Knowing how to talk to investors is a skill every founder should have. A compelling pitch is significant for seed-stage companies these days.

Many founders spend a long time lovingly describing every aspect of the product and all its features.

Then they flip to the customer slide. It usually contains a chart with a line moving up and to the right. At the top of the chart is the number of customers they have gained. And that was all they say about customer acquisition.

On the next slide, they begin describing their team. That is when investors stop listening.

In the 15 seconds, they spend talking about their customers. They tell a lot more about their startup than they do during the 15 minutes describing their product. They tell investors they are not a founder worth investing in.

Your product is not the thing you should be pitching to investors.

Great startups revolve around the customer acquisition process because, without customers, you do not have a business.

Many such nuances have to be kept in mind while pitching to a prospective investor. This is why many founders lose out on funding.

VC financing was up about 30% in 2010 from 2009. More than $4 billion went to about 1,000 companies.

But the flow of funds going to seed-stage firms declined by 2%. This is according to the Moneytree Report by the National Venture Capital Association and PricewaterhouseCoopers.

Angel investors poured $20.1 billion in 2010 into growth firms. This is an increase of 14% over 2009.

But they reduced seed-stage investments by 4%. This is according to the Center on Venture Research at the University of New Hampshire’s Whittemore School of Business.

Not getting funding is a death sentence for many startups. 13% of founders said they shut down due to a lack of funds.

You may have money in the bank. But there will come the point when you have to get additional funding. It will be required to grow your startup and start scaling up.

You can use several tools to communicate with investors. These include press releases to annual reports. Companies use a wide range of tactics to get the right message into current and future investors’ hands.

Our in-depth guide will assist you through each element of talking with investors. It will show what investors are looking for, and how to convince them effectively.

Key terms entrepreneurs should learn when fundraising

-

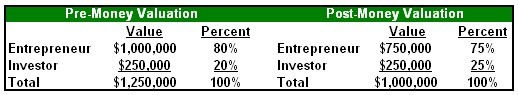

Pre-money valuation

It is the valuation of a firm before an investment. A startup’s pre-money valuation is its value when raising money. It does not include external funding or the latest round.

-

Post-money valuation

The firm’s value after it has raised capital from external investors. It is calculated after the investment has been added to the balance sheet.

To illustrate the difference between both, we will use this example from Investopedia.

Startups sell shares to investors to raise capital. In some cases, they also sell to employees.

-

Common stock

It gives voting rights to the firm. It is worth noting that owners of common stock are often the last ones to receive monetary compensation in the case of an exit or IPO.

-

Preferred stock

These are usually given to investors. It comes with certain rights attached. Those who own these shares will get paid first in the case of an exit.

Preferred stock comes with certain rights attached. What follows are some examples.

How investors protect themselves in cases of fundraising

-

Liquidation preference

These types of clauses have some conditions in the case of an exit (or IPO, M&A, etc.). A certain multiple of the original investment per share is returned to the preferred stockholders before anyone else.

Liquidation preferences of 2X or 3X can hurt founders. This is as in cases of liquidity events, the selling price may be lower than the startup’s valuation.

-

Anti-Dilution

This type of clause gives investors the right to maintain a percentage of ownership. This is when a startup raises capital from different investors at a future period.

Investors (or founders) do not like to get diluted, and anti-dilution clauses allow them to maintain a certain percentage of ownership in the case of future rounds of funding.

-

Tag along

This clause is often used to protect minority investors from missing out on opportunities to sell their investments.

-

Drag along

It protects majority shareholders from receiving permission from minority stock owners to sell their stock.

Investor B may want to sell its shares in a future round. Then investor A would have no choice but to sell his as well

Constituents Investors Want to Meet Before Investing

- Key Management Team Members

- Personal references for key management personnel

- Professional Partners

- Suppliers

- Customers

- Advisory Board Members

- Members of your Board of Directors

- Current Investors

How to Address Investors Effectively

-

Nail your elevator speech

You need an elevator speech.

An elevator speech is a thirty-second summary of your firm. It should tell them what they need to know.

Your goal is to get an investor interested enough to ask follow-up questions. This can only be done by succinctly describing your product or idea.

There are some things that an elevator speech should cover.

What you do.

Keep it short! E.g., “We create state-of-the-art analytics for…”

What problem do you solve?

Again, keep it short. But be descriptive about what solution you provide for the user.

E.g., we help firms to find out the effective elements on their site.

We use heatmap technology to track where visitors are looking and what they are interacting with.

Why are you different?

