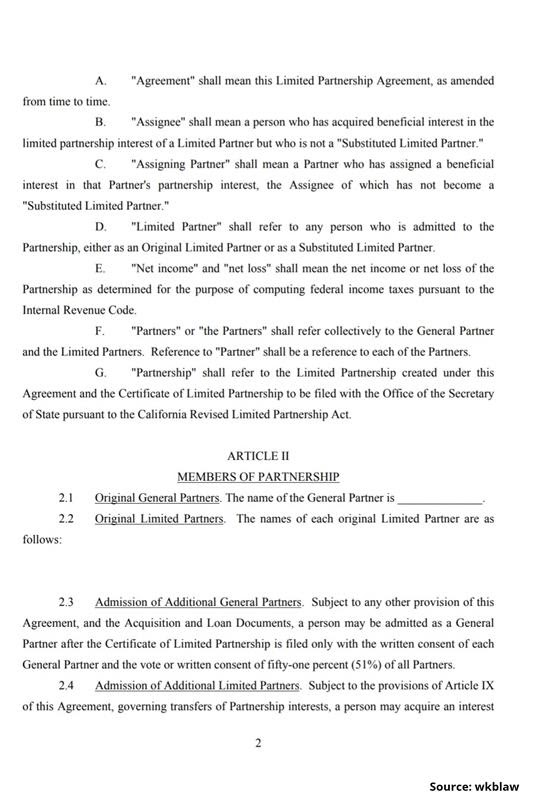

How To Write A Limited Partnership Agreement

Write Basic Information

The names of the parties participating in the agreement should be specified. One must be mentioned as the general partner while the opposite is mentioned as the limited partner.

Their roles within the agreement must be clearly defined.

Other basic information like the age and address of the parties is additionally included. Write a start and end date of the contract’s validity to understand how long the contract is good for.

Define Roles and Responsibilities

The partnership agreement can include the specific duties of each general partner and how much power they need in making business decisions.

The general partner operates the business while the limited partner only puts within the money.

The partnership agreement can include specific duties of each general partner and how much power they need in making business decisions.

For example, one partner may be accountable for bookkeeping, while the opposite is answerable for getting clients and making sales.

Voting Rights

Partners should include the voting rights of all owners in their partnership agreement.

Each partner can have the right to vote on business matters, business transactions, real estate purchases, and managerial changes such as adding or letting go of owners.

However, this part must be detailed when it’s about the limit of their voting rights. Sometimes, general partners might not allow limited partners to vote on particular business issues.

They can also decide if they need to rent a voting committee to handle the voting process or let all the partners vote.

Splitting Profits and Losses

The process of splitting profits and losses is written in the limited partnership agreement.

The ownership interest is one basis for the partners to induce their shares of profits and losses. It can also be allocated differently.

The general partner often gets more than the limited partners, because they handle the daily operations of the business.

Withdrawal And Termination

The exit strategies of partners from a partnership are generally included inside a partnership agreement.

Other than being voted out, partners can leave the business via retirement, death, or disability. To make a smooth transition, the partnership agreement may include a buy-sell agreement.

The agreement provides rules if the ownership interest of the leaving partner may be bought out by other partners.

The limited partnership dissolves when the partners don’t address the likelihood of other partners leaving the agreement.

If partners conform to dissolve the LP, the allocation of business assets is often summarized within the partnership agreement.

Limited Partnership Agreement: Sample Template

Image credits: wkblaw

Pros and Cons of Limited Partnership

Limited partnerships have their highs and lows. It is useful to you in a way but it has some drawbacks.

Think hard before stepping into this type of agreement. Once you sign the document, there is no going back.

Flexibility

The limited partner can leave without dissolving the entire partnership. He has little control over the business. This makes limited partnership flexible.

The general partner also gets paid a percentage of the dividends besides his ownership stake.

Limited partnerships can even be customized by writing an operating agreement, which states how the business is run by both parties.

Tax Benefits

Limited partnerships allow the profits and losses of the corporate to flow through the business to the partners.

The general partners are taxed on their income and tax returns, while the limited partners won’t need to participate within the business in any respect.

Liability

With a limited partnership, the limited partner’s liability is simply up to the quantity of cash he invested within the business. Going beyond that can mean trouble.

You can also usher in more investors without abandoning control of the business. Their liability in debts is additionally limited as long as the agreement is valid.

Maximum Exposure

Limited partners can’t lose the money they invest within the business. In a limited partnership, the partners know about their losses.

This, in turn, makes it easier to boost the capital.

Decision-Making Risks

When an organization goes bankrupt, the final partners bear all the burden of handling financial and legal matters.

However, all the decision-making of the corporation is made by the overall partners. The limited partners don’t have a say to change and implement decisions in it.

Conclusion

Limited partnerships are only favorable if you want to invest in a business and get away from managerial roles and responsibilities

This also opens more opportunities for you to try and do other things apart from the business that you simply have invested in.

Always think through when signing a contract. It helps to grasp everything that’s written on that before inking your signature.