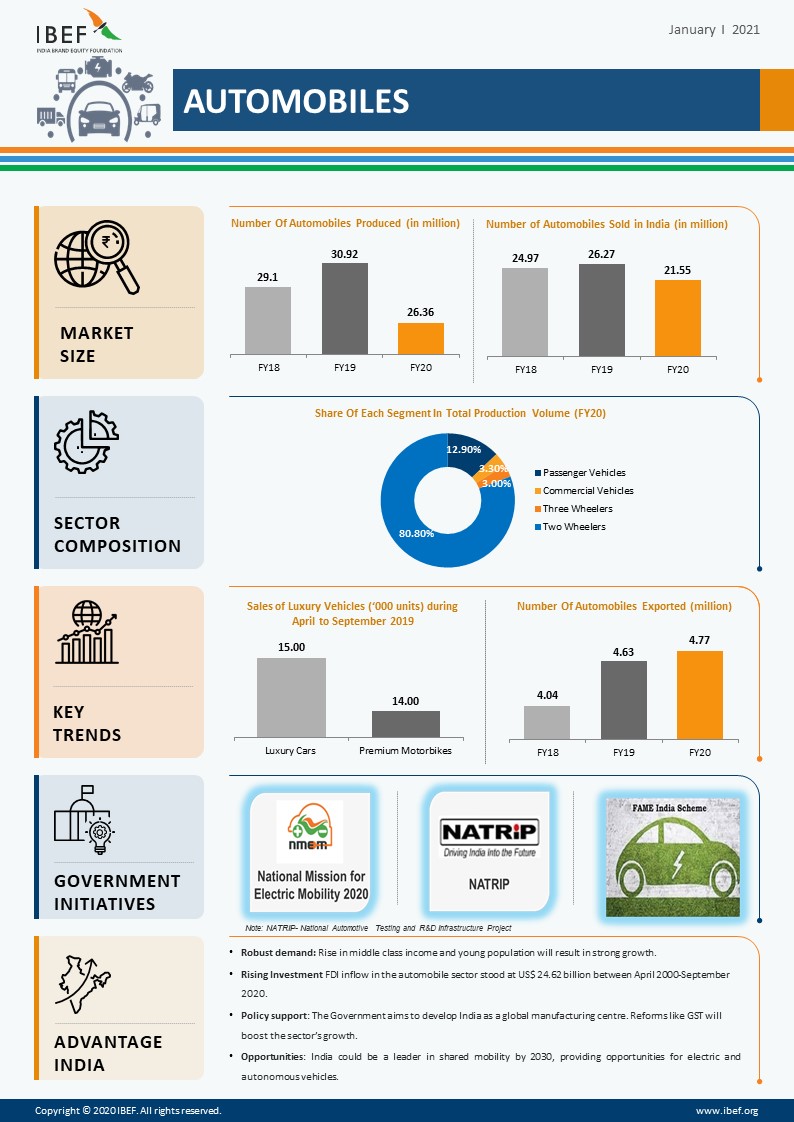

The Indian automobile industry is the world’s fourth-largest industry & is expected to be the next third-largest industry by 2026. The $118B industry will reach the mark of $300B in the coming five years. The industry’s current production score is 26 Million vehicles, including Three Wheelers, Two Wheelers, Passenger & Commercial Vehicles, and Quadricycles in April-March 2020.

India has a solid position in international heavy vehicles, making it the largest tractor producer, third-largest heavy trucks manufacturer, and second-largest bus manufacturer in the world.

With numerous milestones in the name, & some far-reaching estimations by experts, the industry wasn’t immune to the slow growth in the past few years.

Problems faced by Indian Automobile Industry

Indian Automotive Industry witnessed the steepest plunge of 18.71% in 19 years in July 2019, reports Society of Indian Automobile Manufacturers (SIAM). The country faced a glooming phase, registering a 31% worst fall in passenger vehicles ever, 17% in two-wheeler deliveries, and 26% in commercial vehicle shipments. In the July of 2018, the industry observed a downturn. Before it, the industry was booming with 18% to nearly 70 lakh vehicle unit sales in the first quarter.

Despite discounts & festive offers, the Indian Automobile Industry was unable to refix its foot in the customer market. The year 2018-19 made the automobile industry face lots of domestic tensions, severely impacting the country’s GDP & development. So what specific reason led to the fall-off of the Indian Automobile Industry?

-

Demonetization:

The Indian government announced the withdrawal of Rs 500 & Rs 1000 currency notes in November 2016. The aftermath of demonetization had a long-lasting impact, leading to liquidity crunch, job loss & negative impacts on many businesses.

Consequently, it dropped off the net disposable income & per capita GDP growth rate, restricting consumers to spend on non-essential items. Because consumers are naturally, focused on fulfilling their ‘needs’ over ‘wants’ during a cash crunch. Thus, contributing to lack of demand & market slowdown.