Why should the person you are talking to use your product or service over your competition?

Your product may have a feature no one else does, or maybe it is just more comfortable to use. You need to know your key differentiator.

After your speech, connect with the person listening. Ask them a question. Respond to their follow-up questions. Most importantly, stay in touch.

You should always seek to grow your professional network. You may get your next funding source or opportunity.

-

Research your audience

Do some research on who you will be presenting to. Good sources are AngelList, Flashfunders, and SeedInvest.

You can also look for local angel networks. Angel Capital Association has a useful directory for location-specific angel groups.

Some investors may be public figures. You can find out about them online.

Many others prefer anonymity, and it is hard to find out any information about them. If you can, try and find out their patterns.

Some investors want to be involved with firms. They seek a seat at the boardroom table. Other investors would just receive quarterly reports on profitability.

At the minimum, you should be able to answer:

- Do they know your industry?

- Do they have any other investments in your industry?

- What is their personality like? Quiet and careful, or loud and volatile?

- Are they new or seasoned investors?

- Do they belong to an angel investment network, or are they individual investors?

- What companies did they start or come from before becoming an investor?

-

Use realistic data with stats

When you are pitching to investors, you need to provide reliable data. Investors care about what you have already accomplished and how that can make them a profit in the future.

There are many ways to calculate a startup’s value, some more controversial than others.

Sometimes a startup’s value is created before any profit. The numbers behind it are driven by speculation.

Some firms have higher valuations than their publicly traded peers. WeWork has a 525% higher valuation than established competitor Regus!

Investors want the logic behind your numbers.

Do not just say you are acquiring new customers every month. Say exactly how many. It does not matter if you are attracting 10 or 10,000. The fact that you are giving real data shows you are transparent.

Remember: An investor is not just giving your company money. They are giving it to you.

They are investing because they believe in you.

Make them confident in their decision by making data a crucial part of your pitch.

Include market statistics early in the presentation. It will help to hook investors right away.

These are things like profit margins, current users, and market opportunity. It can also be facts that support your cause, as Innovative Solar’s pitch deck.

-

Tell an engaging story

It is no secret that storytelling sells.

Brands who effectively use storytelling in their marketing consistently outperform those who do not, sometimes by up to 64%!

Your pitch should be no different.

If you are given five minutes to present your idea to a group of investors, use it to tell a story and sprinkle in a few facts.

Use traditional storytelling methods. It will illustrate how your product works. Create an antagonist and a protagonist for your story.

The protagonist could be you if you are talking about your inspiration for starting your company. It could also be a made-up example.

Make yourself the protagonist and time the antagonist.

People will spend a lot of money to save time. Showcasing your firm this way helps investors see the benefits. This is true even if they do not understand how the tech works.

-

Have a documented succession plan

Investors want to hear your passion, but they also need due diligence before forking over their money.

Wouldn’t you do the same?

Your startup should already have a solid business plan in place, but do not overlook the importance of including a succession plan in there.

Firms that use succession plans have 3x the revenue of ones that do not.

Succession planning is all about reducing risk.

It means that there is a documented procedure for who takes over control of the company.

It does not have to be for freak accidents. Such plans are useful for long-term growth strategies.

Having one shows that you have thought well into the future and are committed to keeping it going, even when you are not the one running it anymore.

Your plan should include these key components:

Who the successor will be.

This person may change over time. But you should name the person who will take over as CEO from you.

List their accomplishments, current role, and why they are a great fit to take over

.

An overlap or transition period.

Planning your business’ future is not like selling a car.

You cannot just sign on the dotted line, toss over the keys, and say, “She is all yours now!”

It takes some time to teach your protege.

You want to work closely with him or her before actually leaving the company to make the transition as smooth as possible.

How succession will affect your hiring strategy.

When you know who will be stepping in to fill senior roles, you know whom you will need to hire next: people for the roles that were just vacated!

Your VP of Product Development may be taking over as CEO once the founder leaves. Then you know you will need to be hunting for a new VP of Product Development ASAP.

It is not rocket science, but writing it down is essential. It shows you are serious about growth and the future of your company.

That sends a strong message to investors.

-

Dress for success

Dress to impress for your presentation.

No, I am not suggesting you go too far outside of your comfort zone. Just put in a little extra effort.

You are meeting business people who probably spend a lot of time with people who dress for business. So dress for business!

Treat your pitch like a job interview.

Over 30% of people think a person is more trustworthy and better at their job if they are dressed professionally.

There are different professional dress codes, but it never hurts to be too formal for your pitch.

