A financial model is the heart of every business. An accurate economic model is a crucial step in any business success story; whether launching a new venture or growing an established one, having a financial plan will significantly benefit your organization now and into the future!

A solid financial model enables entrepreneurs to make more informed decisions when allocating resources and predicting future outcomes. In addition, a well-crafted financial model can distinguish between a successful venture and one that fails.

What is Financial Modeling?

Financial modeling is a process used to create a financial representation of a business or organization to forecast its future performance and make strategic decisions. It is based on analyzing historical financial data, market conditions, and various other variables to predict the company’s financial health and performance over a certain period. It also helps business owners and investors understand the company’s long-term profitability and determine what investments will yield better returns.

Why is having a solid financial model vital for any startup’s success?

An effective financial model helps startups manage their finances effectively, secure financing, and attract potential investors. A financial model can forecast revenue, costs, and cash flow for multiple years by developing detailed economic projections. It also shows the different drivers of business performance and allows stakeholders to see what scenarios may occur under various economic conditions. Ultimately, it gives decision-makers insight into the viability of their startup so they can make well-informed decisions.

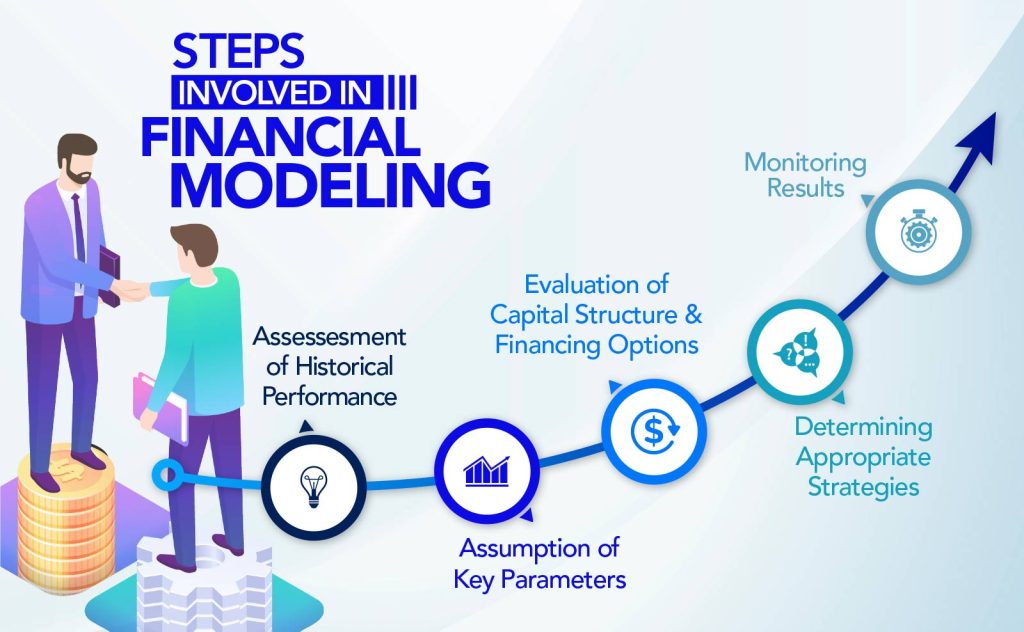

The following steps are involved in financial modeling for business growth:

1. Assess Historical Performance:

Analyzing past performance is essential to understand the company’s current financial position and gaining insights into how well the business performs compared to industry standards. The historical data should include balance sheets, income statements, cash flows, and other relevant financial documents. This helps identify trends, risks, and opportunities associated with different investments.

2. Key Parameters:

Based on the historical data collected from step 1, develop financial models that include assumptions about key parameters such as revenue growth rate, cost structure, pricing policies, etc. These assumptions can be modified according to changing conditions over time so that updated information can be used for future planning and decision-making.

3. Evaluate Capital Structure & Financing Options:

With the help of detailed financial models created from step 2, evaluate capital structures and financing options that will provide sufficient funds for the company’s further growth and expansion plans. Evaluate different sources, such as debt financing, venture capital investments, or any other external funding sources that provide the necessary liquidity to reach desired goals.

4. Determine Appropriate Strategies:

Financial models will also help you understand different strategies to improve profitability by maximizing revenue, cutting down expenses, or diversifying investments. Identify strategies that are more likely to bring positive returns when implemented effectively with correct measures put in place to ensure it works efficiently towards achieving your goals over the time frame you set forth initially while developing your financial models in step 2

5. Monitor Results:

Regularly monitor results generated by your strategies & tactics implemented as part of the overall financial model prepared during steps 2 & 3 so that timely changes can be made whenever needed if there are unexpected fluctuations or conditions not accounted for initially when formulating models. Adjust forecasts accordingly for upcoming periods & revisit underlying assumptions whenever necessary taking into account macroeconomic trends and other industry-specific factors affecting performance periodically.

How do you build a financial Model?