-

Financial Setback:

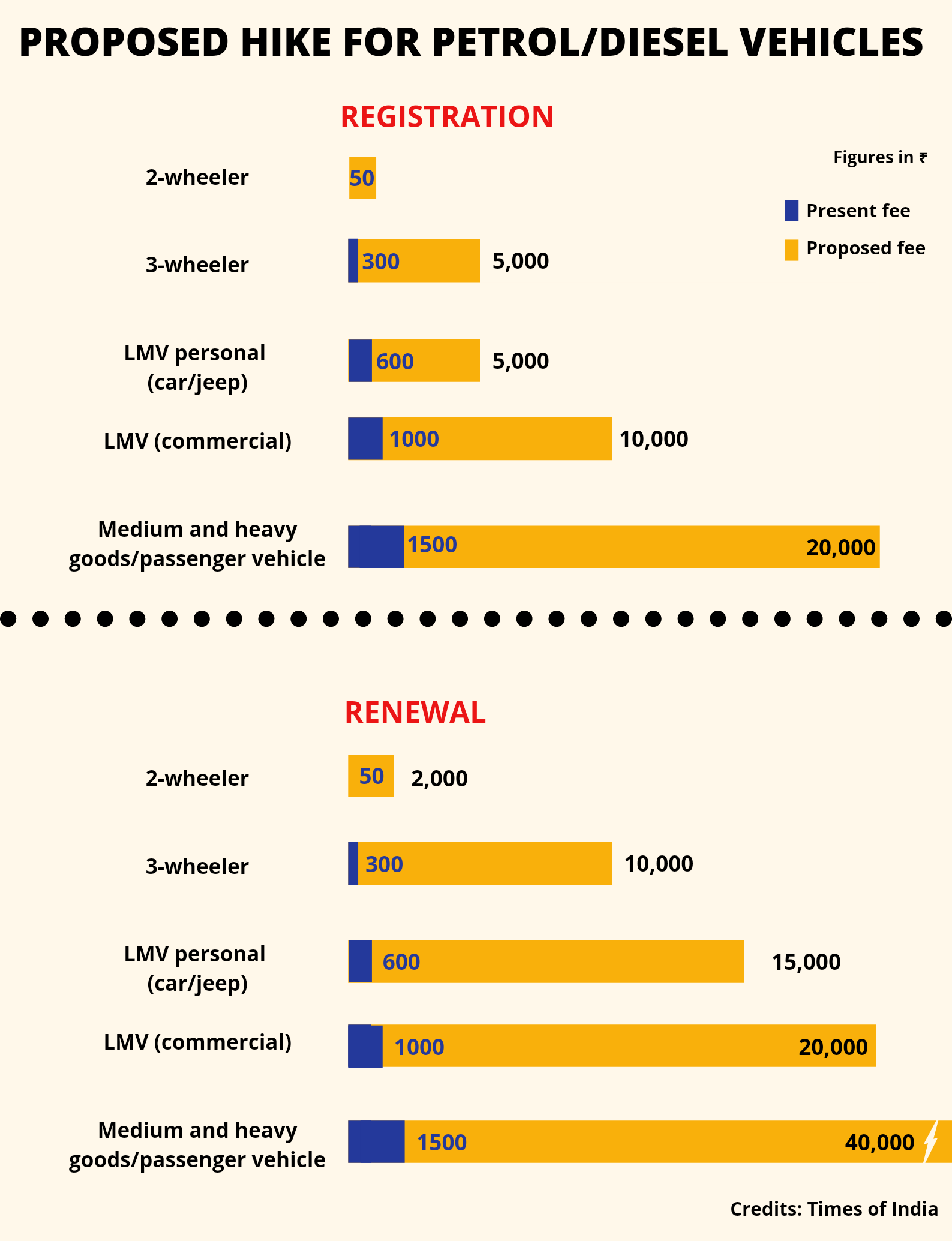

Affordability became an issue when the Indian transport ministry raised prices at every stage of purchasing a vehicle. For discouraging petrol & diesel vehicles, the fee prices were hiked in case of two-wheelers and cabs.

For two-wheels owners, what was costing Rs 50 is now Rs 1000 as registration fee & Rs 2000 for renewal. Whereas for cabs prices are shot at Rs10,000 for registration fee & Rs 20000 renewal than Rs 1,000 formerly.

Additionally, an increase in fuel prices, a hike in the cost of vehicle ownership, interest rates & insurance costs subsided the consumer’s sentiment to buy a vehicle. Moreover, the IL&FS and NBFC crisis in late 2018, led to a drastic liquidity crunch, while exhausting the credits for dealers and & customers.

-

The GST Effect:

Indian Automobiles levies 28% – 25% GST on vehicles from low-end to high-end ones. The rate was previously almost half than the current rate. The massive surge in GST rate increases the final car price making it out of reach of the buyers.

Automobile companies demanded from the government a reduction in the current rate, but to avail, the rate remains unchanged.

-

App-Based Commuting:

The slower growth rate & reduction in purchasing power affects the choices of the young generation. People are finding ways to accommodate the new lifestyle changes. Traffic congestion, longer commute hours, lack of parking space enforces people to choose new mobility patterns.