Now I am not saying go out and spend money you do not have on clothes or fancy cars.

That is foolish and a recipe for bankruptcy.

I mean, pay attention to how you look. Unfortunately, our society is so concerned with appearance over substance, but the evidence does not lie.

Give some effort to your appearance. It will pay off. Especially when successful businesspeople surround you in an investment presentation.

Look the part, get the funds.

-

Know your revenue model

A revenue model, or business model, is a plan to make money and be profitable.

For example, here is AirBNB’s revenue model.

It looks straightforward. A good revenue model should be.

Your revenue model may be in the form of collecting subscriptions. It can also be a one-time payment to download the software.

Paying monthly makes it easy to cancel, but the user pays more than they would if they bought a one-year subscription upfront.

Another way firms earn revenue is through advertising.

Some apps are free to use with ad-based revenue models. They display ads on the app. Some apps hide the ads with a premium subscription. This adds a revenue stream for the company.

Two of the most extensive examples of this are Google and Facebook. Google allows users to search the web for free. It makes money from ads.

It is a straightforward business model, and it works well.

Google offers a few paid products. It includes G Suite, AdWords, and the Pixel phone. Facebook offers no paid products. It is almost 100% supported by ads.

It is one of the most important things they want to know.

Your business model should address market demand and how you are going to attract customers.

It should also list when you might need additional funding or other challenges.

Do not be afraid, to be honest about your company’s challenges.

The people in front of you are all successful business people, which means they have failed more than a few times in their lives.

Being honest builds trust and credibility. Investors know how tough business is, and they will not trust someone who comes in and says, “I have got it all figured out!”

Because no one has it all figured out.

Some Questions Investors Want to be Answered at the Earliest

-

Investors Want to Know What They Are Getting.

- What industry? Why do you need investment? How big can this become?

- Are you thinking locally or globally? Will your business provide a “social return?”

Increasingly, investors also want to know if your business and vision align with their views and philosophies.

There are investors on both sides of such questions. But you will not make a deal if your prospect’s ambitions do not align with yours.

-

Investors Want to Know How You Are Going to Make Money.

- What are you selling? Who and why are your customers?

- Why would they buy it from you? How do you reach your customers?

- What does it cost to acquire a customer? What does your product cost to produce?

- Who are your competitors? How much is required to break even?

Your answers to these first two questions must be clear, concise, and exciting, or the conversation will not proceed beyond this point.

-

Investors Want to Know What You Want.

- What is the investment? Money? Expertise? Time? Something else?

- When and How much money or time do you need? What else do you want?

Everything you say in early conversations affects negotiations. But this is the first step in the actual negotiation process.

-

Investors want to know what they get in return for their investment.

- What specifically are you offering in return for their investment? Equity? A note?

- What kind of equity and how much?

- What are the term, interest rate, and security if you are offering a note?

- When and how can they cash in on their investment?

This is the second step in negotiations.

It is when the prospects have enough information to estimate the rate of return on their investment.

Investors also want to know about exit routes.

-

Investors Want to Know the Likelihood of Success.

- The sales, cost, and profit projections

- Your assumptions when creating them

- What is your marketing plan? Who is your team?

Every investment opportunity has both business risk and management risk. They will form opinions about business risk from your answers.

The business proposition should make sense. Then they will increasingly concentrate on you. Can you pull it off?

Prospects have been judging you all along. But they will ask increasingly specific questions about your offer.

They will want to hear detailed, rational answers that show whether you have mastered your plan.

If you do not understand your plan, it will show, and they will lose confidence.

Activities to do Before Meeting an Investor

-

Research the Investor

Some founders will reach out to any potential investor they can find.

This can work in your favor in some areas. But it actually may waste your valuable time when searching for funding.

The reality is that most VCs or angel investors specialize in certain types of ventures.

They may be interested in specific sectors, companies in a specific development stage, those that produce a specific return, and more.

Avoid spinning your wheels unnecessarily by chasing after investors that likely will not be interested in your request.

A smart idea is to thoroughly research the investors using public information, such as on their website, through social media platforms, news articles, and more.

Pay attention to their current portfolio. Develop an understanding of their backgrounds, successes, failures, and more.

Reach out to other founders who may have obtained capital from them. The more information you can learn about them, the better your chances of success.

Some investors also bring experience, market awareness, and more to the table. This “smart money” investment can pay off richly.

-

Write Your Executive Summary and Business Plan

Potential investors want to review your business plan and executive summary. It helps them to gauge their interest in even holding a meeting with you.