Building an accurate financial model requires attention to detail, patience, and analytical thinking skills. Start with basic data such as cash flows, income statements, and balance sheets to build your financial model. Next, input all assumptions related to revenues and expenses along with growth estimates to project results over multiple years—finally, test sensitivity analysis against various macroeconomic variables to measure potential risks associated with different business scenarios.

Types of Financial Models?

Types of financial modeling include quantitative modeling, which involves quantitative analysis such as data mining or machine learning algorithms; discounted cash flow (DCF) models. It assesses current value based on expected future performance; Monte Carlo simulations which involve running multiple scenarios based on probability; break-even analyses which analyze pricing and profit levels needed for a successful operation; and many more. Each model type offers advantages when understanding your startup’s potential success or failure.

Benefits of Financial Modeling

A financial model is essential in helping startups assess their progress toward achieving their long-term objectives while minimizing risk through comprehensive analyses of past performances and expected outcomes in various scenarios. It helps businesses gain access to new sources of funding as well as create strategic plans that are most likely to result in sustained success. This includes:

- Building Cash Flow Projections

- Forecasting Profits & Losses

- Budget Planning

- Financial Performance Analysis

- Investment Appraisals

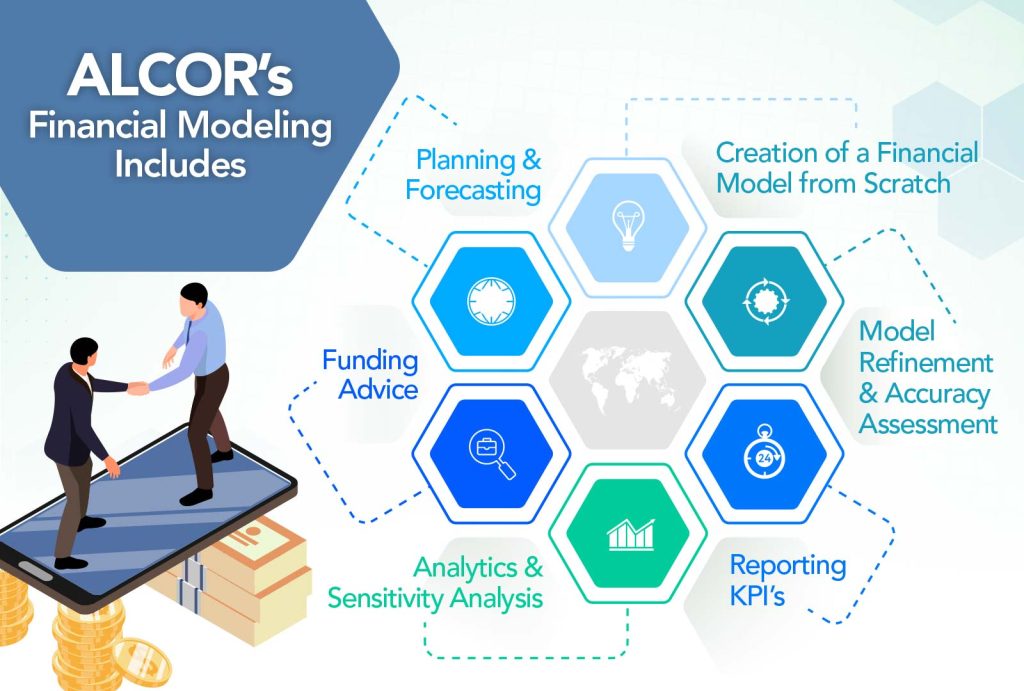

Why choose ALCOR for Financial Modeling:

ALCOR provides comprehensive financial modeling services for startups. With a strong understanding of financial models, our experienced team of professionals can create a compelling and comprehensive model to help startups make well-informed decisions about their businesses. We also specialize in constructing tailored financial models that best suit the individual needs of startups to ensure they have all the information needed to make smart and informed decisions about their finances.

Our services include:

Creation of a financial model from scratch.

Our experienced team can develop a robust and comprehensive financial model based on your startup’s needs and available data sources. The model will be designed with you in mind to meet your objectives and help drive business success.

Model refinement & accuracy assessment

We assess existing models and adjust them where needed to achieve desired results while maintaining accuracy.

Reporting

We provide regular reporting that helps keep stakeholders informed on key performance indicators (KPIs). It Includes revenue forecasts, cost estimates, market analysis, and other insights that could benefit your startup’s operations.

Analytics & Sensitivity Analysis

We offer deep-dive analytics by applying scenarios for key decision drivers like revenue, expenses, etc. It enables management teams to gain valuable insights into future planning opportunities or areas for improvement.

Funding Advice

Our experienced advisors will advise on the most appropriate financing solutions for your startup’s short-term and long-term growth objectives. We ensure you get the most competitive terms from investors or lending institutions.

Planning & forecasting

We work with our clients to design realistic projections and budgeting plans essential for successful businesses and annual planning cycles.

At Alcor, our team of experienced finance professionals is available to assist you every step of the way. We assist you with data gathering through sensitivity analysis and optimization strategies. From developing cash flow forecasts or planning long-term growth objectives, we have the expertise to get you where you want to be. Contact us today for more information about our custom financial modeling services for startups.