“Social barriers are breaking. My friends who could not think of getting off their Mercedes are happily taking Ola-Uber,” says a 25-year old office goer working in Bangalore.

The easy alternate option in Indian markets like OLA, Uber, Zoom Car, Zap delivers a satisfactory driving pleasure at affordable prices. Thus, making it a unanimously preferred choice among the people.

Checkout: How to Boost Customer Acquisition During Lean Periods

-

New Compliant Vehicles:

In 2006, Indian vehicle authorities notified the adaptation of Bharat Stage (BS)-VI compliant vehicles, while scrapping off the (BS)-IV vehicles. The scrappage policy emerged in the wake of pollution control & environmental sustenance. Thus, consequently leading customers to not buy the old compliant vehicles & wait for the latest ones.

-

Lack of Aspiration:

People are trying to be more aware of their decisions than ever before. They have started to understand the ill effects of pollution on the environment. They don’t consider putting their money in depreciable assets as a wise choice.

Instead, they are getting more directed towards investing in stocks, fixed deposits, mutual funds, etc. to lead a better & easy life, rather than spending on automobiles.

-

Holding Back for EVs:

The Presidential Government is pushing electric mobility, to transform India’s automobile scenario towards sustainable mobility mode. In 2019, The Indian government allocated ₹10,000 crores to encourage the development, manufacturing, and usage of electric vehicles through the FAME scheme. Thus, subduing the consumers’ demand.

However, while employing 37 million people at a time in the country, the automobile sector flagged the title of largest employing industry.

But the downturn of the automobile sector made 15,000 temporary workers from original electric manufacturers(OEMs) lose their contracts. The shortage of working capital led to the termination of 300 dealerships, affecting the jobs of 2 lakh people across the country.

The past few years were a terrible period for the Indian automobile sector. However, the ending phase of 2020 saw the revival of the industry.

The Revival of Indian Automobile Industry

Indian automobile industry suffered Rs 2,300 crore plus losses in turnover for every single day closure. Despite getting knocked off by a deadly 2020 event, the Q2 and Q3 phase saw momentum in the prolonged stagnant automobile industry. Maruti Suzuki, India’s biggest automobile manufacturer, registered a 20 percent sales growth. MG Motor reported a 33% rise during the same period.

Whereas Toyota, early in the race, posted a 14% rise in domestic sales in December 2020. Heavy Truck vehicle demand was also on an upturn as it reported a 43% sales increase.

Checkout: Startup Sales Strategy: 10 Best & Effective Strategies, Plan & Example.

With an increase in digitization buzz & reopening of sectors post-lockdown, people are steadily getting back to normalcy. IBEF reports, the Indian automobile industry is expected to reach Rs 16.16-18.18 trillion (US$ 251.4-282.8 billion) by 2026 & is expected to be a leader by 2030

SIAM has estimated a 26.45 percent Y-o-Y growth for the passenger vehicle segment in September 2020. Whereas an 11.64 percent year-on-year growth for Two-wheelers sales during the month.

The rise in automobile exports has also accompanied the party, registering 4.77 million vehicle exports in FY20, with a 6.94% CAGR growth. The industry has attracted US $24.53 Billion Foreign Direct Investment (FDI) from April 2000 to June 2020, reports the Department for Promotion of Industry and Internal Trade (DPIIT).

The highlight of the revival and upcoming growth is the shift of focus to Electric Vehicles (EVs) for controlling harmful emissions. Technology and automobile companies are showing immense interest & investment contributions in the Indian Electric Vehicle market.

It is expected to be a US $7.09 billion opportunity by 2025. A study by Castrol reports, most Indian customers will be in electric cars by 2022.

“The study also highlighted for an average Indian consumer, the price point of Rs. 23 lakh (or US$ 31,000), a charge time of 35 minutes, and a range of 401 kilometers from a single charge will be the ‘tipping points’ to get mainstream EV adoption.”

Various companies like Hyundai, MG Motors, Mercedes, and Tata Motors, have already entered the market with their EVs. The Indian Government is ambitiously moving forward for EV adoption.

Checkout: What is a Tech Ecosystem and How It Can Be Highly Impactful for Startups

It has launched National Automotive Testing and R&D Infrastructure Project (NATRIP) centers as well as National Automotive Board to be facilitators or between the Government and the industry. Five testing and Research centers have been established in the country since 2015, under the National Automotive Testing and R&D Infrastructure Project (NATRIP).

To jumpstart, Ultraviolette Automotive, a manufacturer of electric motorcycles in India, raised an undisclosed amount from GoFrugal Technologies, a software company, in a Series B investment. For developing electronic components and technology for domestic customers and exports.

For developing commercial electric vehicles Mahindra & Mahindra, the well-known Indian automobile maker signed an MoU with Israel-based REE Automotive. Toyota Kirloskar Motors announced investments of more than Rs 2,000 crore (US$ 272.81 million) in India.

Although it’s just a jumpstart, the expedition has not yet begun. The Indian consumer market is now ready to dive into the electric automobile space. Along with new employment opportunities, this shift is expected to make transformational & immense global opportunities for companies and investments.