This means that your written plan needs to sell the firm to the investor. It must be in a way that speaks their language.

An executive summary will highlight the company’s relevant facts, your products and services, and your target market.

Refine your summary based on the specific investor you are targeting. Demonstrate that you have a firm understanding of your market size and customer profile.

You also must explain your value proposition to this target audience. Demonstrate how you are a better option than the competitors.

Your business plan should identify key milestones that you want to achieve with investor capital over the next 18 months.

While you need to write this information clearly and concisely, you also need to discuss it during an investor presentation in a more in-depth manner.

While you want to present your potential return on investment positively, it should also be realistic.

Your potential investor wants to hear about your well-formulated growth strategy rather than just a list of projected numbers.

Inexperienced entrepreneurs tend to be overly optimistic. Not meeting your milestones and objectives can be detrimental to your ability to generate future investments. Always back your expectations up with real data.

-

Prepare and Practice Your Presentation and Pitch

An elevator pitch is a well-rehearsed summary of what makes your company a fantastic investment opportunity for the investor. This is more detailed and more sales-oriented than the business plan.

Consider using images and charts on a slide show presentation to bring your pitch to life in an exciting, engaging way. In your elevator pitch, delve into the history of the business and how it will make the investor money.

The total presentation length should be less than 30 minutes long, and you should plan to spend approximately two to three minutes on each slide. Your presentation should not merely be a summary of what is on the slides. Instead, the slides should be used to support your verbal presentation.

Some investors may interrupt you frequently to ask questions; do not let this rattle you. You should know your material well enough that you can speak confidently about it without reciting a memorized speech verbatim.

Try to keep the meeting structured and professional. Your investors are judging this aspect of the meeting as well as the business opportunity in general.

-

Estimate How Much Money You Will Need and What For

As you might imagine, your potential investors want to know exactly how much money you are trying to raise and what you plan to do with the money. The ideal amount of money to ask for is a sum that will fund your plans for the next 18 months.

Avoid asking for less money than is needed. Do not think investors will refuse your request otherwise. Demonstrate how the funds will be used. It can be used to expand your warehouse space, hire more talent, and more.

Explain what you think is a reasonable equity split. Explain how you arrived at that figure.

Do not give away too much equity. When your income potential is limited, you may lose motivation and drive.

Know your bottom line figure before walking into a meeting. This will help you to make decisions on the fly.

-

Know Your Passion, Energize Your Story

Investors may view dozens of presentations per week. So you need to ensure that your passion for your venture stands out. From the start, make your presentation noteworthy.

A compelling story as a start is a great idea. Remember that the investor is investing in you and your team as much as they invest in the company. Therefore, build credibility, and explain your education, background, and overall interest in presenting.

Convey your passion for your products or services. But your request should be financially viable.

However, you also need to develop a relationship with these investors from the start. Focus on selling yourself and your idea.

-

Have a Conversation With a Hostile Audience

After your sales pitch that lasts approximately 30 minutes, you will next have to go through a rapid-fire series of investors’ questions. Investors will try to catch you off guard. This is to ensure that you know your stuff.

Therefore, anticipate their questions, remain poised at all times, and thoroughly prepare for this aspect of the meeting.

Investors will scrutinize everything from your business plan to your credentials. Consider some of the most challenging questions that an investor may ask you and prepare to answer these ahead of time.

Some investors may make suggestions. You should not shy away from these. Accept the advice with open arms. Show the investors that you are receptive to improving your venture.

Your first few investor presentations may not go precisely as planned, but remember that they are each learning experience that can help you grow. After each meeting, take notes about your experiences, and brainstorm things to improve on to prepare for your next meeting.

It may take you several attempts. But your confidence and knowledge will increase with each meeting.

The process to Reach Out to Investors

-

When to Approach? Before You are Desperate

Startups usually wait to build a perfect product. Investors advise something else. Investors expect founders to approach before they run out of money.

Instead, you want to pitch when you are in top form, with attractive metrics, and holding power. Better yet, you want to start having these conversations before you are even looking for money.

-

Seek the Warm Lead, Do not Barrage with Cold Ones

Do not opt for cold calls or emails. Reach out to a credible friend or investing partner. Ask for introductions or recommendations from investors who would be right for you.

Investors usually get many inquires. So get highlighted as valuable. It is worth paying attention to by someone they trust. Many VCs will not respond to founders that do not have a warm intro. Their deal flow is just too large.

Be smart about creating a road to the investors. This may affect the relationship you build with them. This is just the beginning. Make it right so that you do not need to look for a second chance for a first impression.

Closing the Meeting

Once you have had a phone call and potentially an in-person meeting, this is typically where an actual offer comes.

If you are talking to an Angel, you will get an offer or a decline here.

When you are talking to a VC, you might have to do a full pitch for all the partners depending upon whom you are talking to.

-

If you get rejected, you get one chance to do a follow-up email.

- Explain politely why you think their objection is wrong, and that is it.

Do not get emotional. By doing so, and you might build a reputation.

Investors talk to each other, so do not be the asshole that becomes the conversation topic the next time investors get together.

-

Suppose you get an offer or a show of interest, great!

- Things should be relatively straightforward after this point.

Just make sure you pester them weekly once the term sheet is signed until they write you a check.

A verbal commit of $200k but only if other people come in is not going to help you. It would help if you convinced them actually to write the check.

This is harder to do in real life, but if you have metrics or a reliable team, enough prodding will yield your first solid term sheet signed and check written.

Try to offer a lower valuation only to the early investor that comes in.

- Wait till the first check comes in. The rest will be much easier.

Request investors who say yes for further references.

Make it easy on them by just getting the names and then telling them you were directed by X rather than making them write the emails.

- If you are using convertible notes, you can always up the valuation on subsequent term sheets but never go back down.

This means you can offer early investors a better deal. It will be at a lower valuation than later investors.

This is a powerful tool to get people to commit early on to create a sense of scarcity.

Tips of advice

- Being truthful gets you more credibility when you are in doubt. You may not have everything figured out. Know your challenges. Come up with some reasonable solutions you are working on. Investors will appreciate the honesty.

- Set up your conversion funnel wide in the beginning. If you hit up ten investors only, you might not get anyone. If you hit up 250 investors with properly targeted emails, you will most likely convert at least a few.

- Investor targeting is critical. If you target a foreign market, find investors who know that market well, and have invested in startups that also target that market. When you are a marketplace, find marketplace investors. When you have the hardware, look for hardware accelerators and investors.

- Keep adding committed investors to your round on AngelList immediately. The more investors you have connections with, the more you can reach out to LinkedIn since you get access to their networks.

Real-World Examples of Firms Talking to Investors

Some founders have a real knack for talking to investors. They can show their vision in a few sentences. They present a sound business plan.

For inspiration, consider some of these examples of companies that have done an excellent job talking to investors.

-

Uber

Though it has come under fire recently, Uber initially succeeded at wooing investors.

It attracted many impressive investors. Its apps let regular drivers use their cars to offer rides to paying customers.

There was a clear market need for alternatives to taxis. So, Uber had a compelling solution. It enticed investors who wanted to hitch a ride with the startup.

The private tech firm is now worth billions of dollars.

-

Snapchat

Facebook is still the dominant social media platform. But Snapchat is aspiring to cut into its revenue.

Investors were impressed with the technology itself. It gained traction quickly among teens and twentysomethings. This demographic found Facebook to be their parents’ social media platform.

Snapchat is now a publicly traded company. It earned $1 billion for its early investors.

-

Bruxie Gourmet Waffle Sandwiches

Who knew the world needed more sandwich joints? The founders had a hunch. Customers wanted a better sandwich than the ones at fast-food chains.

It is built on the soul-food concept of chicken and waffles. It was a niche the fast-food industry had yet to exploit. So, Bruxie had no trouble getting an initial round of investors.

The restaurant hosted private investors for a sit-down meal. It then received a second round of financing.

The investors were very impressed with the food. They brought in more investors.

-

GrubHub

GrubHub was formed when two software developers wanted takeout food. They quickly realized there was not a one-stop place where they could go to place their order.

But they soon changed that with GrubHub’s invention. It compiles nearby delivery and pickup restaurants and enables diners to place orders.

There was a large market and compelling market need. The founders had no trouble finding hungry investors.

The company was a hit with investors when it went public. It is valued in the billions.

Conclusion

Be enthusiastic and confident. It will make your investors the same as well. But you cannot fake this stuff.

One of the two main reasons for a business plan is to answer investor questions. Keep that in mind as you prepare it. The other reason is to guide your activities.

If your plan does not answer the questions, and if you are not excited about your vision, you are not ready to talk with prospective investors. Do not have the conversation until you are.

And one last thing.

Although they want an additional something, collateral, you can substitute the word banker for the investor in all the above. Sufficient collateral can compensate for any weaknesses. Yet, bankers want to know the same things.